- Major central banks have delivered dovish surprises this week

- The Bank of England will announce its rate decision on Thursday following undershoots in inflation and wage data

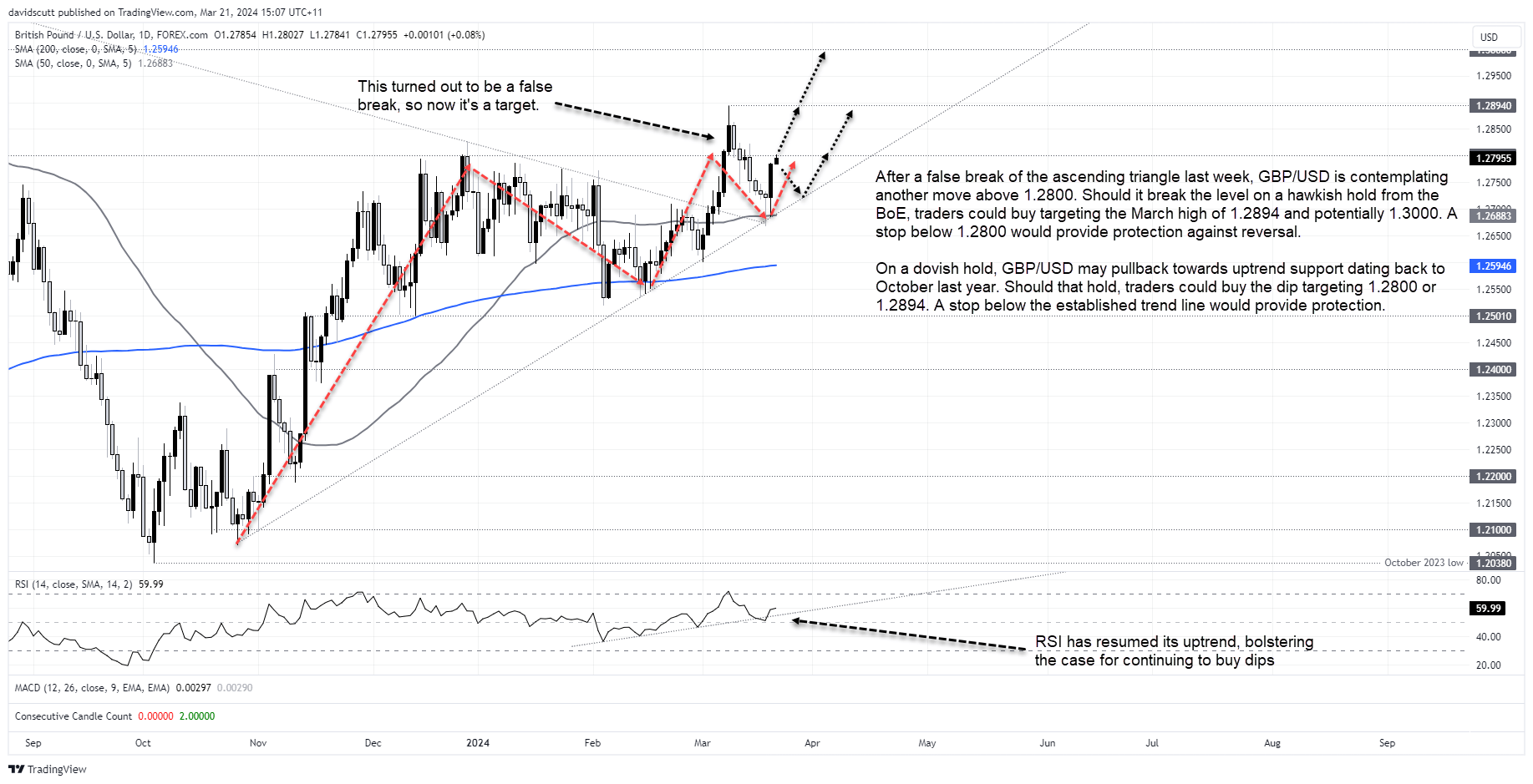

- Despite downside risks from a possible dovish hold, buying dips in GBP/USD is preferred

The trend among G10 FX central banks this week has been to deliver dovish surprises relative to market expectations. The Reserve Bank of Australia ditched its tightening bias, the Bank of Japan said large scale quantitative easing will continue despite hiking rates for the first time in nearly two decades while the Fed stuck to three cuts in 2024 and said it plans to its taper its quantitative easing program ‘fairly soon’.

That provides an interesting backdrop for GBP/USD traders ahead of the Bank of England meeting later Thursday, especially after the small undershoot in UK underlying and headline inflation reported in February, following a similar outcome in wages growth.

Will the thinning herd of inflation hawks on the monetary policy committee become even smaller, paving the way for another central bank dovish surprise? If the trend continues, a reversal of the reversal could be on the cards for GBP/USD.

Buying GBP/USD dips preferred, unless uptrend breaks

For now, buying dips remains the preferred way to play cable, especially after the Fed made it clear it intends to cut rates multiple times this year unless provided compelling evidence to do otherwise.

Under a dovish hold scenario from the BoE – which would continue the theme from major central banks this week – dips towards existing uptrend support offer decent entry points for longs, especially should the price test and hold above the level. With a stop below the trendline for protection, traders could target the March high around 1.2894 with a potential test of 1.3000 after that.

Alternatively, a hawkish hold may see GBP/USD break back above 1.2800, putting it on track to retest of 1.2894 set on the false break earlier this month. If we do see a bullish break, make sure you evaluate the risk-reward with an appropriately placed stop-loss order below 1.2800 for protection.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade