- Pound analysis: More losses likely for GBP

- Dollar analysis: Attention turns to US CPI

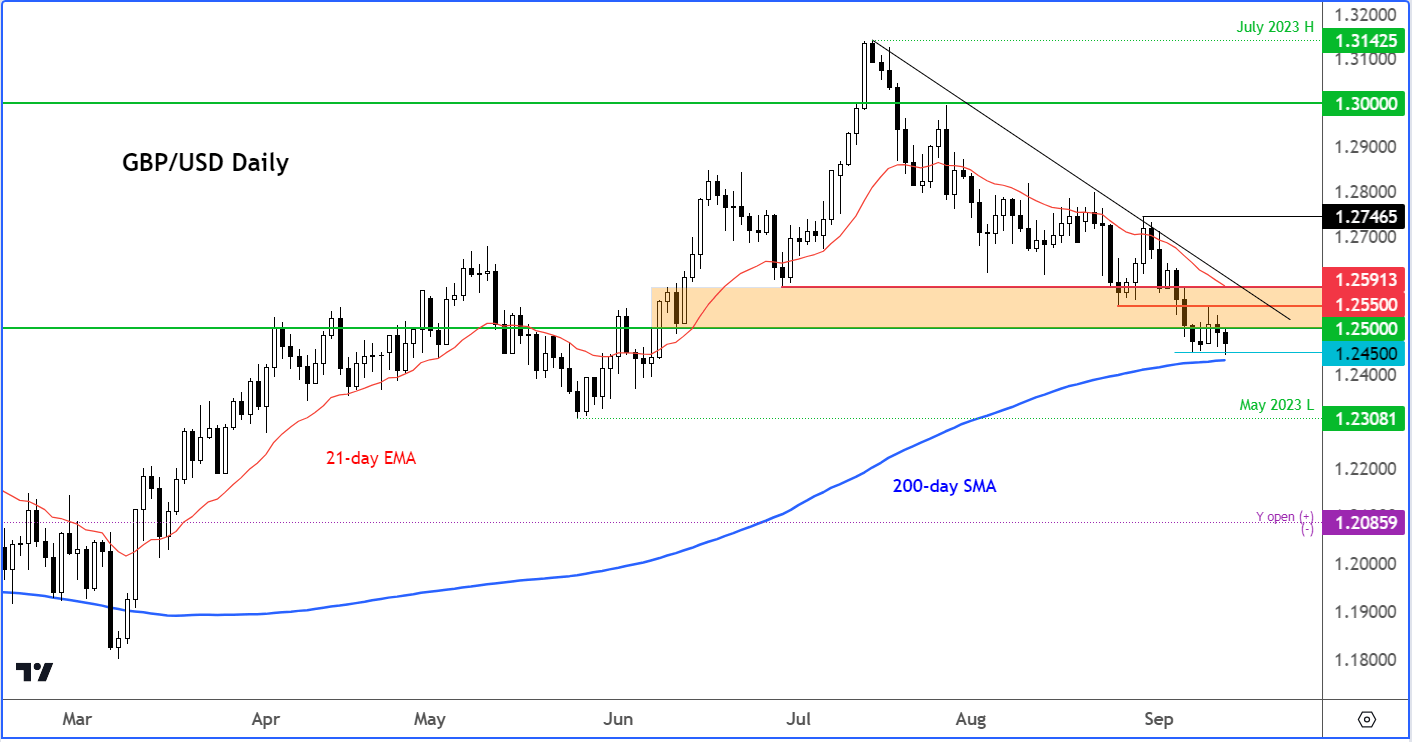

- GBP/USD analysis: Path of least resistance to the downside

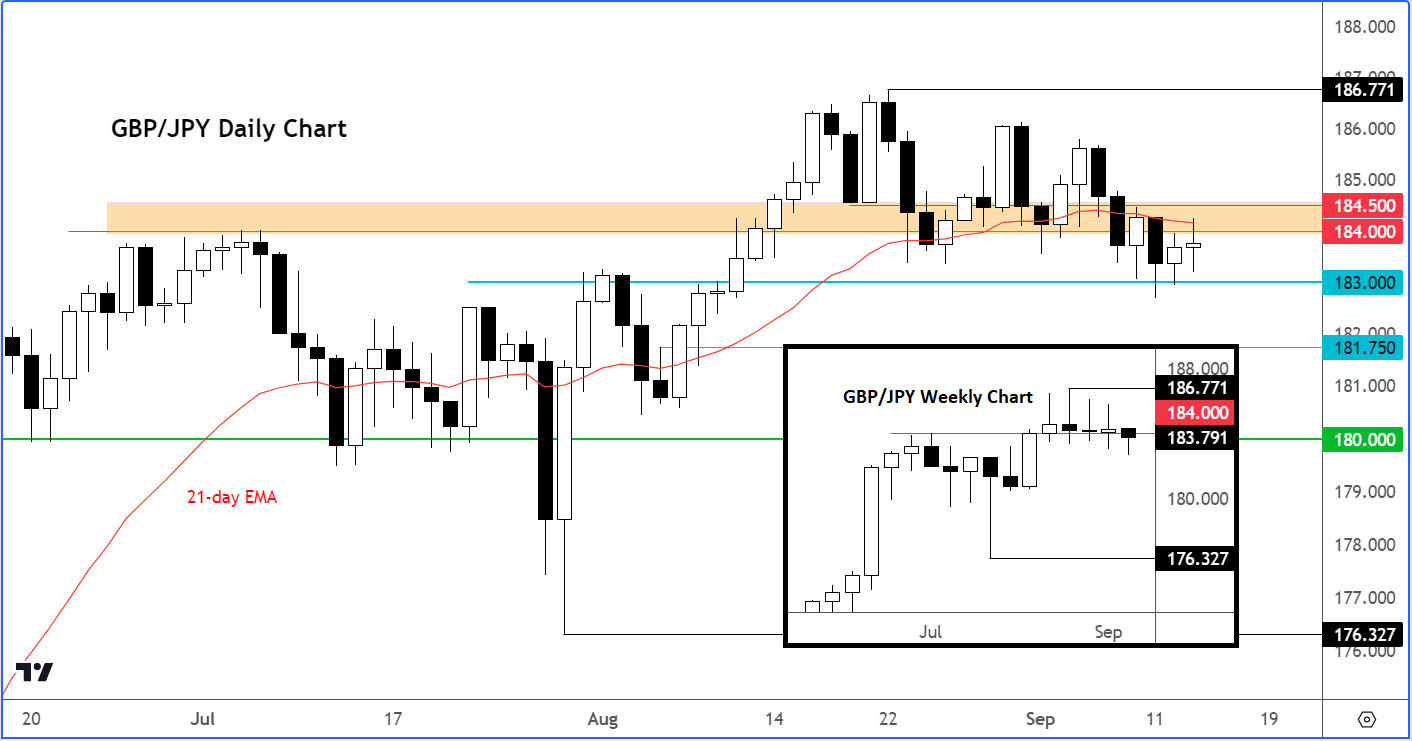

- GBP/JPY analysis: Guppy could break lower on BoJ speculation

Today’s latest data once again highlighted the growing threat of stagflation in Europe, with UK economic output and eurozone industrial production both falling more than expected. High levels of inflation and low growth, combined with downbeat business and consumer sentiment, and not to mention rising borrowing costs, all make for a tough economic climate for investors to navigate through. Consequently, there’s not much appetite for taking on too much risk right now. Indeed, the German DAX index hit a 4-week low, while the GBP/USD slipped to its weakest point since early June, below 1.2450, and other pound crosses like GBP/JPY struggled. The EUR/USD also remained rooted near 1.07 handle ahead of US inflation data later in the day.

Pound analysis: More losses likely for GBP

The pound was hit by news UK GDP contracted by more than expected in July. Clearly, the poor weather was a factor behind the weakness while the strikes also took a toll on the economy. Output contracted by a rather large 0.5%, giving back a similar gain in June, and disappointing expectations of a 0.2% drop. On Tuesday, we found out that UK unemployment rate rose to 4.3% from 4.2%, while total earnings in the three months to July were 8.5% higher compared to the same period a year earlier – the highest since records began in 2001.

So, more evidence is emerging every day that the UK economy is clearly struggling as the sharp rise in borrowing costs are squeezing consumers and businesses alike, while high inflation is also increasing wage demand and unemployment.

Consequently, I think there is no need to hike rates further, although the market is still attaching around a 50% probability for one final 25 bps rise in the Official Bank Rate next week. Last week the BoE governor Andrew Bailey said that the hiking cycle is almost complete.

Dollar analysis: Attention turns to US CPI

The GBP/USD will remain in focus later as investors await inflation data from the world’s largest economy. US CPI is expected to have risen to 3.6% YoY in August from 3.2% YoY in July. Meanwhile, core inflation is expected to cool to 4.3%. A massive beat or disappointment is needed to move the probabilities of a rate change, with the market attaching a 93% chance for a no hike in September.

But if US inflation were to remain elevated, this will raise the likelihood that the Fed will maintain a contractionary policy in place for longer than priced in – especially after the recent run of better-than-expected data, showing the word’s largest economy remains resilient.

GBP/USD analysis: Path of least resistance to the downside

If US inflation data were to surprise to the upside, then this may well give the dollar another shot in the arm and pave the way for the GBP/USD to extend its drop. The cable may well then go on to take out the May low of 1.2308 at some point in the near future.

Meanwhile, on the upside, key resistance around 1.2550 – 1.2590 must be taken out before the chart starts looking bullish again.

All told, the risks remain skewed to the downside for the GBP/USD.

GBP/JPY analysis: Guppy could break lower on BoJ speculation

The GBP/JPY may be a more interesting pound pair to watch moving forward. The weekly chart (see inset) shows 4 doji candles in as many weeks, suggesting the long-term bullish trend has lost its momentum. UK data has been quite poor of late and there are doubts about whether BoE will hike rates again. Meanwhile, the BOJ has started speaking about ending negative rates in Japan. So, the JPY could be about to make a comeback against some of the major currencies, including the GBP. If rates have already topped out, then the 184.00 – 184.50 resistance area must now be defended by the bears. The next downside target should support at 183.00 breaks is 181.75, the base of the last bullish breakout in August.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade