- EUR/USD outlook boosted by German and Eurozone GDP expansion

- ECB still likely to cut in June but pace of subsequent cuts may be slower

- US data highlights include FOMC, NFP and ISM surveys this week

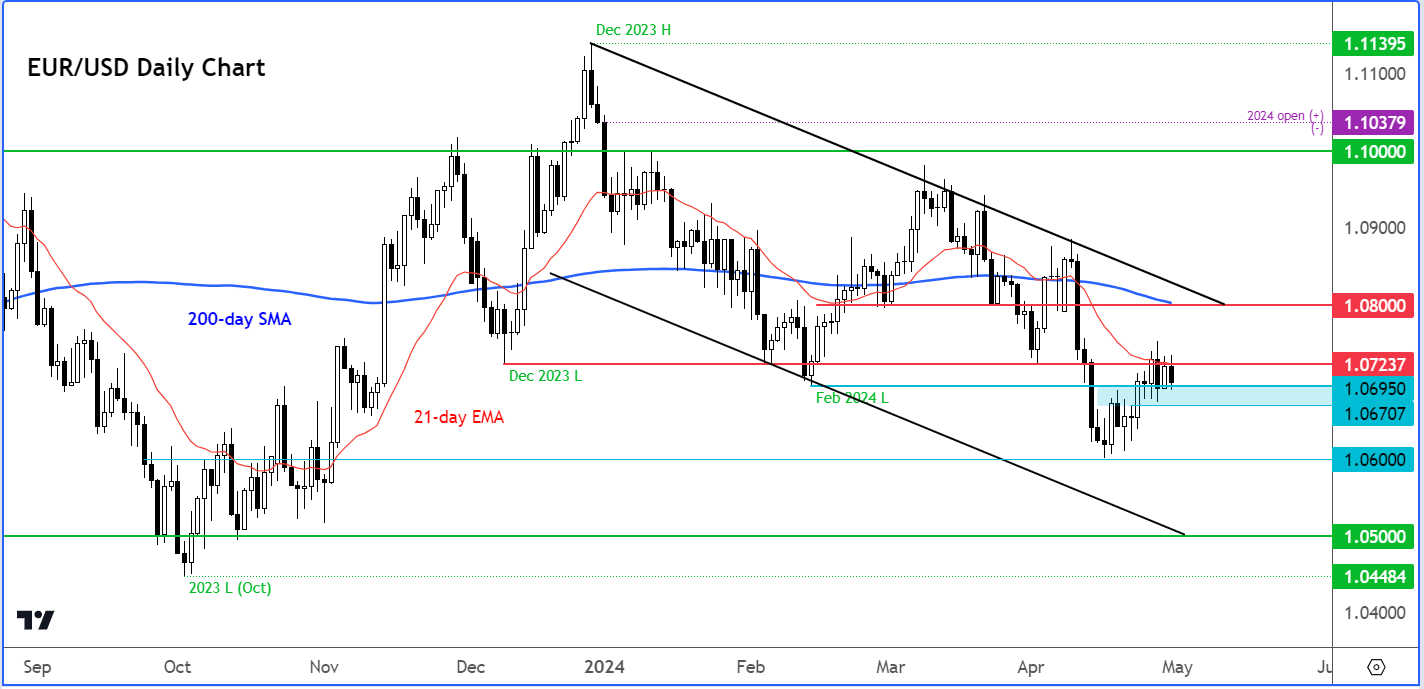

- EUR/USD technical analysis point to potential rise to $1.08

The EUR/USD gave up earlier gains on the back of just-released US employment cost index which came in much higher than expected, boosting the dollar. Earlier, the EUR/USD had risen on the back of this morning’s Eurozone data dump. It looks like Southern Europe in particular has survived the macro headwinds of high inflation and restrictive monetary policy relatively well, helping to fuel a 0.3% rise in Eurozone GDP in the first three months of the year. The stronger performance of the Eurozone economy and the slightly hotter than expected CPI data means the ECB may not be too eager to start an aggressive easing cycle, although a rate cut in June still remains our base case. Nevertheless, sentiment towards the euro should improve especially against currencies where the central bank is already more dovish than the ECB. As far as the EUR/USD is concerned, well it faces a key test this week with the upcoming US data releases and the FOMC policy decision. Judging by the reaction to the employment cost index (1.2% vs. 1.0% expected), it is going to be a tough ride for the EUR/USD.

EUR/USD outlook: What does today’s Eurozone data mean for ECB and euro?

