- EUR/USD analysis: US dollar eases off after initial bounce

- US NFP rises by 300K, boosted by part-time jobs

- EUR/USD analysis: US CPI and ECB policy decision coming up

EUR/USD analysis: US dollar eases off after initial bounce

Today’s stronger US jobs report came as a real surprise, disappointing those who were convinced that the Fed would cut interest rates in June. Correspondingly, the odds of a cut in June fell to less than 60% and up went bond yields and the US dollar. However, the gains evaporated as the European session wore on. Investors were probably looking ahead to next week already, when inflation data is due. The EUR/USD managed to bounced back more than 40 pips after briefly dipping below 1.08 handle. While stock markets were also making back a good chunk of the losses suffered on Thursday, haven demand amid geopolitical situation in the Middle East lifted gold to a new record high above $2325 while crude oil rose to a new high for the year, with WTI hitting $87.00 and Brent $91.00. Precious metals were ignoring the dollar and yield strength once again.

US NFP rises by 300K, boosted by part-time jobs

In March, the US saw a surprising addition of 303,000 jobs, easily surpassing expectations of around 212,000. The unemployment rate fell to 3.8% from 3.9%, while wages grew in line with expectations at 0.3%. However, all the jobs gains were part time. The number of part-time jobs soared by 691K while full-time jobs dropped by 6K.

Meanwhile, as business surveys consistently indicate forthcoming weakness in the coming months, traders are anticipating seeing further signs of economic cooling by summer. Perhaps this is why the dollar struggled to maintain its post-NFP gains.

Still, the likelihood of a rate cut from the Federal Reserve in June appears slimmer now, and may even fall below a flip coin should CPI come in hotter next week.

EUR/USD analysis: US CPI and ECB policy decision coming up

The week ahead features more market-moving data that could potentially set the tone for the rest of the month. Among the highlights, we have policy decisions from the RBNZ, BOC and ECB, while the FOMC minutes are also due. But the key event is likely to be the US CPI report on Wednesday. For EUR/USD, the CPI data and ECB policy decision have the potential to move the popular trading pair out of its recent ranges.

US CPI

Wednesday, April 10

The direction of the US dollar in the short term will hinge on whether upcoming data leads to a reduction in the Fed's projected 2024 interest rate cuts to only two or remain at 3. Currently, the market is pricing in 3 rate cuts, although some questions marks have been raised about whether the Fed will cut at all in June following a stronger US jobs report (although that’s debatable as the gains were boosted by part-time jobs). Anyway, should CPI overshoot expectations, then the odds of a June cut could fall further. However, if we see any sharp weakness in economic activity or inflation data moving, this will further strengthen the case for 75 basis points as the minimum anticipated number of rate cuts for this year, and potentially more. Headline CPI is expected to come in at +3.5% year-over-year vs. +3.2% in the previous month. Month-over-month, both headline and core CPI estimates are expected to print +0.3%, following +0.4% gains the month before.

ECB policy decision

Thursday, April 11

Earlier this week, Eurozone CPI surprised to the downside with a headline print of 2.4% year-on-year in March vs. 2.6% in February, with core CPI weakening to 2.9% from 3.1% in February. While CPI is now close to the 2% target, the ECB is likely to wait until June before potentially cutting interest rates. This meeting comes too soon, but Christine Lagarde and her ECB colleagues could use this meeting to prepare the market for a June cut. More data on wage growth is still needed and will be available in May. The ECB wants to ensure that wages are coming down before starting the rate-cutting cycle.

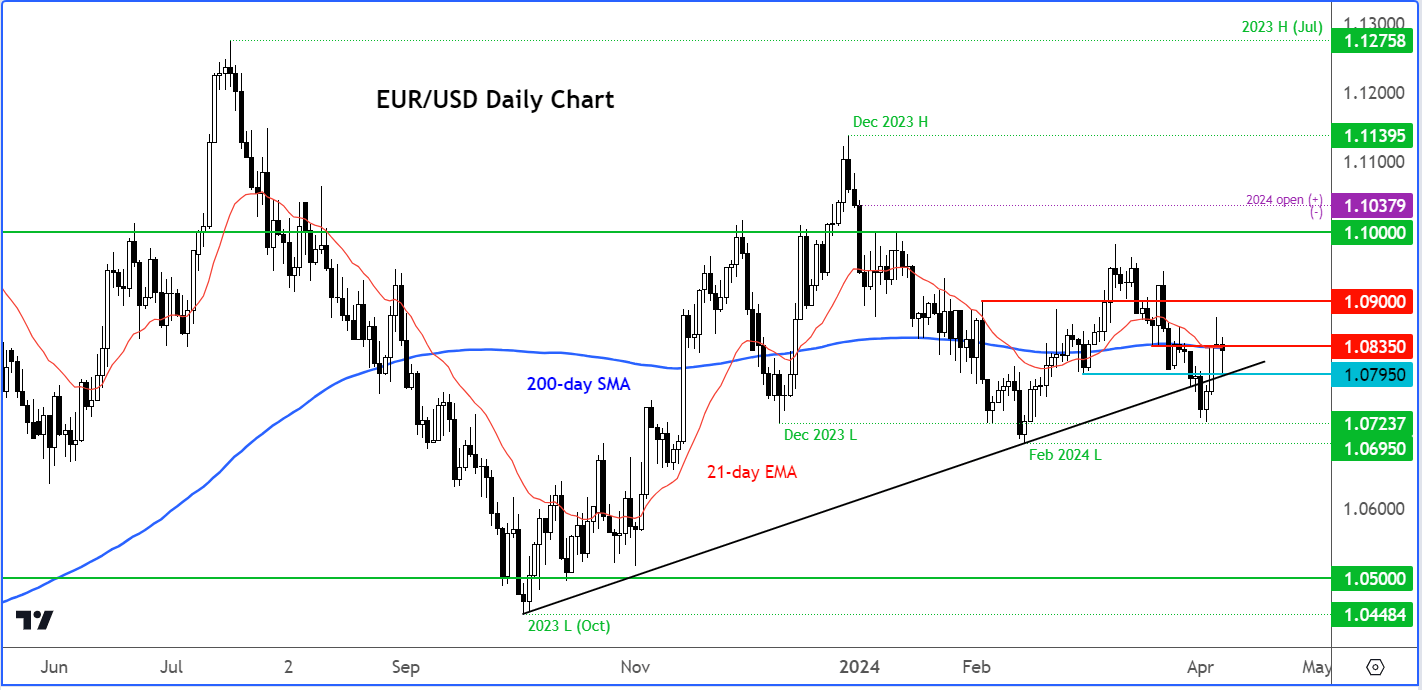

EUR/USD technical analysis

Source: TradingView.com

The EUR/USD found some support around the technically-important 1.0725 area on Tuesday, which meant that it would go on to rise above short-term resistance at around 1.0800 handle and re-establish its broken bullish trend line. Following the stronger NFP data, the EUR/USD dropped from around 1.0850 to just below 1.0800 handle before bouncing back. Support held, for now. But the upside was limited, with rates struggling to move much higher above the 200-day MA around 1.0835/1.0840 area. The EUR/USD needs to move sharply away from its 200-day MA in either direction to establish a clear directional bias. Until that happens, range-bound trading is the name of the game for the EUR/USD. On the upside, the next level of resistance above the 1.0835/40 area is around 1.0900.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade