US futures

Dow futures -1.06% at 38045

S&P futures -1.15% at 5012

Nasdaq futures -1.54% at 17249

In Europe

FTSE 0.4% at 8070

Dax -0.92% at 17900

- Meta slumps as the year of efficiencies comes to an end

- US GDP falls, but core PCE rises in Q1

- Alphabet and Microsoft report after the close

Tech stocks lead losses after Meta disappoints

US stocks point to a drop on the open, with the tech-heavy NASDAQ leading the decline after some disappointment regarding the outlook from Meta and after a US data drop.

US Q1 GDP was weaker than expected at 1.6% annualized, down from 3.4% in Q4 2023 and below forecasts of 2.5%. This marked the slowest growth for the economy in almost two years as consumer and government spending eased.. However, core PCE in the quarter was hotter than expected at 3.7%, up from 2% and well ahead of forecasts of 3.4%.

Separately, jobless claims were also stronger than expected, suggesting that the US jobs market continues to hold up well.

The data supports the view that the Fed can be patient about cutting interest rates. There is still nothing in the data that screams the Fed needs to cut. With inflation rising, the Fed will likely keep rates high for longer.

The data comes ahead of tomorrow's core PCE index, which is the Fed's preferred gauge for inflation. Expectations are for inflation to cool to 2.6% YoY in March but hold steady at 0.3% on a monthly basis.

The Fed will meet next week and is not expected to change monetary policy. The market is pricing in under two quarter-point rate cuts this year.

Corporate news

Meta has plunged premarket after its quarterly results. The social media tech giant had strong Q1 earnings and revenue that beat the forecast. However, investors are disappointed after revenue guidance was slightly lower than expected and amid plans of higher spending on AI going forward. It would appear that the year of efficiency is over, and the market is not comfortable with that.

Other social media stocks, such as Snap and Pinterest, are also pointing to sharp losses ahead of the open as they track Meta's decline.

Alphabet is due to report after the close, and Wall Street is expecting EPS growth to $151, a share on revenue growth of $78.75 billion. The Olympics and US elections could boost ad spending outlook. Investors will be cautious following Meta’s numbers and huge AI spending plans.

Microsoft is due to report after the close and expectations are for EPS of $2.83 on revenue of $60.88 billion. In the same period last year Microsoft reported EPS of $2.45 on revenue of $52.88. Microsoft is expected to announce a 19% growth in cloud revenue. The results come as the share price trades up over 10% so far this year, outperforming the S&P 500 but underperforming some of its magnificent seven peers.

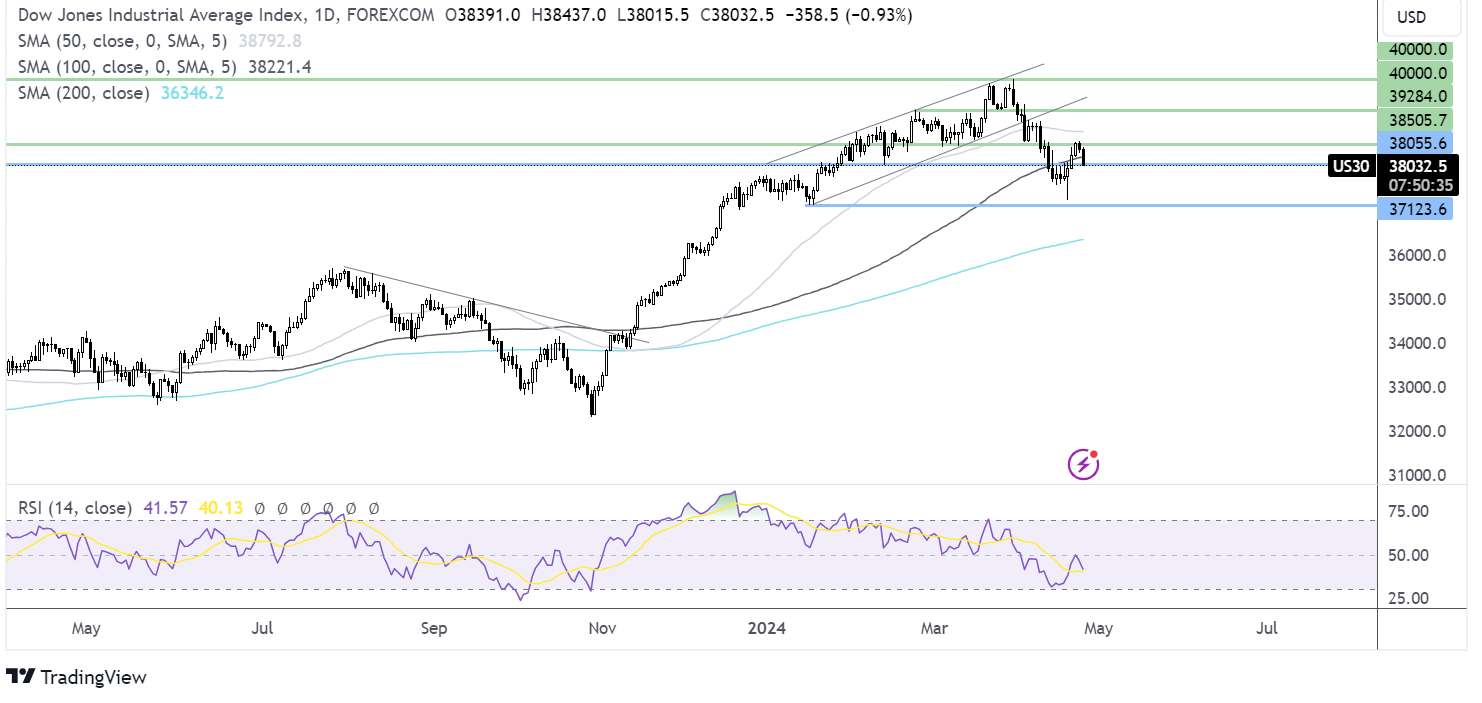

Dow Jones forecast – technical analysis.

After running into resistance at 38550, the Dow Jones is falling, breaking below the 100 DMA and is testing 38000 the February low. The bearish engulfing candle and the RSI below 50 keeps sellers hopeful of further losses. A break below 38,000 opens the doo to 37275 – 37170 zone the 2024 low. Any recovery would need to rise above 38550 to extend gains towards 39240 the February high.

FX markets – USD rises, EUR/USD falls

The USD is rising after the data drop. While growth is slowing, inflation was hotter than expected, and the jobs market showed no signs of slowing.

EUR/USD is falling despite improving big data from Germany. German consumer confidence index rose more than expected to a two-year high. This marked the third straight month of improving confidence, and it came after business confidence also improved, suggesting that the German economy could be starting to recover from its recent downturn.

USD /PY is in focus as the yen weakens below the 155 level, which is considered a line in the sand for intervention by Japanese authorities. While there have been recent threats, no action appears to have been taken. Attention will turn towards the Bank of Japan's interest rate decision on Friday morning. A weaker yen, sticky inflation, and signs of wage growth could cause the BoJ to adopt a slightly more hawkish tone.

Oil holds steady

Oil price is holding steady on Thursday after losses yesterday as investors weigh up signs of cooling fuel demand in the US and the ongoing conflict in the Middle East.

The weekly EIA oil inventory report showed that gasoline stockpiles fell less than expected. In contrast, refinery stockpiles unexpectedly rose, reflecting signs of slowing domestic demand ahead of the key US driving season.

Oil prices have been pressured in recent weeks after stronger-than-expected data has raised expectations that the Federal Reserve will keep the US interest rate high for longer, which could hurt growth and the oil demand outlook.

Meanwhile, the ongoing war between Hamas and Israel could limit oil losses. Given that supply hasn't been affected, the risk premium is lower than it has been.