CFD trading with City Index

Trade CFDs on over 6,300 global markets including indices, shares, FX, commodities and cryptos, with tight spreads on an award-winning platform.

Award-winning provider

Why trade CFDs with City Index?

-

Lowering the cost of trading

Competitive pricing across every asset class, plus free live market data and no hidden fees.

-

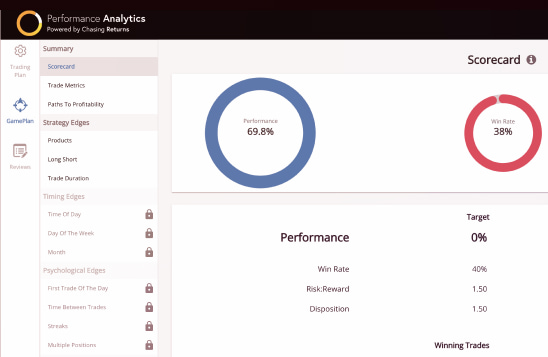

Advanced trading platforms

Trade on your browser or smartphone, and access exclusive tools including Performance Analytics and Guaranteed Stop Loss Orders.

-

Extended market hours

Find and execute more opportunities with out-of-hours trading on indices and share CFDs.

-

Award-winning

Winner of Best CFD Provider - ADVFN International Financial Awards 2022 and Best Trading Platform 2022 – Online Money Awards.

- 1. Choose a CFD market

- 2. Decide to buy or sell

- 3. Select your trade size

- 4. Add a stop loss

- 5. Monitor and close your trade

See our CFD trading costs

When you buy and sell share CFDs, you’ll pay commission. With every other CFD market we offer, though, there’s no commission to pay – all the costs to open and close your position are covered in the spread. You’ll pay an overnight funding charge if you keep a daily CFD open overnight.

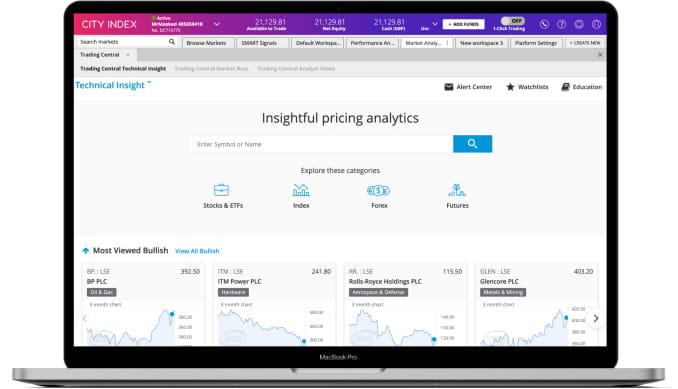

Trade wherever you are, on our fast, reliable platforms

Customisable charts

16 chart types with 80+ indicators designed to help you perform technical analysis.

Award-winning platform

Our powerful technology is designed to suit you, whatever your level of trading expertise.

Insightful market data

Our research portal highlights trading opportunities using fundamental and technical analysis.

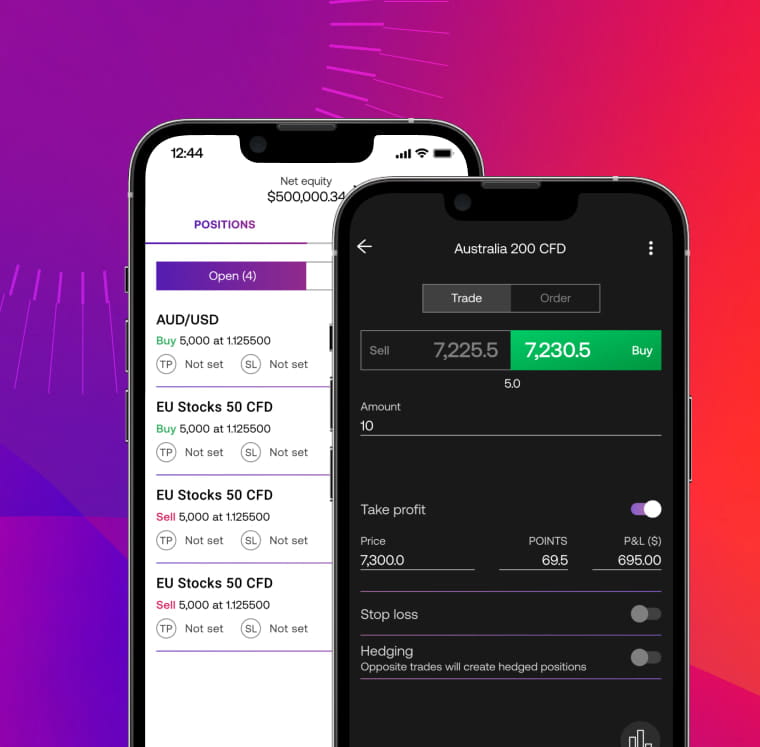

Trade anytime, anywhere

Follow the markets on native apps built specifically for your smartphone and tablet.

Powerful tools

Open an account with the best CFD provider*

Open an account with the best CFD provider*

Frequently asked questions

How do CFDs work?

CFDs work using contracts that track the live prices of financial markets. When you trade one of these contracts, you’ll exchange the difference in the market’s price from when you open your position to when you close it. You can buy CFDs to open a long position or sell them to go short.

For example, say you buy an Australia 200 CFD when the index is at 7100, then sell it at 7200. You’ll exchange the difference between 7100 and 7200, pocketing 100 points as profit. If the ASX fell to 7000 instead, though, you’d lose 100 points.

Your total profit or loss is dictated by the number of contracts you buy or sell.

Learn more about how CFDs work.

How do you calculate CFD profits?

To calculate CFD profits, you multiply the number of CFDs you have traded by the point value of each CFD – and multiply that figure by the number of points the underlying market has moved from when you opened your trade to when you close it.

If the underlying market has moved in your chosen direction, you earn that figure as profit. If not, you make a loss.

That might sound complicated, but it becomes much simpler in an example.

Buying a single Australia 200 CFD will earn you $1 for every point the index rises and lose you $1 for every point it falls, which means an Australia 200 CFD has a point value of $1. Buy 10 Australia 200 CFDs, and you’ll make $10 for every point the index rises – but lose $10 for each point it falls.

If the ASX moves from 7100 to 7200, then it has moved 100 points. You’ve bought CFDs, so you profit if the index moves up, meaning your 10 CFDs make you a profit of (100 points * $10 point value) $1000.

If you’d sold 10 CFDs instead, you’d make the same figure ($1000) as a loss.

Of course, you’ll need to minus any overnight financing fees to get the net outcome from your trade.

Learn more about how to trade CFDs.

Do day traders trade CFDs?

Yes. The leverage and range of markets available with CFDs make them a popular option among day traders:

- Leverage magnifies profits and losses, which can be useful when trading relatively small price movements

- The range of markets helps day traders save time, accessing thousands of trading opportunities from a single login