- Gold outlook remains fundamentally supported in the long term

- Traders eye GDP and Core PCE data, ahead of NFP next week

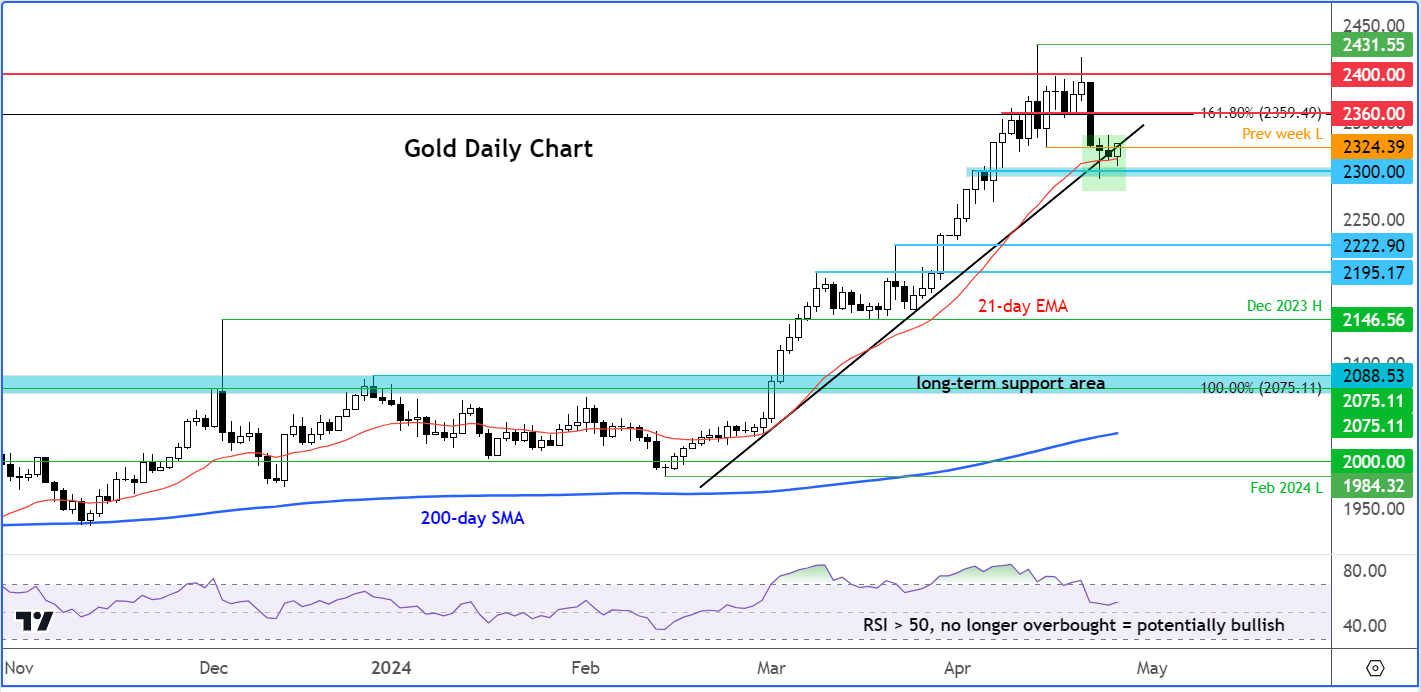

- Gold technical analysis shows the metal is finding some renewed support

Gold has been able to regain its poise after the sharp drop we observed at the start of the week. The metal has found decent support around the $2300 level, with traders keeping a close eye on bond yields and incoming US data. Overall, not much has changed in as far as gold’s long term bullish outlook is concerned. With prices no longer severely overbought on the technical front, we have seen a bit of dip-buying again. While the potential for a larger correction is always there, my base case scenario is that dips will be shallow, and we could see repeated all-time highs in months ahead.

