US futures

Dow futures -0.2% at 35608

S&P futures -0.9% at 4543

Nasdaq futures -1.4% at 14837

In Europe

FTSE -0.15% at 7656

Dax -0.26% at 15565

Euro Stoxx -0.6% at 4220

Learn more about trading indices

Stocks tumble as more hawkish Fed expected

US stocks tumbled after data revealed that US inflation jumped in January by more than expected. CPI rose to 7.5%, up from 7% in December and ahead of the 7.3% that was forecast and marking the fastest pace of inflation in 40 years. On a monthly basis inflation rose 0.6%, ahead of the 0.5% forecast.

Core inflation, so removing the more volatile items, grew 6% YoY again the biggest rise since 1982.

The data comes after a solid non-farm payroll report for January and supports the Fed’s intentions to start raising interest rates in March. Investors are expecting an even more aggressive move from the Fed, with the chances of a 50-basis points rate hike rapidly rising.

Reflecting the more hawkish expectations the US dollar rallied following the results, jumping 0.25%. Meanwhile stocks came under pressure, with the rotation out of high growth tech stocks back in full swing. Nasdaq futures are down -1.3%. Stocks may struggle to gain much ground from here to the March Fed meeting as investors weigh up the chances of a 25 or 50 basis point hike.

Meanwhile, jobless claims played second fiddle to the CPI report, but also supported the Fed’s intentions to hike rates. Initial jobless claim rose by 223k, just below forecasts of 230k, and below last week’s 239k as the recovery in the labour market continues.

In other corporate news:

Disney is up 6% pre-market after impressive results. The streaming side of the business saw new subscribers hit 11.8 million, soothing fears of a streaming slowdown and preventing the share price from suffering the same fate as Netflix. Disney is also more diversified than Netflix – the theme parks unit of the business saw revenue rise to $7.2 billion in the quarter, doble the $3.6 billion forecast.

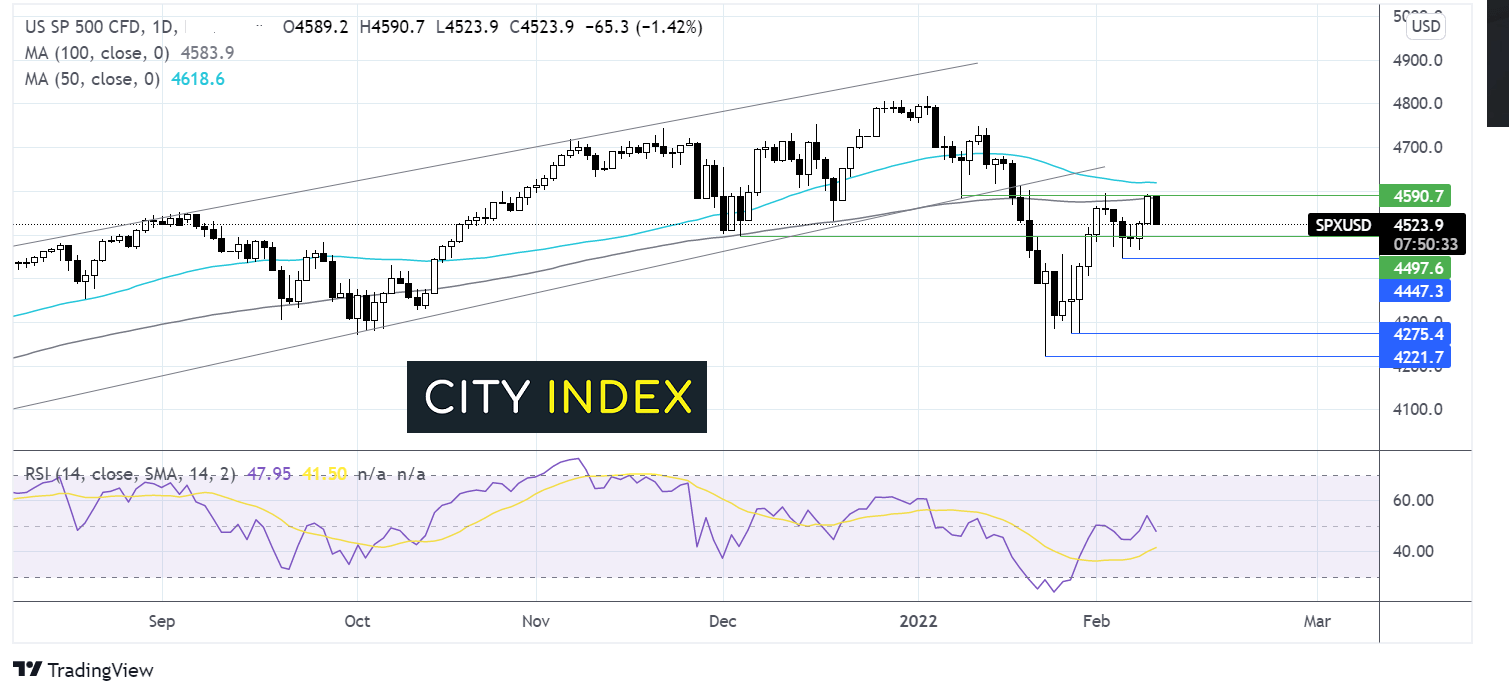

Where next for the S&P500?

The S&P500 failed to break above the 100 sma horizontal resistance at 4590 and is falling lower with a potential bearish engulfing candle forming, which could point to lower prices to come, if it pushes below yesterday’s low of 4526. So far 4526 if offering support. Should this sipport be taken out 4500 is the next support the December low. On the flip side, a move over 4590 could see buyers gain traction.

FX markets USD surges, EUR falls

The USD is rallying hard following the inflation data, as expectations of a more hawkish Fed lift treasury yields and the USD.

EUR/USD is after US inflation data. Earlier in the session the European Commission revealed that it raised the 2022 inflation forecast to 3.5%, up from 2.2%. The report also said that economic growth this year will be slower than expected in November owing to Omicron. The outlook sent European treasury yields higher, boosting the euro.

GBP/USD +0.01% at 1.3534

EUR/USD -0.29% at 1.1388

Oil rises after inventory draw, US – Iran talk news awaited

Oil prices are grinding higher for a second straight session after stockpiles unexpectedly fell and as investors awaited the outcome of recent US – Iran nuclear deal talks.

EIA inventories fell by 4.8 million barrels in the week ending February 4th, taking inventories to their lowest level since October 2018. Forecasts had been for an increase in inventories by 369k. The large draw in stockpiles comes as demand continues to ramp up after Omicron.

However, gains were limited as investors watch the outcome of the latest round of US – Iran nuclear talks. The White House is putting pressure on Iran for a quick agreement, which could mean that Iranian oil sanctions are lifted, helping to ease supply tightness.

WTI crude trades +0.9% at $89.50

Brent trades +0.7% at $91.50

Learn more about trading oil here.

Looking ahead

21:05 BoE Bailey speech

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.