- GBP/USD was looking heavy even before last Friday’s bearish break

- Fundamentals suggests inflation risks may be skewing to the downside

- A rate cut from the BoE in June is deemed a coin toss

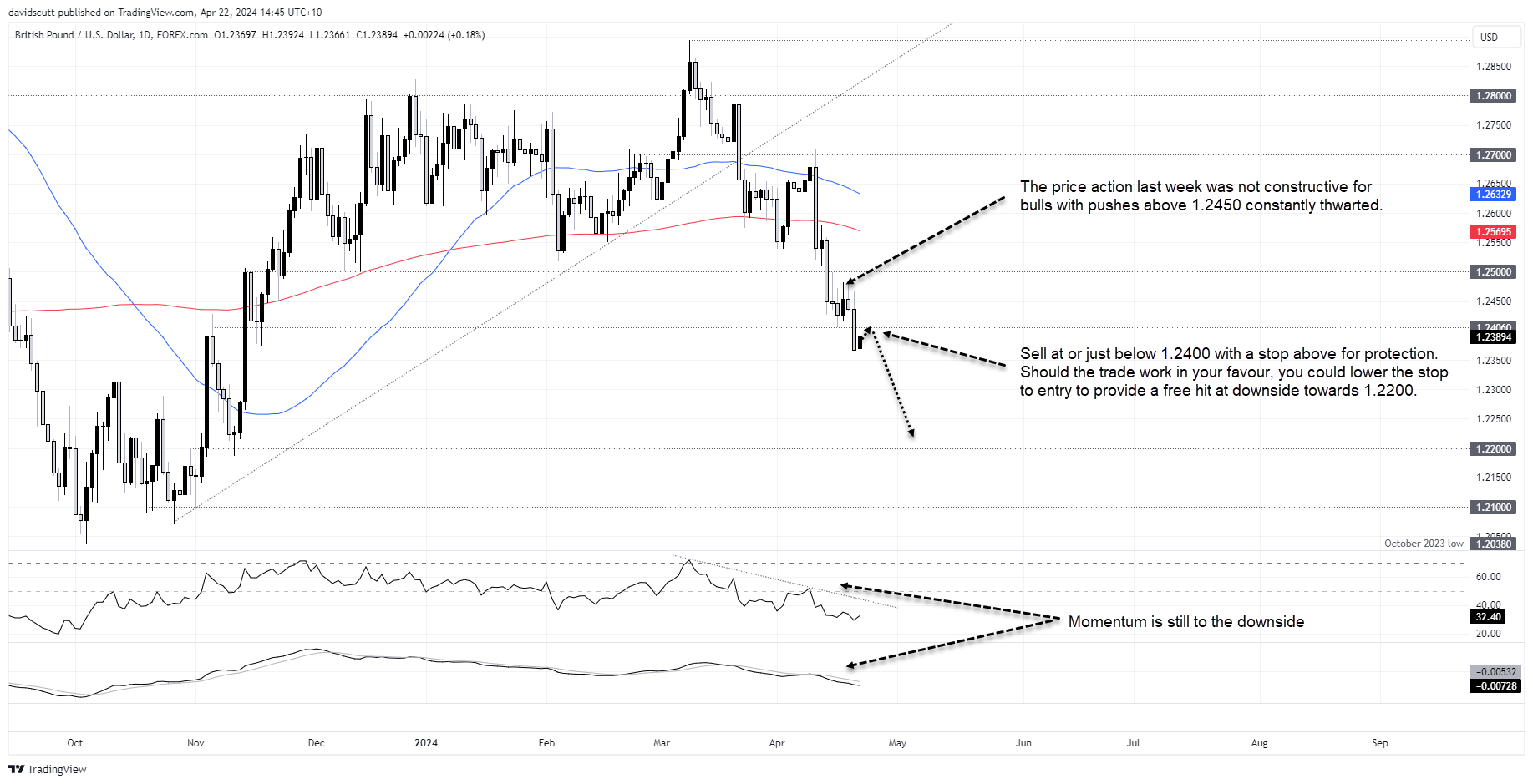

Divergent economic and monetary policy outlooks for the US and UK continue to weigh on GBP/USD, making the case for downside a far easier sell than for upside right now. With Friday’s break of 1.2400 taking GBP/USD back to levels not seen since November, it’s opened the door for an extended bearish trend with little visible support on the charts.

UK supply-demand imbalances dissipating fast

While the US economy continues to rollick along, the UK is doing the exact opposite, reinforcing the growing view the Bank of England will cut interest rates before the Fed in the upcoming easing cycle.

Last Friday’s UK retail sales report was the latest in a lengthy list of indicators to point to weakness with turnover excluding fuel sales tumbling 0.3% in March, below the 0.3% gain expected. From a year earlier, sales barely grew at 0.4%, with sales volumes deeply negative when brisk inflationary pressures were taken into consideration.

While UK wages are growing strongly, creating upside risks for inflation in the absence of a substantial and unlikely pickup in productivity, it’s obvious that demand and supply imbalances are normalising quickly, leading to rising unemployment and weaker demand. As such, upside inflation risks are being countered by weakness in economic activity.

Even hawkish BoE members are capitulating

Having been one of the most hawkish G20 central banks in 2023, policymakers at the Bank of England monetary policy committee are now acknowledging that risk.

Bank of England Deputy Governor Dave Ramsden, who was among the most hawkish members on the MPC until recently, was the latest to change his tune on Friday, suggesting inflation may undershoot the bank’s inflation forecasts issued in February.

"Over the last few months, I have become more confident in the evidence that risks to persistence in domestic inflation pressures are receding, helped by improved inflation dynamics," Ramsden told the Peterson Institute for International Economics. "For me, the balance of domestic risks to the outlook for UK inflation, relative to the February... forecasts, is now tilted to the downside, with a scenario where inflation stays close to the 2% target over the whole forecast period at least as likely.”

Ramsden’s words, following the weak UK March retail sales report earlier in the session, saw markets move to price a 25 basis point rate cut in June as a coin flip, up from around a one-in-three chance beforehand.

GBP/USD downside easier to sell than upside

The repricing of the bank rate curve weighed on GBP/USD on Friday, seeing the pair sink to fresh year-to-date lows. While there is ample event risk this week, headlines by the US core PCE inflation report on Friday and flash PMI readings on Tuesday, from a technical perspective, the risks for GBP/USD are skewed to the downside.

The performance last week after the break of 1.2500 was instructive, constantly running into sellers parked above 1.2450. Even without the retail sales report and Ramsden’s dovish remarks, the price action was pointing lower prior to the break of 1.2400. With RSI and MACD continuing to signal building downside momentum, it looks far easier to sell rallies than buy dips right now.

Should GBP/USD push back towards 1.2400 it will make for a decent setup for shorts, allowing for positions to be established at or below the figure with a stop above for protection. Increasing the appeal, there is little visible support evident until we get back to 1.2200, creating a setup that offers ample reward for taking only limited risk.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade