The stubbornly high inflation and strong wage data in March point to another 25-basis point interest rate rise from the Bank of England on Thursday, which means our bullish GBP/USD forecast is unlikely to change much. We reckon that the BoE is unlikely to deliver a dovish surprise, given that CPI has remained in double-digits for far too long.

What do we expect form the BoE?

On Thursday, the BoE is likely to retain its data-dependent guidance. It will probably decide against explicitly announcing a pause and will leave the door wide open to further rate hikes. In line with market expectations, I also expect a 25-bps hike to 4.5% with the MPC’s vote likely to be split 7-2.

Having slowed the pace of tightening to the standard 25 basis points at its previous meeting in March, the market was initially quick to price out further rate rises. But inflation data had other ideas as UK CPI remained stubbornly high and above the 10% threshold. The persistence of inflation in double digits has increased the likelihood of another hike, which explains why the GBP/USD has been able to hit repeated yearly highs lately.

Meanwhile, the Bank could potentially revise its GDP forecasts upwards, thanks to a stronger-than-expected jobs market and the government’s additional energy support in the second quarter. If the BoE re-iterates that further tightening could be on the cards because of the persistence of inflation, then this could send the GBP/USD above 1.26 and en route to 1.30.

This means that the downside risks to our bullish GBP/USD forecasts is predominately due to the dollar. With the US jobs market remaining quite strong and the Fed pushing back against rate cut expectations, the green back has shown some signs of life against certain currencies.

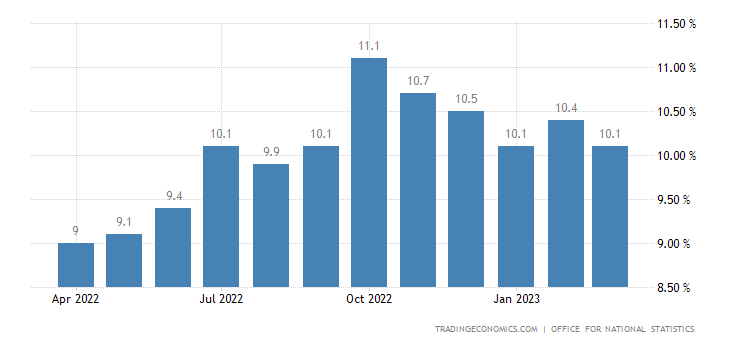

UK inflation still far too high

While there have been some signs to suggest inflation has peaked in the UK, the rate hasn’t fallen below the 10% level for 7 consecutive months now, or 9 months if you round up the August 2022 reading of 9.9%. Inflation has been super-hot. The BoE will want to see clear evidence that it is heading towards their 2% target in the not-too-distant future before it can become comfortable. So, it will likely keep all its options open on Thursday, in case inflation continues to surprise to the upside – even if this potential 25bp hike is going to be the last one in the cycle.

Inflation has wrong-footed the BoE, with CPI remaining nearly 2 percentage points higher than its February forecast. For this reason alone, one should expect the BoE to remain maintain a more hawkish tone than would have otherwise been the case in this stage of the hiking cycle.

How will GBP/USD react to BoE decision?

The BoE rate hike is fully priced in, so there’s a risk we may see an initial negative reaction as people who had front-ran the BoE take profit on their long GBP/USD positions. But given that inflation is very high in the UK, I don’t think the BoE will push back too strongly against future rate hike. This means the GBP/USD may avoid falling too significantly, if at all. Thus, the path of least resistance is likely to remain to the upside. Indeed, if the BoE is more hawkish than expected, then we may even see the onset of a rally towards 1.30 next. In fact, the GBP/USD might be heading that way anyway, as it is not all about the BoE rate decision…

GBP/USD forecast: It is not all about BoE

The other side of the equation when it comes to the GBP/USD exchange rate is, of course, the US dollar, which has started to show some signs of life again after its recent falls. The greenback faces another key test as markets will get the opportunity to fine-tune their expectations over the next Fed rate decision. Markets have been pricing in rate cuts in the US, owing to some weakness in certain sectors of the US economy and the ongoing banking turmoil. But with employment remaining strong, Fed Chair Jerome Powell has pushed back against rate cut speculation, providing the Dollar Index with some support around 101.00.

This week’s US macro calendar includes the release of US CPI inflation for April and the latest consumer sentiment data from the University of Michigan.

US CPI

Wednesday, 10 May

13:30 BST

With the Fed’s rate decision out of the way, investors will continue to keep a close eye on incoming US data releases as they can impact the US dollar forecast. In recent times, the market has been repricing lower the Fed’s projected interest rate path, implying we have reached a peak. This has caused a significant downward move in the dollar. So, a lot of attention will be on CPI as investors figure out whether the Fed will indeed now pause or lift rates even more.

UoM Consumer Sentiment

Friday, 12 May

15:00 BST

We have seen some rather weak economic pointers of late, although some indicators have still managed to surprise to the upside such as NFP. Let’s see how high levels of interest and inflation rates have impacted the consumer confidence. Demand concerns could intensify if we see a very weak print, leading to speculation the Fed may soon have to start loosening monetary policy again.

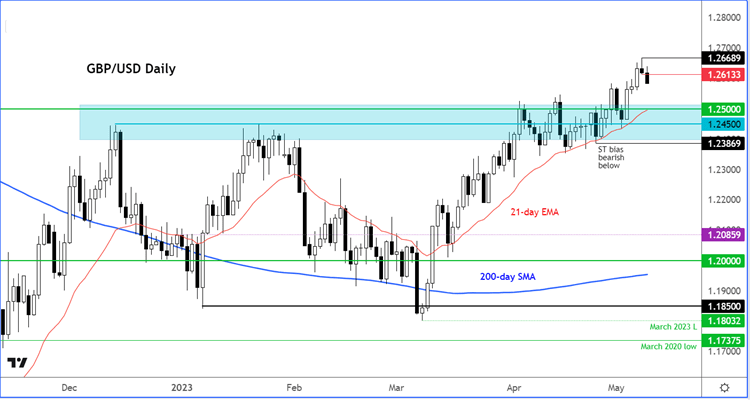

GBP/USD Technical Analysis

At the time of writing on Tuesday, the GP/USD was lower on the session. But the higher highs on the cable’s chart means the trend is still bullish, until proven otherwise. In addition, you have the 21-day exponential providing consistent support on the dips, while the 200-day average has started to point upwards again.

Given these technical factors alone, I would only concentrate on the long side and look to fade the dips back to support, until the chart tells us otherwise.

So, the first area of support for the bulls to defend is around 1.2500, which had been strong resistance in the past.

On the upside, the next bullish objective is just above Monday’s range at 1.2670, where trapped sellers’ stops are likely to be resting. So, the cable could pip to 1.27ish next. Above that level, there are no further obvious targets to watch, so price could climb to 1.28, 1.29 and eventually all the way to 1.30 in the days/weeks to come without any fundamental trigger to reverse the trend.

When is the BoE rate decision?

The BoE rate decision is on Thursday, 11 May at 12:00 BST. BoE Governor Andrew Bailey will hold a press conference about the interest rate decision at 12:30 BST.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Bank of England FAQs

What is a basis point (bps)?

A basis point (bps) is the standard measure for interest rates and other percentage changes in finance. One basis point is a 0.0001 change, which equals 1/100th of 1%. So, a change of 25 bps is the equivalent of 0.25% and a 50bps change is 0.5%.

Learn about the Bank of England’s base rateWhat is a BP hike?

A BP hike describes an interest rate that has been increased. For example, if a rate has risen by 100 basis points, or bps, it would have risen by 1%. The phrase is most commonly used to describe central bank decisions.

Find out more about central banksIs a rate hike good or bad?

A rate hike is typically good news for commercial banks, as they can charge more for loaning out capital. For other businesses – and consumers – rate hikes are bad for profits because the cost of borrowing goes up, so rate hikes tend to have a negative impact on stocks. But a country’s currency often increases in demand when interest rates are raised.

Learn more about interest rates and financial markets