What is margin?

Margin is the amount of money available in your trading account to open or maintain a position.

What is leverage?

Leverage allows traders to open positions on markets without the need to cover the total exposure of that market.

As an example, if you trade a market with 30:1 leverage, that means you’ll be able to open a position with a margin requirement of 3.33%. So, for just $1 you can open a position worth $30.

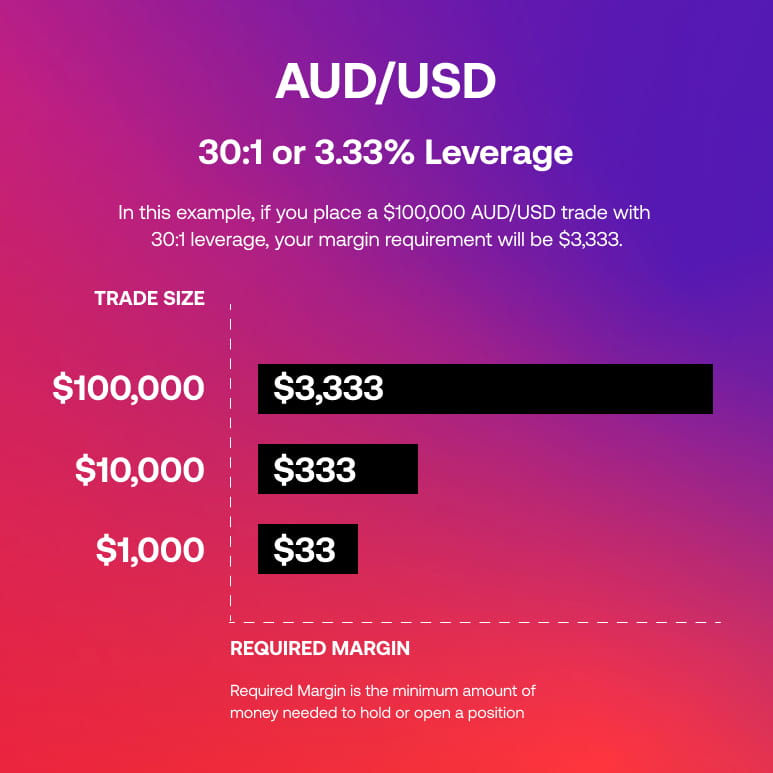

In our example, we’ll use the AUD/USD pair (which tracks the performance of the Australian dollar against the US dollar).

If we wanted to trade $100,000 in AUD/USD without using leverage, then we’d need $100,000 to cover the position. However, if we traded AUD/USD with a leverage of 30:1 (a margin requirement of 3.33%), then we would only need $3,333 to open a position worth $100,000.

Magnified profits and losses

When trading on margin of 30:1, you only need 3.33% of the trade’s full value to open the position. However, any profit or losses made from this position would be equal to the full amount of the trade - in our example, $100,000.

Using our AUD/USD trade as an example, that means we would make a $10 profit or loss for each point the market moved either in our favour or against us, highlighting the potential magnified profit or losses when trading leverage products.

Margin requirement

Brokers offer clients margin when using leveraged products so that they can trade more efficiently, without having to cover the entire value of a given position and only needing to have a fraction of the trade size in their account.

You should ensure that your account has sufficient funds at all times when trading on leverage so that none of your open positions are subject to margin close out.

What is margin close out (MCO)?

If a retail client’s margin level reaches the standardised margin close out (MCO) level, for example, 50% (i.e. 50% of the minimum required margin to cover your open positions), we will close any or all of your open positions as quickly as possible; this is to protect you from possibly incurring further losses. A retail client’s account will also have negative balance protection applied, meaning that your losses cannot exceed your deposits.

It is very important you are aware of your net equity balance and the margin requirement for your open position(s). The margin level indicator will inform you whether you are approaching the margin close out level, while the available to trade will indicate the excess funds available.

To assist in monitoring your margin level, we summarise your net equity together with your margin requirements in your daily statement and within your account details on the trading platform.

For further information on margin level and margin close out, please refer to the CFD customer agreement and product disclosure statement.