Gold remains fundamentally supported in the long term

While the potential for a more meaningful correction exists, many investors who have missed the recent gold rally are eyeing opportunities to buy on dips. Supporters of gold point out that recently gold prices have shown resilience despite the dollar strength and elevated yields. They argue that with prices no longer excessively overbought, the trend could resume, especially considering gold's fundamental drivers such as continued central bank purchases and inflation hedging. After years of above-forecast inflation, most global fiat currencies have lost significant value, leading investors to perceive gold as a reliable hedge against inflation, contributing to its strong performance. This is in my view the main reason behind gold’s bullish trend in recent years. Meanwhile, critics of gold argue that high yields and reduced expectations for Fed rate cuts in 2024 will likely support the dollar, keeping pressure on gold and other dollar-denominated metals. However, so far in 2024 this hasn’t been the case.

An additional source of worry for investors, and another supporting factor for gold is the rising levels of interest payment by the US government. This is not going to be addressed any time soon. For now, bond investors don’t seem to be too concerned about the possibility of a US default, although gold’s price action suggests otherwise, with the metal rising to repeated all-time highs recently despite the renewed rise in yields.

The persistence of high yields and elevated interest rates is causing the servicing cost of US Federal debt to become increasingly burdensome. The annual interest expense alone has soared to $1.1 trillion, compared to less than half of this figure just a few years ago. With interest rates remaining high and debt levels reaching unprecedented heights due to ongoing deficit spending, the US appears to be on an unsustainable fiscal path. Implementing tax increases and reducing government spending is the only feasible approach to regain some degree of control. Failure to tackle this issue could result in a severe recession and have a substantial impact on financial markets.

Traders eye GDP and Core PCE data

In the much shorter-term horizon, the direction of the dollar and therefore gold may depend on today’s publication of first-quarter GDP data, although the Fed's primary focus on inflation and employment metrics may mitigate its impact. Nevertheless, a significant deviation from expectations in either direction could prompt a corresponding movement in the dollar and therefore gold prices.

It is possible that the upcoming PCE inflation figures on Friday and the jobs report next Friday pose greater risk events for the dollar. Recent robust growth and persistent inflation have tempered expectations of rate cuts, but the extent of hawkish repricing may already be priced in. Therefore, any signs of weakness in US data could alleviate concerns about the Fed's capacity to lower rates, as market expectations for rate cuts have significantly diminished since the beginning of the year.

Gold outlook: Is the metal about to stage another rally?

Regular readers of my posts know that I’ve been anticipating a pullback in gold prices in recent weeks, which finally occurred at the beginning of this week. This was partly due to reduced concerns about a direct conflict between Israel and Iran, dampening gold's safe-haven appeal. However, the decline in geopolitical tensions wasn't the primary reason for my forecast. It was mainly due to the extreme overbought conditions in gold prices from a technical standpoint, which needed a correction. Additionally, I had some concerns about the ongoing sell-off in bond markets, pushing up yields and raising the opportunity cost of holding non-interest-bearing assets. While the latter concern still holds, gold prices are no longer as overbought as they were a couple of weeks ago. With gold now reaching my initial downside target of around $2300, I'm less confident about the possibility of a deeper correction.

So, I maintain my longer-term bullish outlook on gold and anticipate fresh record highs in the near future. The key question now is whether gold has formed a near-term low before new records are reached, or do we go a bit deeper first?

Gold outlook: Technical levels and factors to watch

Meanwhile from a technical point of view, the XAUUSD chart is starting to show some signs of strength again, as it tests the 21-day exponential moving average. So far, we haven’t seen a decisive move higher this week, but do watch out for a bullish signal to emerge around these levels. Even if we don’t see a decisive move higher this week, an ideal scenario would involve a bullish continuation pattern like a bull flag or triangle forming around these levels, especially as gold trades near the 21-day exponential moving average, often acting as good support in strongly trending markets. Additionally, gold is currently testing the short-term bullish trend line and support around $2300. However, if gold fails to exhibit bullish price action around $2300, a deeper retracement towards the next significant support level around $2222 could occur.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade