The British pound was the strongest FX major on Tuesday after BOE’s chief economist said he’d “err on the side of caution for cutting bank rate”, sending GBP up against all of its major peers. Pill also warned that the latest official data showing a large fall in unemployment should not be taken at ‘fade value’, which is why the central bank is placing greater emphasis on service price inflation and wage growth over unemployment.

The pound had come under increasingly bearish pressure in recent days on bets of two rate cuts, beginning in August. Yet Pill’s comments allowed mean reversion to kick in and saw GBP/USD rise 0.8%, in line with my bullish, countertrend bias on Tuesday.

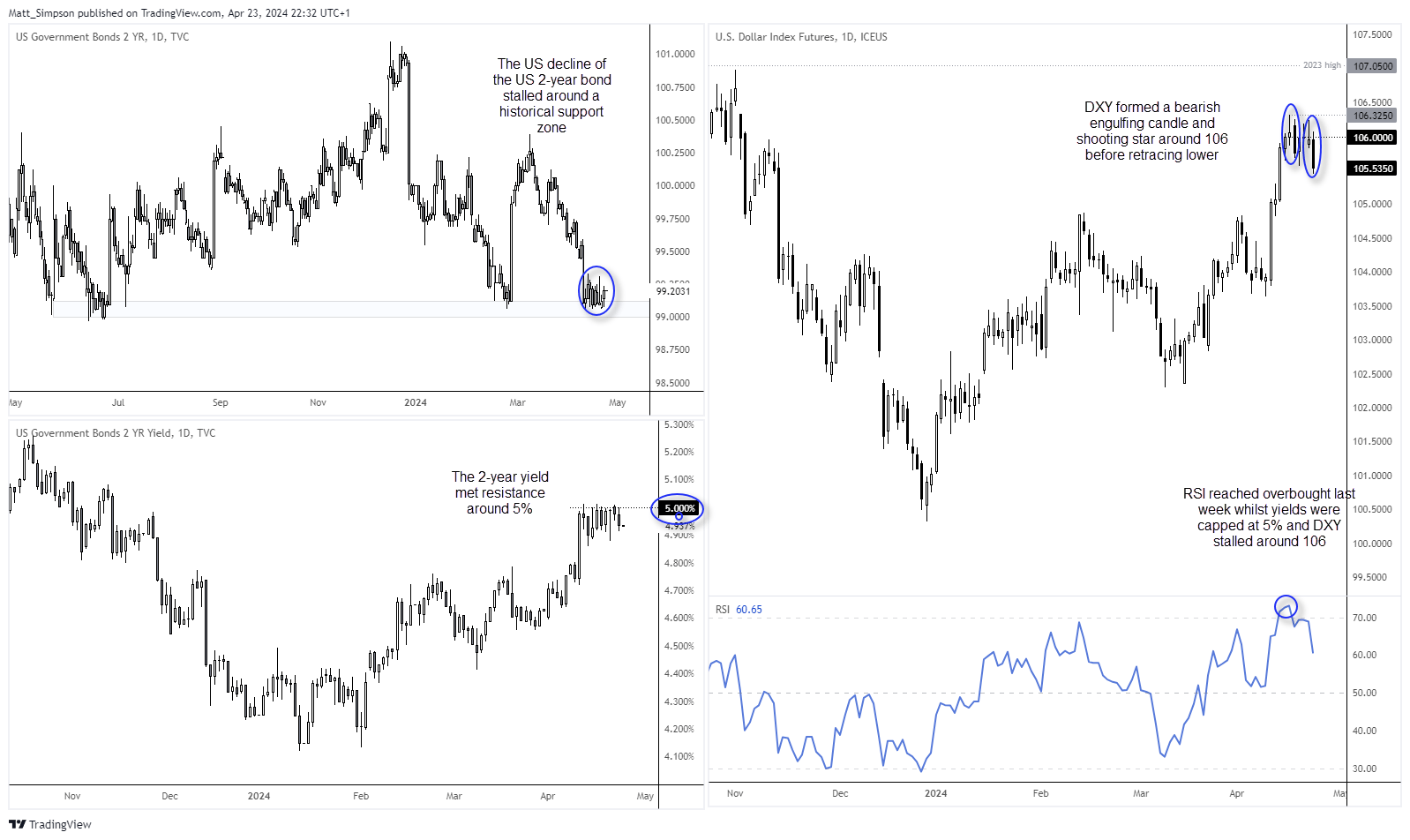

The US dollar began to retrace lower after failing to hold above 106. Which is encouraging as I have flagged a couple of times over the past week that the US 2-year bond found support at a historical level, which seemed to be capping yields at 5% and therefore raised the risks of a US dollar pullback.

- WTI crude oil rallied in line with Tuesday’s bias and closed above $83, thanks to a weaker US dollar

- Gold formed a bullish hammer at a 50% retracement level to suggest bullish mean reversion may kick in (but as for now, the bias is not for a break to new highs)

- Wall Street indices rose for a second day ahead of earnings from big Tech

- USD/JPY cautiously rose to a fresh 34-year high yet, for now at least, remains hesitant to tap the 155 handle ahead of a key US inflation report and BOJ meeting

Economic events (times in AEST)

- 11:30 – Australian quarterly and monthly CPI report

- 18:00 – German Ifo business survey

- 19:30 – US durable goods orders

- 22:30 – Canadian retail sales

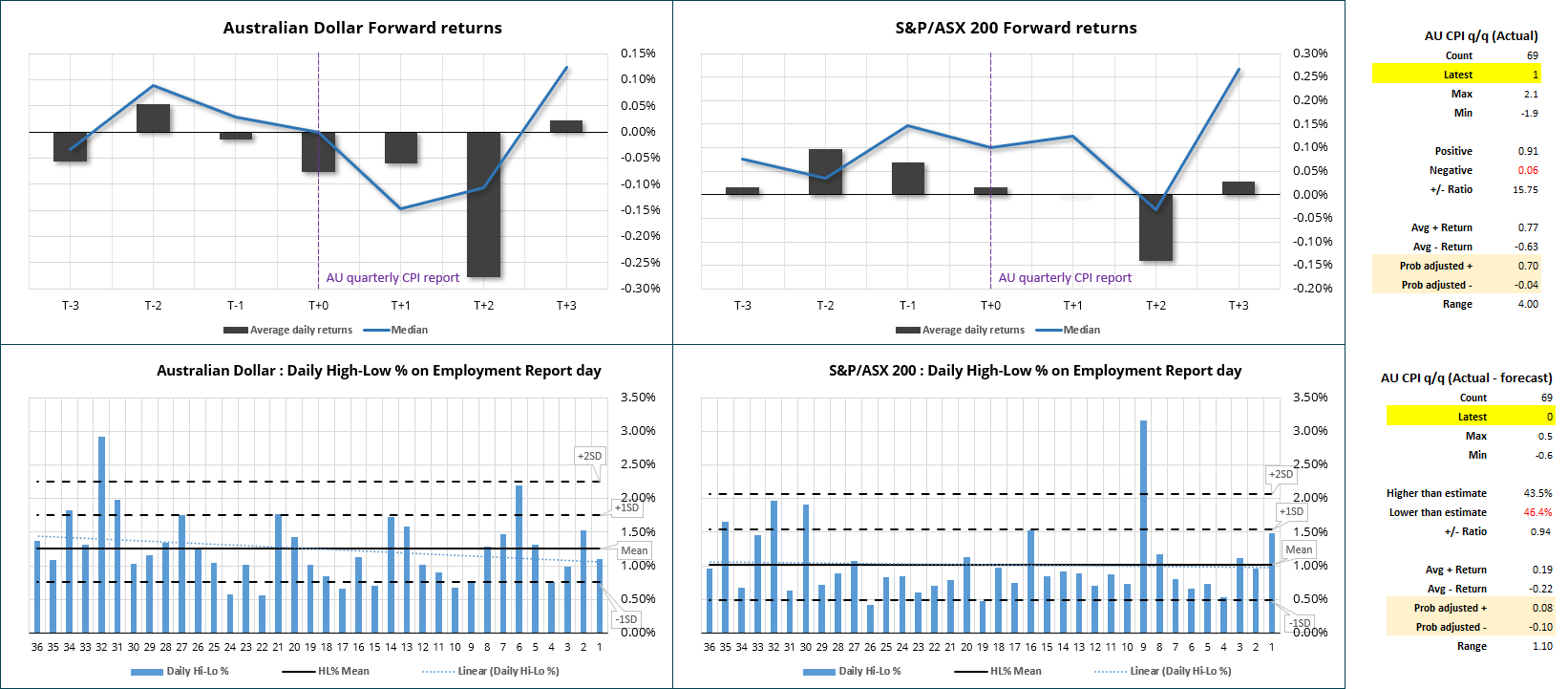

Australia’s inflation report is the biggest event for currency traders in today’s APAC session. The RBA pay very close attention to the quarterly report given its established history, and as it is perceived to be more robust than the monthly report it is assumed more likely to prompt any policy action from the RBA.

Clearly what most want to see is a softer set of inflation figures to warrant a cut from the RBA sooner than later. Let looking through the data for CPI q/q, odds slightly favour a miss with 43.5% higher than estimates and 46.4% lower than estimate. Only 0.94% of the CPI q/q reads came in on estimate according to the data.

- This has seen AUD/USD post negative average returns on CPI day, T+1 and T+2.

- The strongest negative returns are T+2

- Yet T+1 is the strongest negative median returns

- The ASX 200 has averaged flat returns on CPI day and T+1

- Although the ASX 200 has produced positive median returns on CPI day, T+1 and T+3

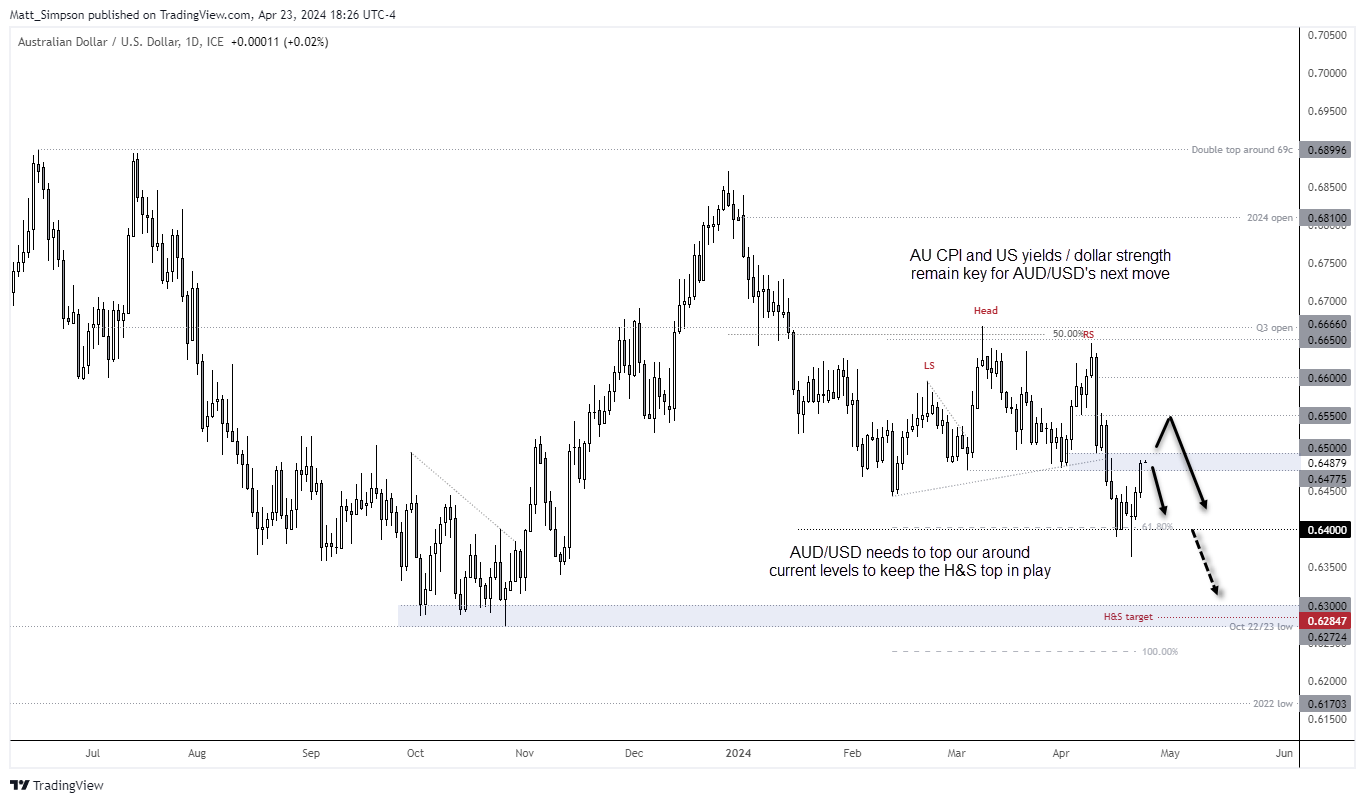

AUD/USD technical analysis:

The two-day rally for AUD/USD has seen the pair reach my upside target zone in the first half of the week, as anticipated. How much higher it climbs from here is now down to whether CPI data comes in stronger than expected and if the US dollar continues to correct. Given NZ inflation remains sticky and it tends to move in lockstep with Australia’s inflation, there’s a chance that today’s CPOI report won’t be enough to replenish dovish bets to materially weaken AUD/USD.

And with AUD/USD sitting in a resistance zone, my bias is neutral until the data arrives and we get a better feel for the US dollar’s direction. Ultimately, a soft CPI report coupled with USD strength could prove to be the high for AUD/USD and another crack at breaking below 64c. But unless we are treated to a broad risk-on environment, I suspect the upside potential for AUD/USD could be limited. And if AUD/USD does top out around current levels, it keeps the head and shoulders top in play which brings a move down to 63c onto the agenda.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade