Following the weaker US inflation report, the markets’ reaction was a swift one. The US dollar plunged across the board along with bond yields, while US stock indices, gold and silver all surged higher. Now that that the initial reaction is out of the way, will the initial moves hold or are going to see a reversal?

In case you missed it, HERE is everything you need to know about the inflation report, written by my colleague Matt Weller.Why did the stock markets rally?

Essentially, stocks surged higher because of optimism that the Fed’s rate hikes are taking effect in the economy and that the peak may have been reached for interest rates. But how much of that optimism had already been priced in? Judging by how the US dollar had been in a free-fall over the past few sessions, the markets was already pricing in the potential for the CPI to miss. Buy the rumour, sell the news? Are we going to see that type of a reaction later today or tomorrow?

Following the weaker inflation report, the major US indices all crossed above their respective highs made in June. As well as the indices, it is also worth noting that some key levels were crossed in other asset classes. For example, 1.30 on the cable and 1.12 on the EUR/USD.

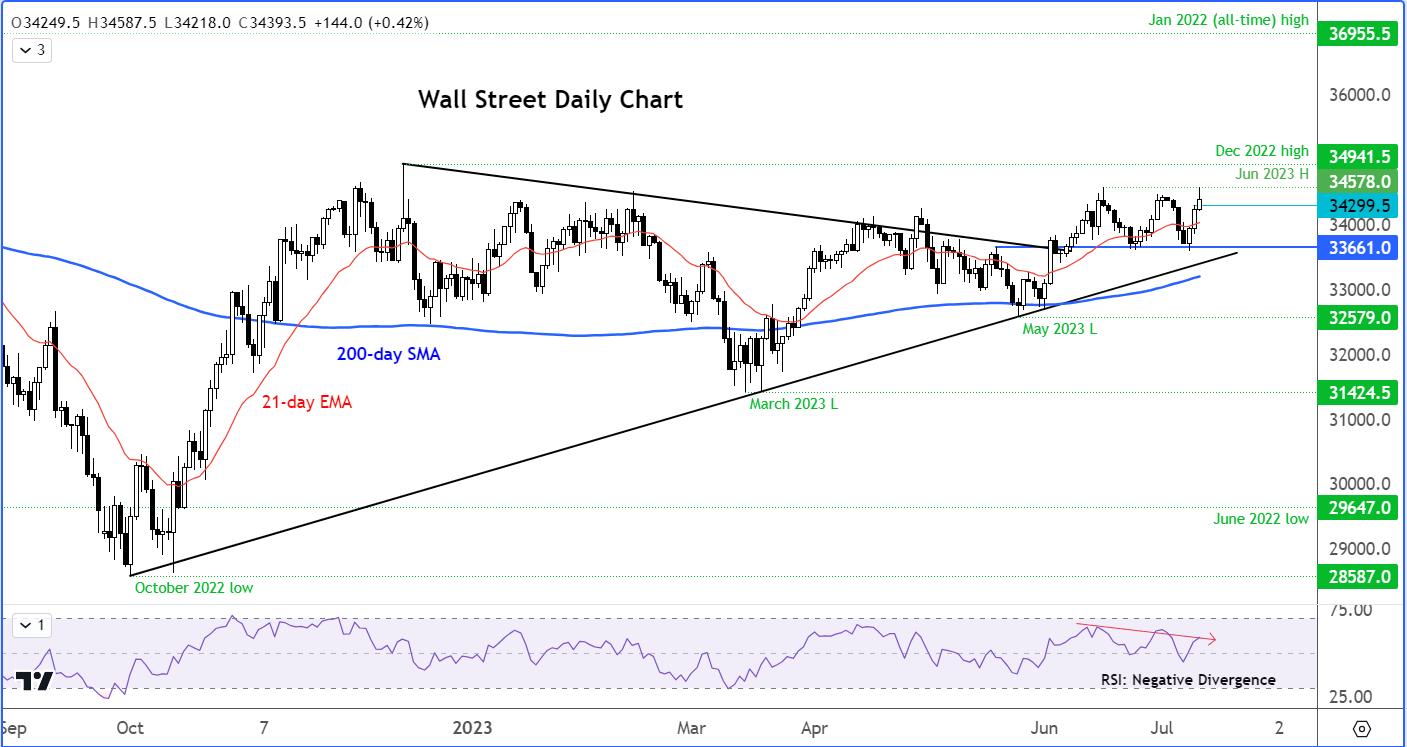

Dow analysis: Technical levels to watch

So, the key question is whether these breakouts will hold or we go back lower?

At the time of writing, the markets were off their best levels, but remained well in the positive territory. So, the bulls were still in charge. Still, it is very important to watch today’s closing levels and see whether the bulls can keep the gains by tomorrow.

On the Dow, the bulls will want to keep the index above Tuesday’s high of 34300. Ideally comfortably above.

If they manage to do that then the bulls will aim for the high made in December at 34941 next. This would keep the

Failure to do so means the index will create a bearish-looking inverted hammer candle on its daily chart. If that were to happen, things would get a lot more interesting heading int the second half of the week.

So, lets wait and let the dust settle. Clearly the bulls are in control of price action, and we wouldn’t bet against them. However, if the charts tell us otherwise by the close of play today, or tomorrow, then at least a temporary top could be in place. We will update our Dow analysis accordingly.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade