GBP/USD Key Points

- Solid ADP jobs data and a surprise drop in ISM Prices Paid is good news for the US economy…

- …but that also means that the Fed may feel more comfortable cutting rates in the middle of the year.

- GBP/USD has bounced off key technical support at its rising trend line and 200-day MA in the mid-1.2500s, hinting at a potential retest of 1.2700 pending Friday’s NFP report.

This coming Friday’s NFP report – full preview article coming tomorrow morning – was always going to be the marquee fundamental release of the week, but today still brought a couple key updates as appetizers ahead of the main event.

The ADP Employment report this morning beat expectations, coming in at 184K vs. 148K eyed, and last month’s reading was also revised up to 155k, hinting that the labor market may be even stronger than previously suspected. One standout aspect of the report was the median change in pay for “job switchers,” which came in at 10.1% vs. 7.6% last month.

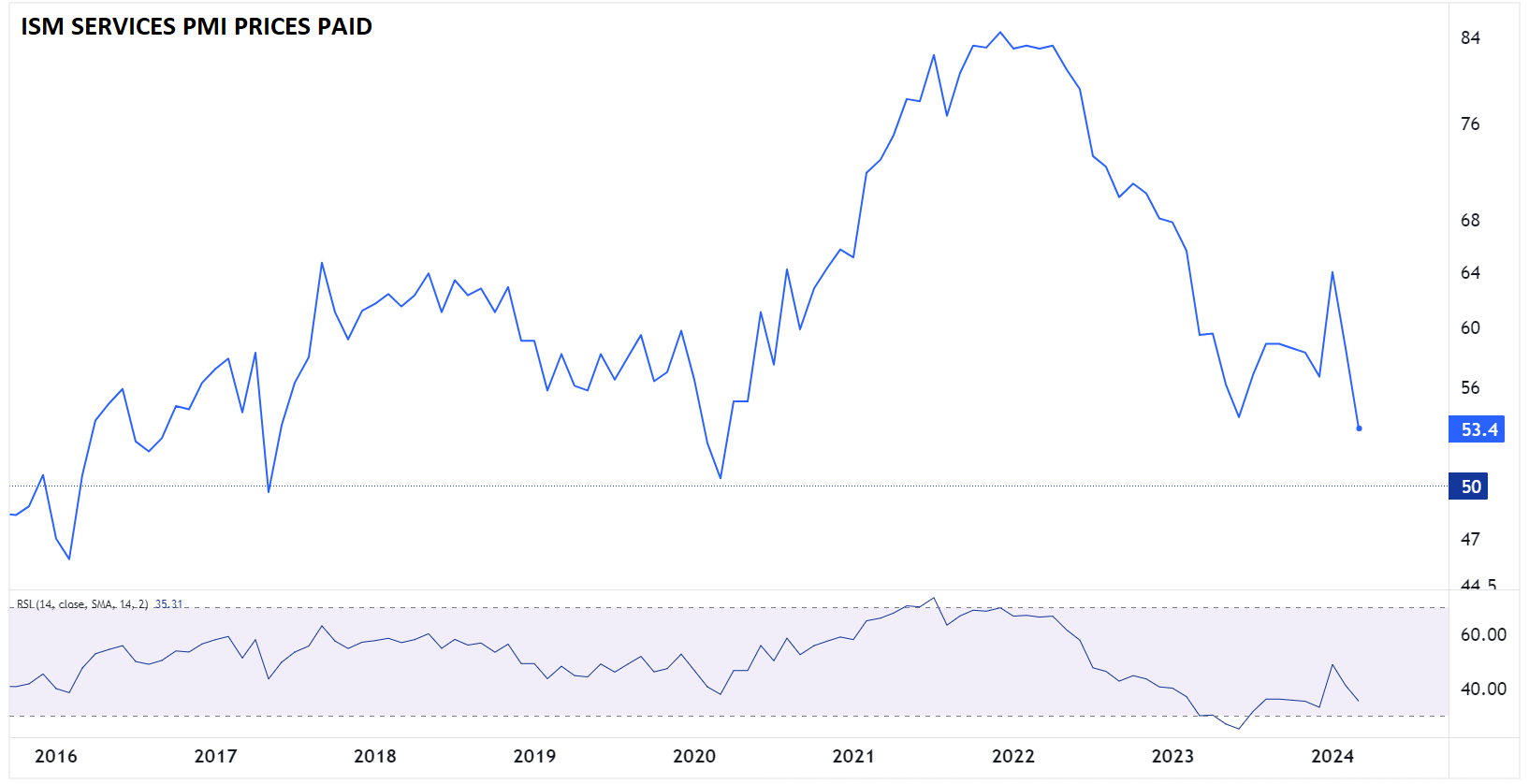

Later this morning, traders got their first look at the ISM Services PMI survey, which fell to 51.4 on a headline basis, with the closely-watched “Prices Paid” component falling to 53.4, the lowest reading in nearly 4 years. As we’ve noted before, this indicator tends to be a leading indicator for consumer inflation readings, and this month’s moderation will therefore be well-received by monetary policymakers at the Federal Reserve.

Source: TradingView, StoneX

In summary, relative to where we were this morning, we’ve learned that the US job market may be stronger than anticipated and future inflation may be lower than assumed. In lunchtime comments, Fed Chairman Powell reiterated that “he recent data do not, however, materially change the overall picture, which continues to be one of solid growth, a strong but rebalancing labor market, and inflation moving down toward 2 percent on a sometimes bumpy path.”

In other words, the Fed still expects to start cutting interest rates in the middle of this year, and that expectation is putting the US dollar under pressure today, driving pairs like GBP/USD higher.

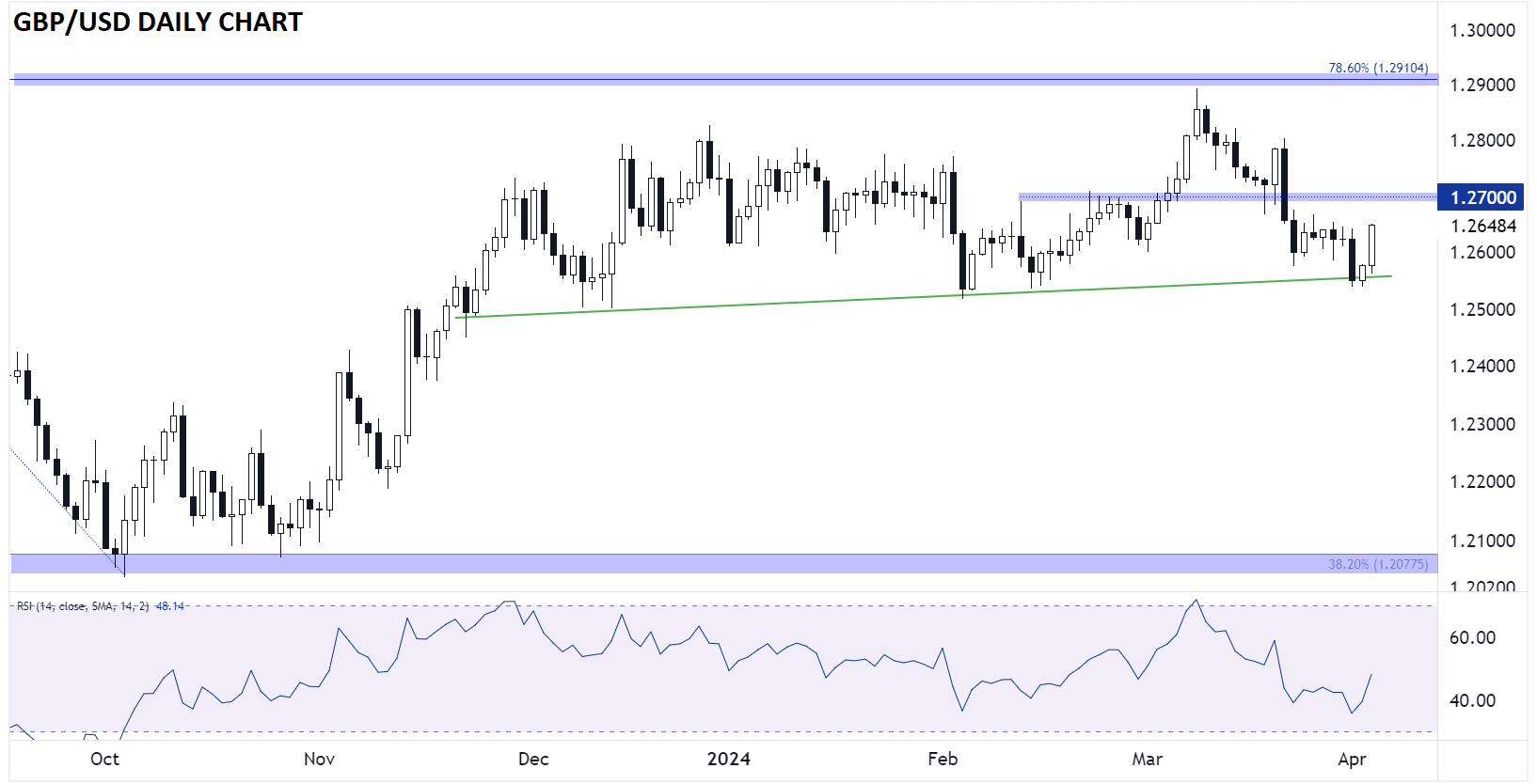

British Pound Technical Analysis – GBP/USD Daily Chart

Source: TradingView, StoneX

As the chart below shows, GBP/USD bounced off its rising bullish trendline near 1.2550 yesterday, extending those gains to test one-week highs in the mid-1.2600s as we go to press. The pair is back above its 200-day moving average after a short-lived foray below it to start the week, potentially setting the stage for a retest of previous support/resistance in the 1.2700 later this week, especially if there are any signs of a slowdown in US economic data.

Meanwhile, only a drop below the bullish trend line and this week’s low near 1.2550 would flip the medium-term bias back in favor of the bears.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX