- How to place a CFD trade

- How does CFD trading work?

- Open a CFD account in Australia

- Choose a CFD market

- Pick a CFD strategy

- Decide whether to buy or sell

- Select how many CFDs to trade

- Manage your CFD risk

- Open, monitor and close your position

- CFD trading in Australia

- What’s the best CFD platform in Australia?

- How to trade CFDs FAQs

How to place a CFD trade

To place a CFD trade, you first need to understand how contracts for difference work. Then, you can choose whether to go long or short and open your position by selecting your chosen number of contracts. You’ll realise any profits or losses when you close the position.

CFDs are sophisticated tools, enabling you to speculate on both rising or falling markets, use leverage and access thousands of instruments – 24 hours a day. But to take full advantage of the versatility of CFDs, you’ll want to ensure you understand how to trade them correctly.

Follow these eight steps to open your first CFD position today:

-

Learn how CFD trading works

Understand the basics behind contracts for difference, and how they differ from other financial products -

Open a CFD trading account

Get started with a demo account, or go straight to live markets -

Choose a CFD market

Decide which market you want to trade on. Looking for inspiration? Head over to our research portal -

Pick a CFD strategy

CFD strategies give you guidelines for when and how you’ll enter and exit your positions -

Decide to buy or sell

Click 'buy' if you think your market will increase in value, or 'sell' if you think it will fall -

Select your trade size

Choose how many CFDs to buy or sell -

Manage your CFD risk

A stop loss is an order to close your position out at a certain price if it moves too far against you, and a useful way of limiting your risk -

Execute, monitor and close your trade

Open your position

and see your profit/loss update in real time. You can exit it by clicking the close trade button

Let’s take a closer look at each step.

1. Learn how CFD trading works

CFD trading works using contracts that mimic live financial markets. You buy and sell these contracts in the same way that you'd buy and sell in the underlying market. But instead of choosing how much of a particular asset you would like to invest in – such as the ASX 200 – you pick how many contracts to buy or sell.

If the market moves in your favour, your position will earn a profit. If it moves against you, it will incur a loss. You realise your profit or loss when you close the position by selling the contracts you bought at the outset.

If you want to calculate your potential profit or loss ahead of time to understand your CFD risk, our deal ticket automatically shows you P&L figures when you set stop-losses and take-profits in our platform.

ASX 200 CFD example

- You open a new City Index account and deposit $2,000

- After doing some research, you decide to trade the Australia S&P (ASX 200)

- You believe that the ASX 200 – the Australia S&P in City Index platforms – will fall, so you plan to sell the market at 7,540

- You sell two ASX 200 CFDs, which means you earn $2 for each point of downward movement, and lose $2 for every upward point

- You set a stop at 7,550, which will close your position if it hits a loss of $20

- The Australia 200 falls and you close at 7,500. 7,540-7,500 = 40 points, so you make $80

However, if the ASX 200 had risen instead, you would have made a loss. For more in-depth examples of how CFD trading works, take a look at our CFD examples page.

2. Open a CFD account in Australia

To buy and sell CFDs, you’ll need an account. This is what you’ll use to research new opportunities, open and close positions, manage your risk, monitor your P/L and more.

Before you commit real capital, you can open a demo CFD trading account to try things out with zero risk. A City Index demo, for example, gives you $20,000 in virtual funds to buy and sell our full range of markets. All the price movements are real, the only part that isn’t is the money involved. So, it’s a great place to practise.

When you’re ready to risk real capital, you can open a live account, which usually takes minutes (application subject to review and approval). Then, once you’ve added some funds, you’ll be all set to get started.

3. Choose a CFD market

One major advantage of CFDs is the huge range of markets you can choose from.

At City Index, we offer contracts on over 6,300 individual markets across shares, indices, currencies, commodities, interest rates, bonds and more. From a single platform, you can access major global markets in the UK, US, Europe, Asia, Australia and New Zealand.

With so many choices, it’s important to find an opportunity that suits you. There are lots of research tools available in our platform to help you do just that – including news and analysis pieces, technical indicators, alerts and more.

Once you’ve chosen a market, use the search function on the platform or app to find it. You’ll be able to see its live price, view a chart and look at all the information you need to know before taking your position.

4. Pick a CFD strategy

There are a lot of different ways to trade with CFDs, which makes it important to set out some guidelines for what and when you’ll trade. The aim is to find the most advantageous entry and exit points to ensure you achieve consistent returns over time.

Here are some popular CFD strategies you could consider:

Trend trading

Trend trading involves identifying the direction of a market, and opening a CFD trade that will take advantage of the movement until the trend reverses.

This is one of the longer-term CFD strategies you can take, as you’d need to hold the trade for as long as it takes the run to finish – ignoring any smaller retracements.

Hedging with CFDs

Hedging is a trading tactic that is used to reduce the risks of trading. It works by placing trade(s) that will offset the potential losses or negative balance of an already open trade.

An example of this would be if you had an existing trade open on a specific instrument that is currently trading negatively, you may wish to place an additional trade in the opposite direction to level out your balance. Whilst this practice cannot completely remove risk and/or losses, when used correctly, it can reduce them.

5. Decide whether to go long or short

CFD markets have two prices. The first is the sell price (the bid), and the second price is the buy price (the offer). The difference between the two is known as the spread.

Both are based on the price of the underlying instrument. The sell price is always lower than the market price, while the buy is higher.

Before you open your position, you’ll need to decide whether you want to buy or sell. If you believe your market will go up, you go long by trading at the buy price. If you believe it will fall, you can short it by trading at the sell price.

Shorting a market means you earn a profit if it falls in value, and a loss if it rises. Find out more about shorting.

6. Select how many CFDs to trade

You’ve chosen your market and decided whether to go long or short. But how do you select the size of your position? With CFD trading, you select the number of contracts to buy or sell.

Each contract represents a certain amount of its underlying asset. With stocks, one CFD is equivalent to one share. With FX, you will be trading per pip, therefore if you buy at 1.4305 and sell at 1.4306, you will make one times the pip value of the trade. To see what a contract means for your market, look up the 'tick value' in the instrument's market information sheets.

CFDs are bought and sold in the base currency of the underlying market. So, if you’re buying a US share CFD, then your profit or loss will be calculated in US dollars.

Contracts for difference utilise leverage, which means you only need to have a small percentage of the overall trade value, known as the margin, in your account to open a position. The larger the value of your trade, the more margin is required.

It is important that you have enough funds in your account to cover your margin.

With City Index’s Web Trader platform, you can calculate your margin before placing a trade through the platform’s margin calculator, monitor each position’s margin requirement separately and review your account’s total margin requirement through the “margin level indicator”.

7. Manage your CFD trading risk

Before you place your trade, you’ll want to consider your risk-management strategy.

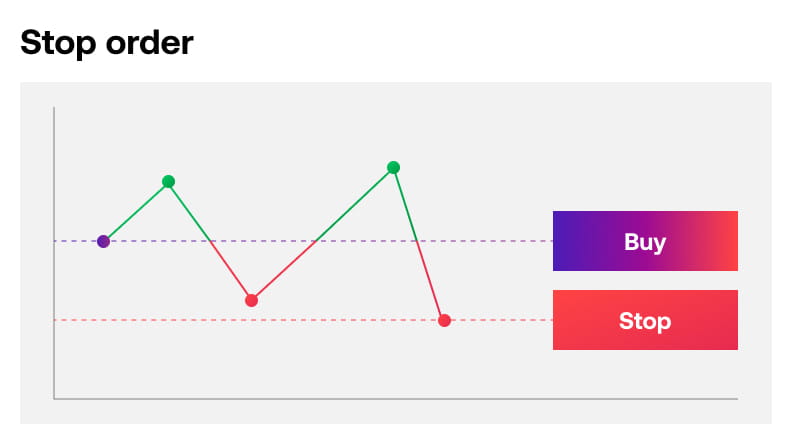

A key risk-management technique is to place an order, such as a stop loss, that will automatically close the trade if the market reaches a certain level.

A stop-loss order is an instruction that tells your provider to close your position once it reaches a specific level set by you. This will, as the name suggests, be at a worse price than the current market level and can typically be triggered on losing positions to help minimise losses.

A drawback of basic stop orders is that they can be subject to slippage – this is what happens when a market is moving too quickly, and your order can’t be executed at the exact price you’ve asked for. Instead, it will be filled at the first available price, which can be worse than the one you requested.

This is why traders might use a guaranteed stop-loss order or GSLO instead, which will always execute at your chosen price, regardless of market conditions. They’re free to attach but you’ll incur a charge if triggered.

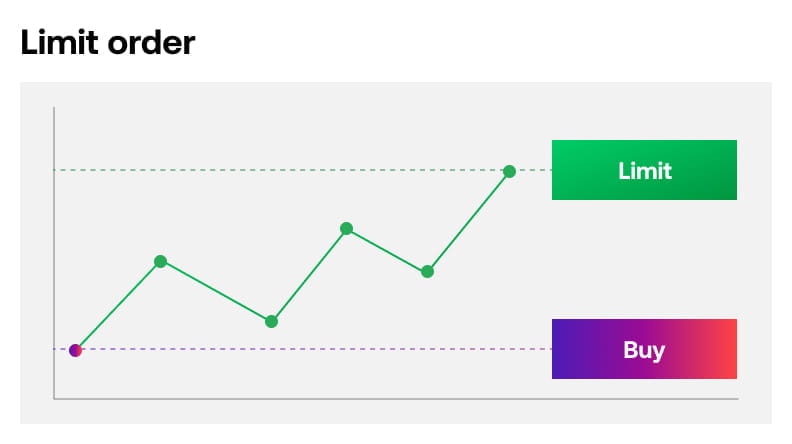

A limit order, meanwhile, is an instruction to close out a trade at a price that is better than the current market level and is typically used to help lock in profits.

Standard stop losses and limit orders are free to use and can be placed in the dealing ticket when you first place your trade, or once it is open.

Once you’ve set up your risk management, you can execute by hitting ‘Place Trade’.

8. Open, monitor and close your CFD trade

Now your position is live, your profit and loss will move as the underlying market goes up and down.

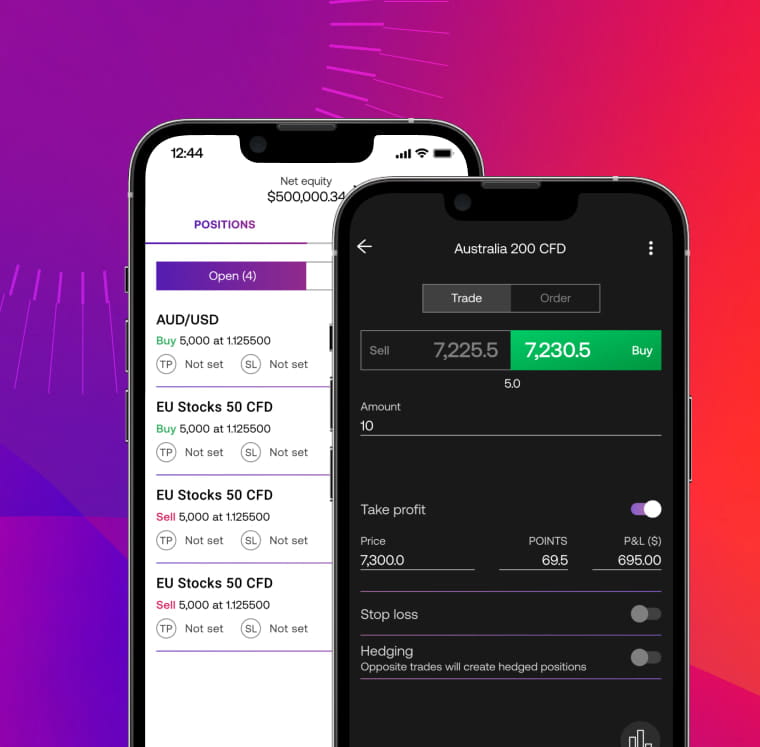

You can track market prices; see your profit/loss update in real time and edit, add to or exit your position from your computer, or by using our mobile app.

If you didn’t select a stop or limit before opening the position, then it isn’t too late – you can add them now. If you already have exit orders in place, meanwhile, you can move them to reflect changing conditions.

With a stop loss attached, your trade will automatically close. But otherwise, the position will remain active until you decide to exit the market, unless you run out of margin in your account – then your positions may be automatically closed if you don’t top up your funds.

To close a CFD, you can just select the 'close position' option within the positions window.

Alternatively, if you wanted to close a trade manually, you would trade in the opposite direction from where you opened it. If you bought 500 CFDs at the outset, then you can sell 500 CFDs now to close. If you sold 500 CFDs to open, you buy 500 CFDs to close. But you’ll need to make sure the ‘hedging’ function of the platform is switched off in settings to do this manually, otherwise you’ll end up with two positions netting each other off.

Your net open profit and loss will now be realised and immediately reflected in your account cash balance. Your P&L will also be automatically be converted to your account’s chosen base currency.

To calculate your profit or loss manually, just subtract the opening price from the closing price (or the opposite for short positions), then multiply that figure by the size of your position. Just remember to take any costs into account.

CFD trading in Australia

CFD trading in Australia is popular – and legal – but there are a few restrictions in place to protect individuals, including how much leverage can be offered. These regulations are important as they make sure you’re trading with a trusted Australian CFD provider, such as City Index.

Learn more about Australia CFD regulation