Risk Management

At City Index we provide a range of products, tools and resources to help you manage your risk and empower your decision-making.

Experienced traders know that understanding risk and finding effective ways to manage it are fundamental parts of a successful trading strategy. By using risk management tools effectively, you could limit potential losses without capping your profit potential. When trading CFDs, there are two major risk factors to consider:

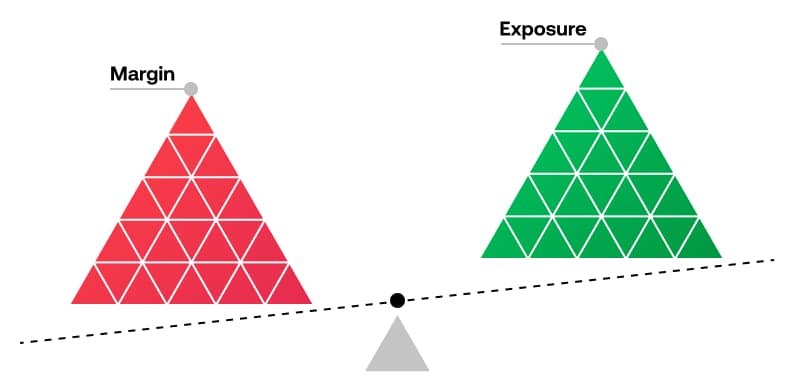

CFDs are a leveraged product, so you only need to deposit a small percentage of the overall trade value. This means that losses, as well as wins, are magnified and you could lose more than you deposit if the market moves against you.

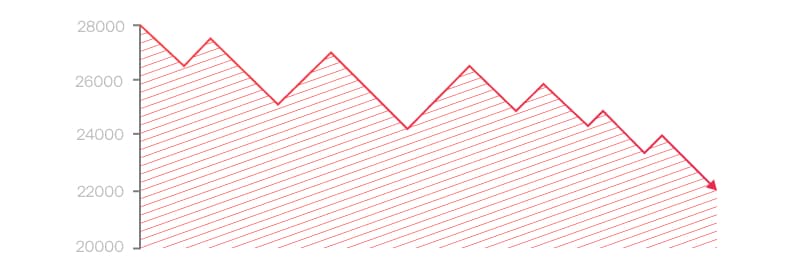

Markets can move quickly and unexpectedly, reacting to a range of different factors, including announcements, political decisions, or even natural disasters. While volatility can provide trading opportunities, it can also result in sudden or unexpected losses.

You can find out more about the risks involved with trading CFDs in our dedicated Trading Academy

Amongst our wide range of risk management tools, we offer two exciting options to trade with limited risk, designed specifically to help protect your funds. Trade with confidence and flexibility knowing that your risk is fixed, whilst your potential gains remain unlimited.

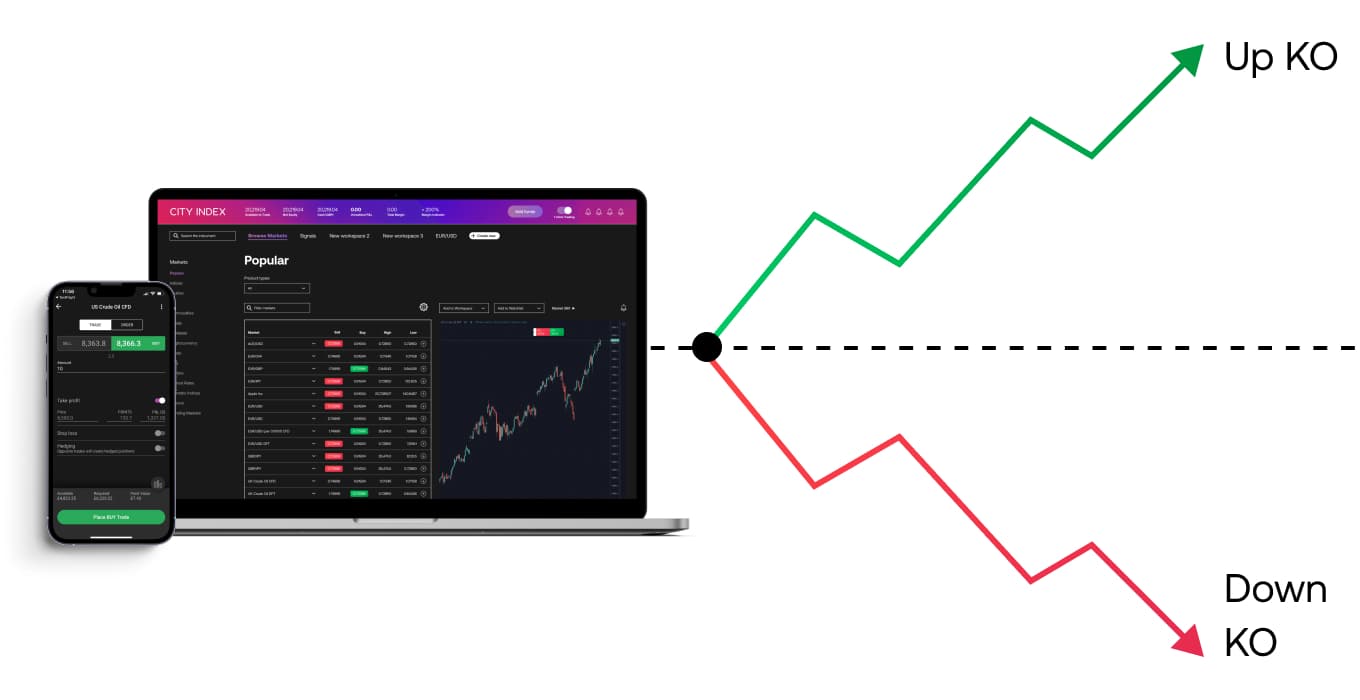

An exciting, innovative and simple way to trade a range of major FX, Indices and Commodities markets. Knockout Options have a range of unique benefits and features, including:

- Limited risk with guaranteed protection

- Guaranteed closeout price

- Flexible margin

- Simple, transparent pricing

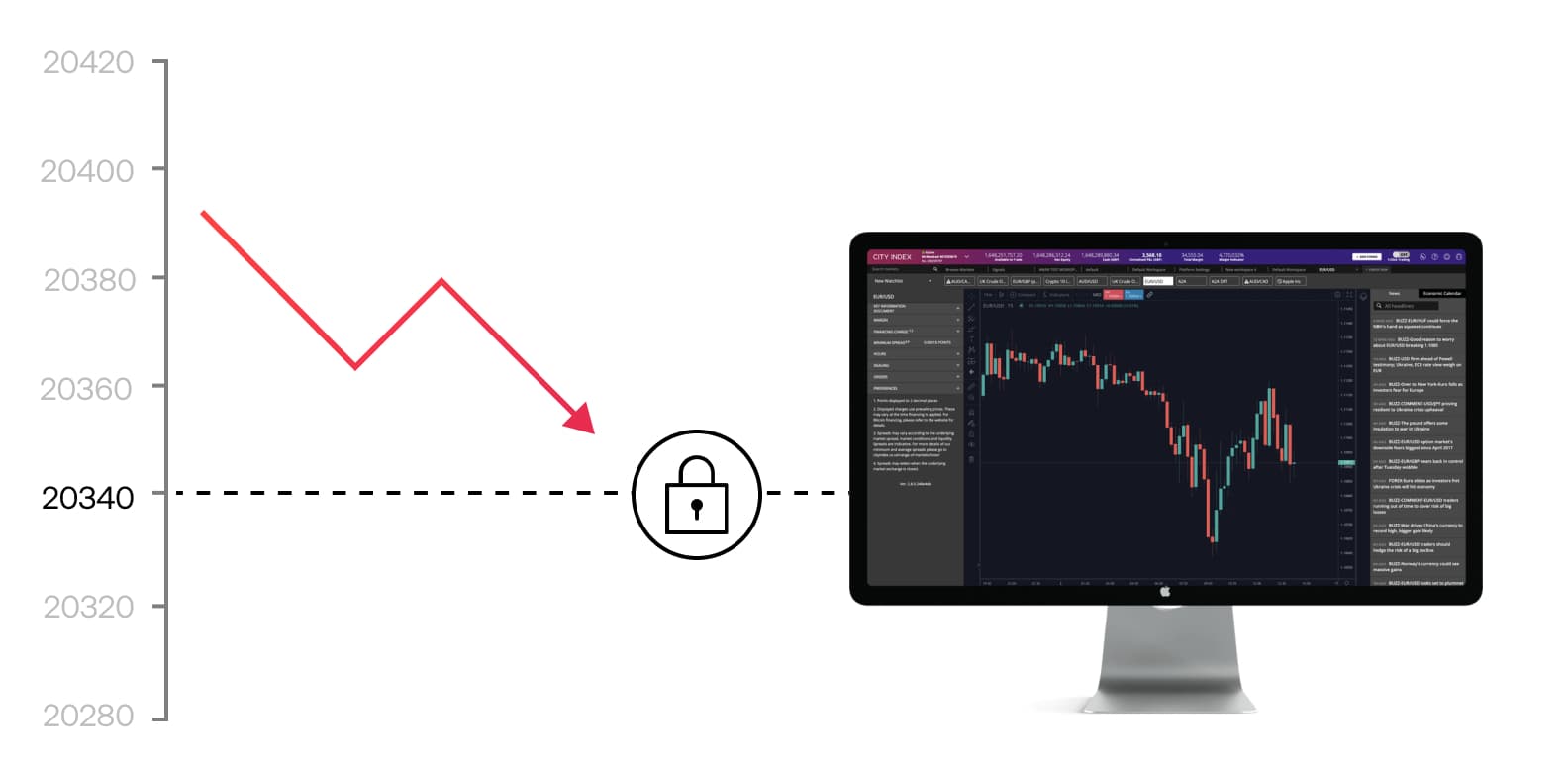

Use guaranteed stops to ensure your trade closes at the exact level chosen by you - even if market gapping or slippage occurs. Key features include:

- Guaranteed closeout

- Cost-effectiveness

- Availability on 4000+ markets