Access over 6,300 global markets

-

6,300 global markets

Access all asset classes with a CFD account

-

Competitive spreads

Major indices from 1pt and commodities from 0.06pts.

-

Award-winning platforms

Best Platform for the Active Trader - ADVFN International Financial Awards 2021

Why we deliver more

-

Extended hours on US share CFDsTrade Netflix, Apple, Tesla and more pre- and post-market.

-

Daily and weekly optionsManage your risk with our improved options offering across 20+ markets

-

Low trading costsCompetitive spreads and no commission except for shares

-

Wide range of marketsTrade on FX, indices, cryptocurrencies, commodities, shares, ETFs, interest rates, bonds and options. Includes extended hours on US shares, and out of hours trading on major global indices.

-

No market data chargesExperience one-click trading, integrated Reuters news, comprehensive TradingView charts, expert market analysis, and real-time price alerts all within the platform. And there’s no market data charges, no matter what you trade.

Competitive pricing

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

Latest research

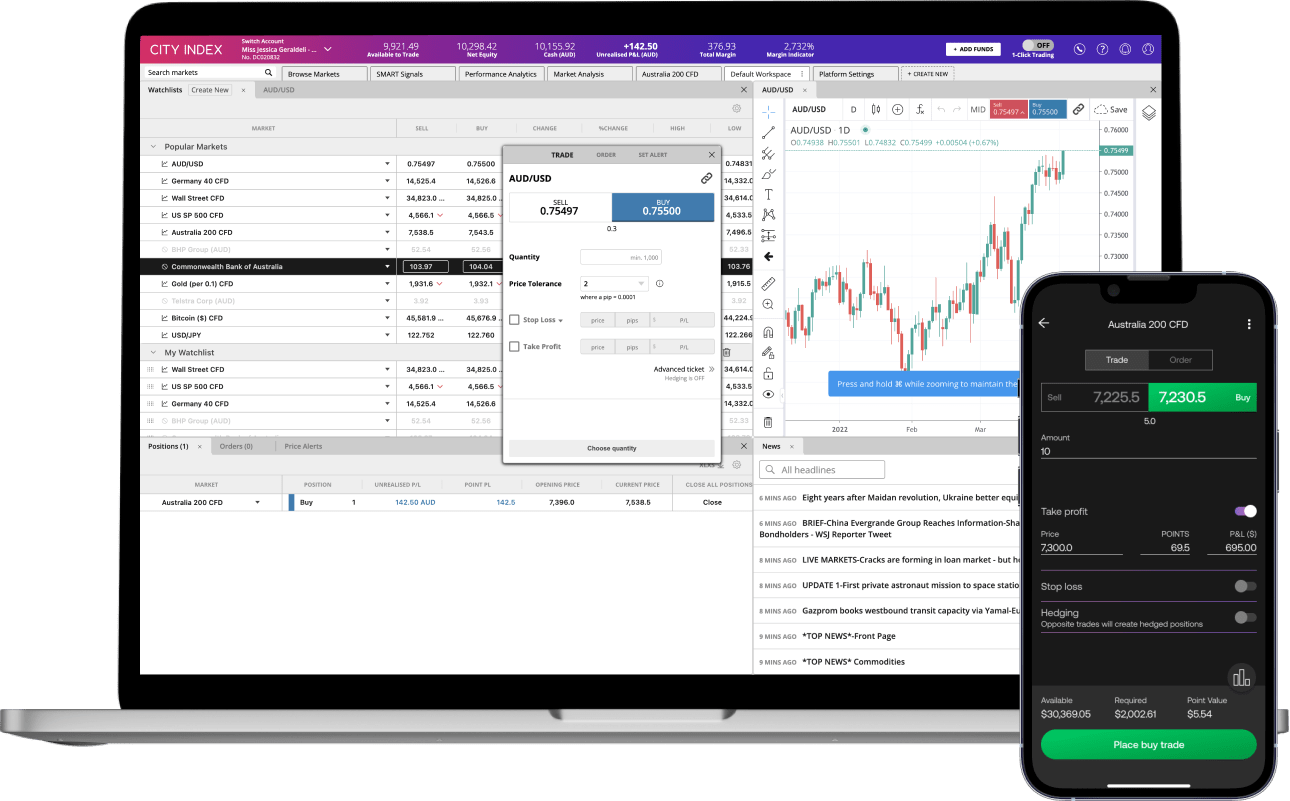

Intuitive, intelligent trading platforms

An award-winning experience

Trade with confidence on our easy-to-use platform, featuring one-click trading and integrated Reuters news, or choose the world’s most popular FX trading platform MT4, now with added asset classes.

Mobile trading apps

Access our complete range of CFD markets through our mobile trading apps on iOS and Android that offer you full functionality with seamless multi-device dealing.

How to trade with City Index

Whether you are new to trading or an experienced trader, it’s easy to open an account with City Index. Simply complete our short, secure online form and you could be trading live markets in minutes. Application is subject to review and approval.

If you think a market is going to go up in value, you go long or ‘buy’. If you think a market is going to go down in value, you short or ‘sell’.

Ready to start trading now? Get started with your application.

Introduction to the financial markets

Completely new to the markets, and not sure where to begin? Get started with our easy-to-read guide on trading the global markets.

CFD trading explained

Want to learn how to trade CFDs? Find out about how CFDs work, choosing the right markets for you, adding stop and limit orders, and much more.

Trading with City Index

Learn how to analyse markets and spot trading opportunities with our research portal, and the difference between fundamental and technical analysis.