Forex trading

-

Competitive pricing

Enjoy low trading costs – including AUD/USD from just 0.5 points

-

Range of markets

Trade 84+ global FX pairs including majors, minors and exotics

-

Award-winning provider

Awarded “Best in Class” 2023 by ForexBrokers.com

Why trade Forex with City Index?

-

Institutional-grade liquidityBenefit from Tier 1 banks liquidity and 40 years’ experience in forex trading.

-

Advanced chartingTake advantage of the industry leading TradingView charting package to trade global currency markets, with 80+ indicators and one-click trading.

-

A globally trusted brokerTrade with a trusted market leader, regulated in Australia since 2006.

Competitive pricing

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

Major FX moves and news

Latest research

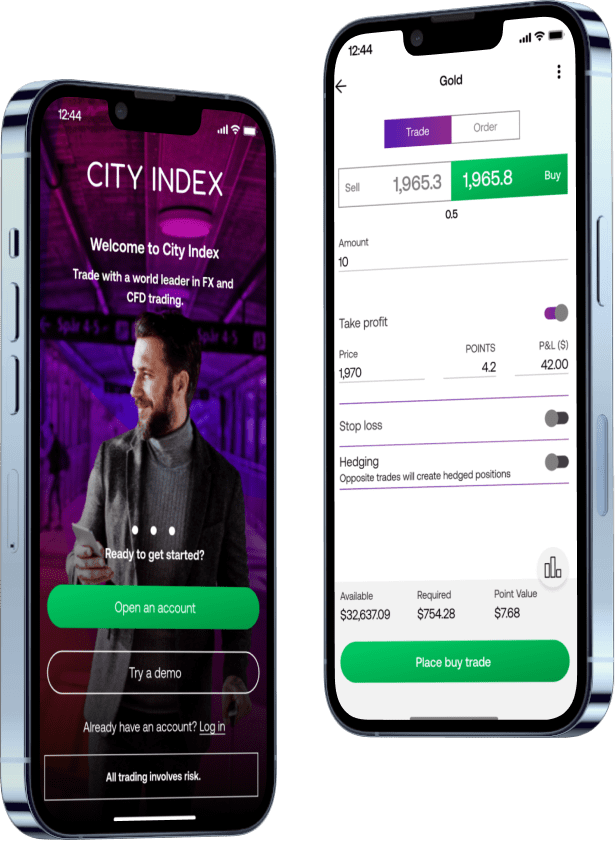

Mobile trading app

Seize trading opportunities with our easy-to-use mobile apps, with simple one-swipe trading, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charting

Complete with in-chart trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access insightful market data on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

Learn to trade forex

What is forex trading?

Forex trading is the buying and selling of global currencies. When you trade forex with City Index Australia, you can go long or short on the price of currency pairs using CFDs or Spot FX.

How to trade forex

2. Choose a FX pair to trade

3. Open an Australian forex trading account

4. Open, monitor and close your first position

Forex trading examples

Say you believe the Australian dollar will rise against the US dollar. You can place a buy trade on AUD/USD. If the price rises, you’d make a profit for every pip it moved in your favour. But if the market falls, you’d make a loss for every point the price moves against you.

Forex market hours

Currency markets are open 24 hours a day because there’s no central exchange. Instead, prices are determined by interbank trading, the exchange of currencies between banks on a constant basis, all over the world.

Hundreds of thousands of clients all over the world use City Index as their provider of choice. Here’s why.

With 24/5 dedicated client support, we’re always on hand to help – and 99.99% of all valid trades are executed by our market-leading trading technology.

We’re backed by Nasdaq-listed StoneX, a Fortune 100 company with over a century in the financial markets. Combined with our four decades of heritage, you’re in good hands.

Enhance your trading experience with our exclusive Performance Analytics technology and comprehensive risk management tools including Guaranteed Stop Loss Orders. Our tools are designed to help you manage risk effectively and make informed decisions.

Frequently asked questions about forex trading

How do banks trade forex?

Banks trade forex on behalf of their clients and as speculative trades from their own dealing desks – the purpose of which is to hedge client exposure. Banks trade millions of dollars’ worth of forex, so have a greater influence over the market than smaller players.

Banks also don’t trade forex over short timeframes like retail traders do, instead they only take a few larger positions that they’ll hold for longer.

Learn what moves forex markets.

Who trades forex?

Forex is traded by a broad range of participants, from banks, brokers, and hedge funds to retail traders. Any company that operates or has customers overseas will need to trade FX. Central banks are also active in forex markets, as they seek to keep their currency trading within a specific range.

Learn more about forex trading.

Is forex trading legal in Australia?

Yes, forex trading in Australia is legal and is regulated by the Australian Securities and Investments Commission (ASIC). There is a strict framework that governs forex trading, but this is to protect Australian traders and promote healthy competition.

Brokers and banks have to be registered with ASIC before they can offer forex and CFDs.

Learn more about City Index Australia

How old do you have to be to trade forex?

There is no minimum legal age to trade forex in Australia. However, you must have a bank account to fund your forex trading account, and you can’t open a bank account in Australia if you’re under 18 without parental consent.

See what documents you need to open a forex trading account in Australia.

Do you need a licence to trade forex in Australia?

You as an individual do not need a licence to trade forex in Australia. However, City Index does have an Australian Financial Services Licence (AFSL) as required by ASIC.

Learn more about City Index Australia