Gold and silver trading

-

Go long or short

Profit from falling as well as rising prices on precious metals like gold and silver.

-

Safe-haven assets

Hedge against falling indices and periods of market turbulence.

-

Wide range of commodities

Trade copper, gold, silver, platinum and other metals.

Why trade gold and silver?

-

Diversify your portfolioAdd gold and silver to your portfolio to hedge against inflation and diversify your investments across asset classes.

-

Trade on leverageTake advantage of leveraged trading to speculate on precious metals with no need to own the underlying asset.

-

Choice of marketsTrade gold and silver as futures, options and spot markets with a market-leading provider.

Competitive gold and silver pricing

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

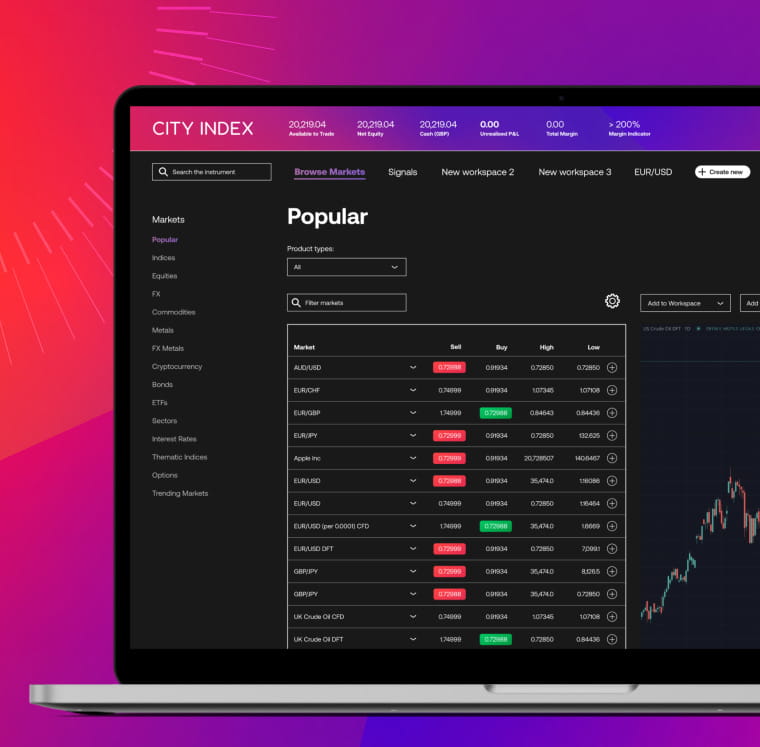

Gold and silver trading platforms at City Index

Web Trader

Your new online trading platform, Web Trader, includes advanced charts with custom indicators, fast and reliable HTML5 technology, and customisable workspaces.

Fast, reliable and customisable trading platform

• Configure and personalise multiple workspaces

• Switch between workspaces with a single click

• Benefit from advanced trading charts and overlay multiple financial markets

Trading tools

• Smart trade tickets with advanced risk management tools

• Define stops and limits by points, P&L or price

• Real-time margin calculator informs your trade decisions

Market news and analysis

• Dedicated Market 360 pages to help identify key opportunities

• Latest market insights with charts and pricing

• Detailed market analysis from Reuters news

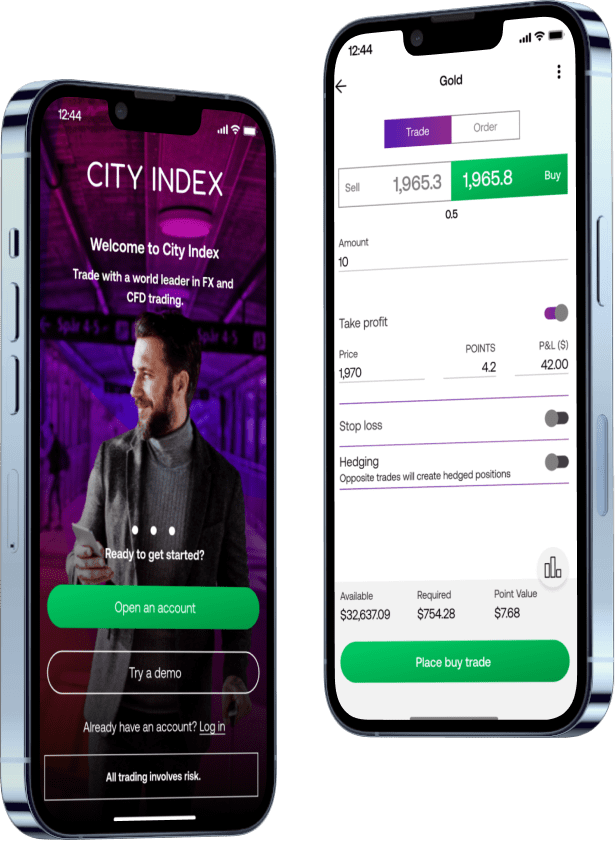

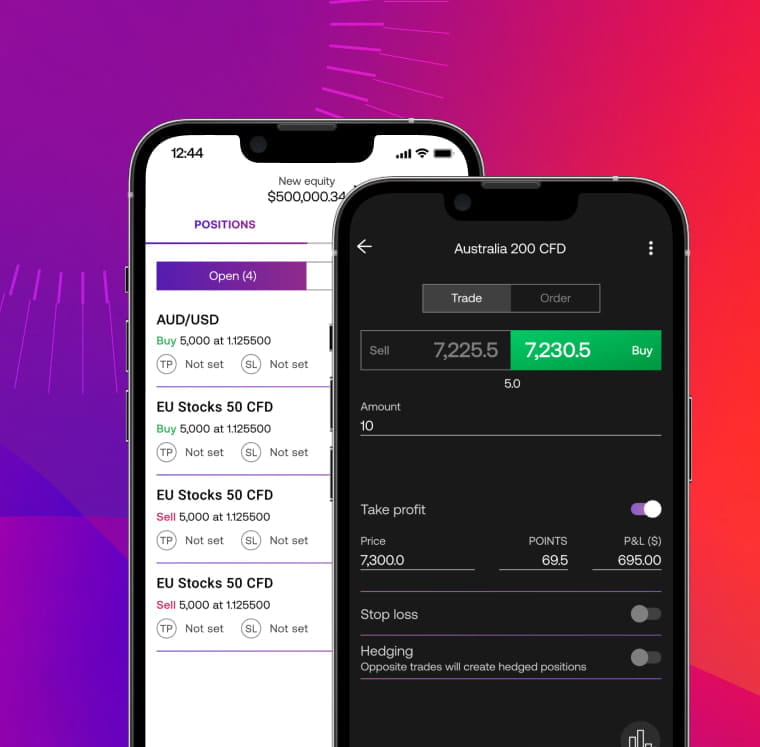

Mobile trading apps

Seize opportunities with our powerful mobile trading apps, complete with advanced charting, custom technical indicators and a range of intelligent trading tools.

TradingView charts

Access the industry-leading TradingView charting package, complete with over 80 custom technical indicators, drawing tools and trading through charts.

One-swipe trading

Open and close positions in seconds directly from charts with one-swipe trading and amend any stops and limits by dragging orders on the chart.

Risk Management

Trade with limited risk using our advanced tools, including Guaranteed Stop Loss Orders.

MetaTrader 4 (MT4)

Expert Advisors (EAs)

Download and explore automated trading strategies via the MetaQuotes Language 4 (MQL4) or create your own Automated Trading System using MQL4.

Custom technical indicators

Analyse price movement and trends with technical indicators customised to your trading strategies.

Trade on all devices

Access your MetaTrader 4 account across all your devices with MT4 trading apps on iOS and Android. Open on desktop, close on a smartphone.

Gold and silver news and analysis

Latest research

Why trade gold and silver?

Gold and silver are the most-traded precious metals markets, often used for portfolio diversification and as a hedge against inflation.

What moves the price of precious metals?

Like most markets, metal prices are driven by supply and demand. Economic and political changes will also impact the price. Gold and silver are often seen as safe-haven investments during times of heightened market volatility.

What moves the price of gold?

Gold is prized for its stability – when other markets fall, gold can retain its value. But that doesn’t mean it’s free from volatility.

Frequently asked questions

Can you day trade precious metals?

Yes, you can day trade precious metals including gold, silver, platinum and more. To day trade these precious metals, you need to ensure that you all your positions are closed by 5pm EST. This avoids the risk of overnight gapping and funding charges impacting your bottom line.

CFD trading is a popular way to day trade precious metals. It enables you to speculate on metal prices without ever taking ownership of the markets themselves, and provides access to leverage to make your capital go further – although leverage will also increase your risk.

Learn more about CFD trading on precious metals.

What are the trading hours for metals?

You can trade most metals – including gold, silver and platinum – 23 hours a day from Monday morning to Friday. However, there will be times when precious metal markets are more volatile and liquid than others.

The precise times for each market will vary depending on whether you’re trading its spot, futures or options variant. You can see a full rundown of the hours for each market on our commodity hours page.

How do you trade metals?

There are a few different ways to trade metals. Most metals trading in the open market is executed via futures – derivatives that involve trading a metal on a set date in the future at a price set today.

To buy and sell metals futures, you’ll need an account with a futures broker. Or, you can trade on futures prices using CFDs – which enable you to go long or short on metals without ever taking ownership of the underlying asset.

Learn more about how to trade commodities.