While core CPI was a bit stronger than anticipated, it is worth pointing out that the ECB looks at the trend of data, which has shown consistent falls. Their main concern is now wages, which continues to remain strong and could keep consumer prices underpinned. On balance, today’s data releases argue against aggressive rate cuts, which to be fair was never on the agenda anyway – not with the Fed remaining cautious. However, the ECB is still likely to opt for a rate cut in June, but the pace of subsequent cuts might not be as fast as Eurozone data had suggested earlier this year. This should, at the very least, keep the EUR/USD’s downside limited. At best, we could see a strong recovery in the EUR/USD should the upcoming US data releases again cause a dovish repricing of the Fed’s rate cuts.

Before discussing the upcoming US data releases and the EUR/USD technical analysis, let’s first discuss this morning’s release of Eurozone data and what that might mean for the ECB’s upcoming rate decisions…

EUR/USD outlook boosted by German and Eurozone GDP expansion

In the first quarter, Eurozone GDP expanded by 0.3%, marking the most robust growth since the onset of a long period of stagnation that was triggered by the energy crisis in the third quarter of 2022. This was a much-needed improvement in the Eurozone economy. With the unemployment rate remaining low, wages strong to boost consumer spending, and a more moderate inflation growth, things are finally looking brighter.

Growth was broad based with southern Europe appears to have once again surpassed the north. Spain and Portugal enjoyed the strongest growth in the euro area, of 0.7% in the quarter. Italy’s growth accelerated to 0.3%, while was still better than Germany and France, both seeing a more modest quarter-on-quarter growth of 0.2%. Nevertheless, the slight expansion of Europe’s largest economies still signifies progress despite not being exceptional.

German retail sales point to turning point for economic powerhouse

Meanwhile retails sales in Germany showed a strong recovery in April. Sales surpassed expectations for a month-on-month increase of 1.3%, printing a 1.8% increase. The recovery means nearly the entire 1.9% decline in February was made good.

The rebound in consumer spending signals positive momentum for the broader economic recovery and indicates a potential turning point for the German and eurozone economies. These figures complement the recently-released stronger-than-anticipated levels of business and consumer confidence.

Core Eurozone inflation falls less than expected

Eurozone headline inflation remained stable at 2.4% as expected. But core inflation dropped in April to 2.7% from 2.9%, with services inflation moderating the most. Still, the drop was less than expected, as food inflation accelerated to 2.8% from 2.6%.

EUR/USD outlook remains in focus as attention turns to US data

Tuesday’s US data highlights include Employment Cost Index, S&P/CS House Price Index, Chicago PMI and CB Consumer Confidence. Employment cost index was hotter at 1.2% q/q. The rest of today’s figures are second tier in nature and unlikely to cause a significant move in the US dollar. Top tier data and macro events are scheduled in the second half of the week. Let’s discuss the top three macro events this week, which should impact the EUR/USD outlook.

- FOMC policy decision (Wednesday): Even before the hawkish repricing of US interest rates in the last few weeks, virtually no one was expecting a rate cut in May. So, the key focus in this meeting will be about how the Fed is assessing the direction of prices and employment. Previously Powell and co had dismissed the hotter inflation data in the first months of the year, but recently the rhetoric has changed, and we have seen a corresponding rally in US dollar. The market is now expecting a more hawkish-leaning FOMC meeting. But any inclination towards a rate cut before the end of the summer would now provide a dovish surprise.

- Non-farm payrolls report (Friday): Recent robust growth data and persistently high inflation figures have tempered expectations of rate cuts in 2024. But while hard data has been strong, we have seen soft survey-based figures, pointing to weakness. It is also possible that the extent of hawkish repricing may already be priced in. Therefore, any signs of weakness in US employment or wages data could alleviate concerns about the Fed's capacity to lower rates, leading to a sell-off in the dollar and fresh rally in gold.

- ISM services PMI (Friday): The S&P Global PMI data released last week showed US business activity increased at a sharply slower pace April amid signs of weaker demand. Its services PMI showed the weakest reading in 5 months as orders fell in both the manufacturing and services sectors and companies responded by scaling back employment. If this is anything to go by then the closely watched ISM survey could disappoint expectations and potentially lead to another dovish repricing of Fed interest rates.

EUR/USD outlook: Technical levels and factors to watch

Source: TradingView.com

The EUR/USD has reluctantly managed to find some support in recent days. That said, the bulls need to do more to reverse the larger bear trend, as the EUR/USD continues to reside inside a large bear channel since December. Still, in light of today’s stronger Eurozone data, a potential rise towards the resistance trend of the channel at 1.0800 could be on the cards, where we also have the 200-day moving average coming into play. We need to see the EUR/USD defend support in the 1.0670 - 1.0695 ranges, which was being tested at the time of writing. Failure to do so could result in the resumption of the bear trend towards 1.06 handle. So, the bulls need some confirmation here, and a potential rise to above today’s earlier high of 1.0735 could be the trigger.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade