Market Summary:

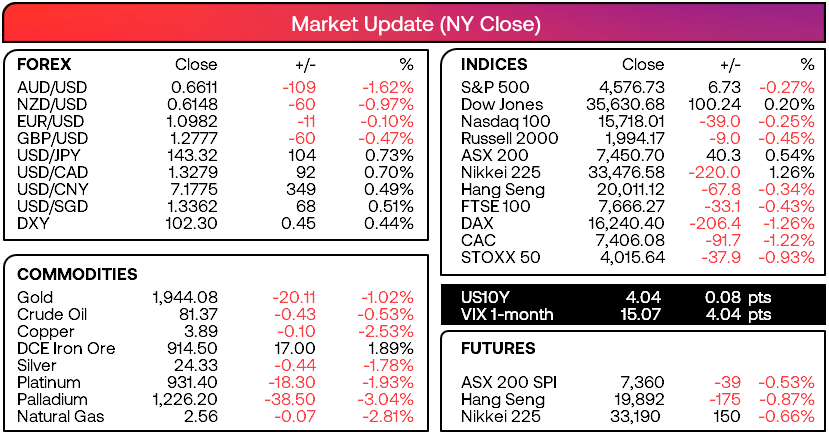

- Fitch Ratings agency downgraded the US long term ratings outlook to AA+ (from AAA) to reflect “expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance…” according to the announcement on their website

- S&P 500 E-mini futures fell around -0.6% at the open (which is a bit of a ‘meh’ response in the grand scheme of things) and Treasury Secretary Janet Yellen called the downgrade ‘arbitrary’ and ‘outdated’

- Still, it weighed on the US dollar and sent gold 0.4% higher as it sucked in safe-haven flows early in the Asian session

- The US dollar continued to advance as US job openings fell to a 26-month low, to serve as a timely reminder of just how tight the US labour market remains

- However, the US manufacturing sector continued to shrink although at a slightly slower pace with the ISM survey falling to 46.4 (below 50 denotes contraction). Prices paid – a rough measure of inflationary pressure within the sector – also contracted at 42.6

- The RBA held their cash rate at 4.1% for a second month, and many are now speculating that it could be their peak rate. The focus now shifts to Friday’s SOMP (Statement on Monetary Policy) to see if any significant revisions are made to their quarterly forecasts

- The stronger US dollar and dovish RBA meeting sent AUD/USD down to 66c, which is a major line of defence for Aussie bulls over the near term. We noted in yesterday’s report that AUD/USD shares a strongly inverted 20 -day correlation with DXY (US dollar index), so perhaps it can break support if DXY keeps advancing

- China’s manufacturing sector contracted faster than expected in July according to a privately run PMI survey by Caixin

- Australian building approvals fell -7.7% in June. Yet building approvals is a volatile number at the best of times, so whilst it fell -7.7% m/m in June – the growth has simply slowed relative to May’s 20.6% surge.

Events in focus (AEDT):

- 09:00 – Australia’s construction and manufacturing index (AIG)

- 09:50 – Japan’s monetary policy meeting minutes, retail sales, monetary base y/y

- 11:30 – The RBA’s chart pack for Australia

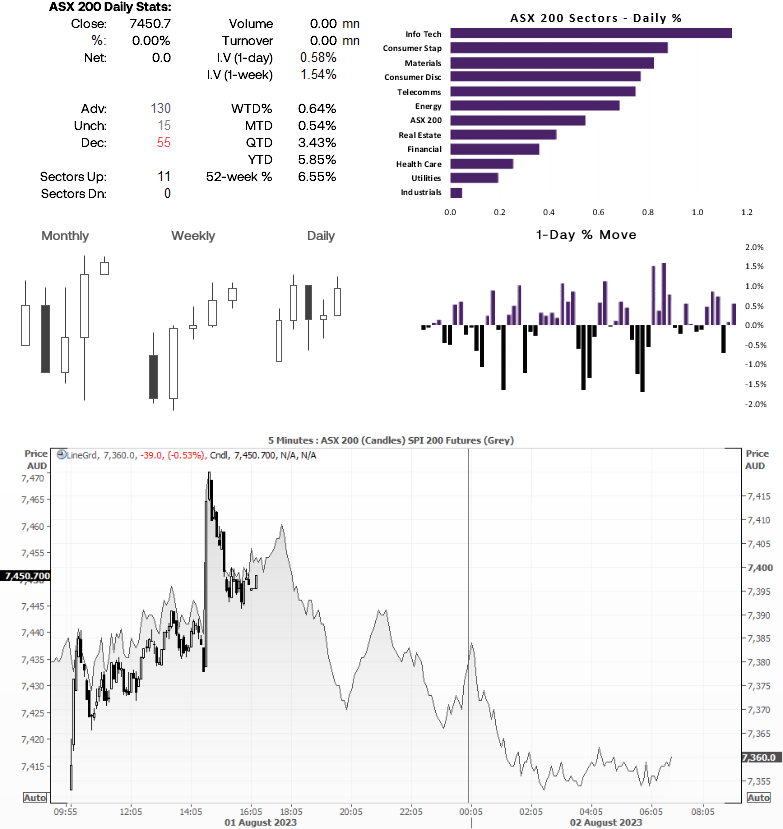

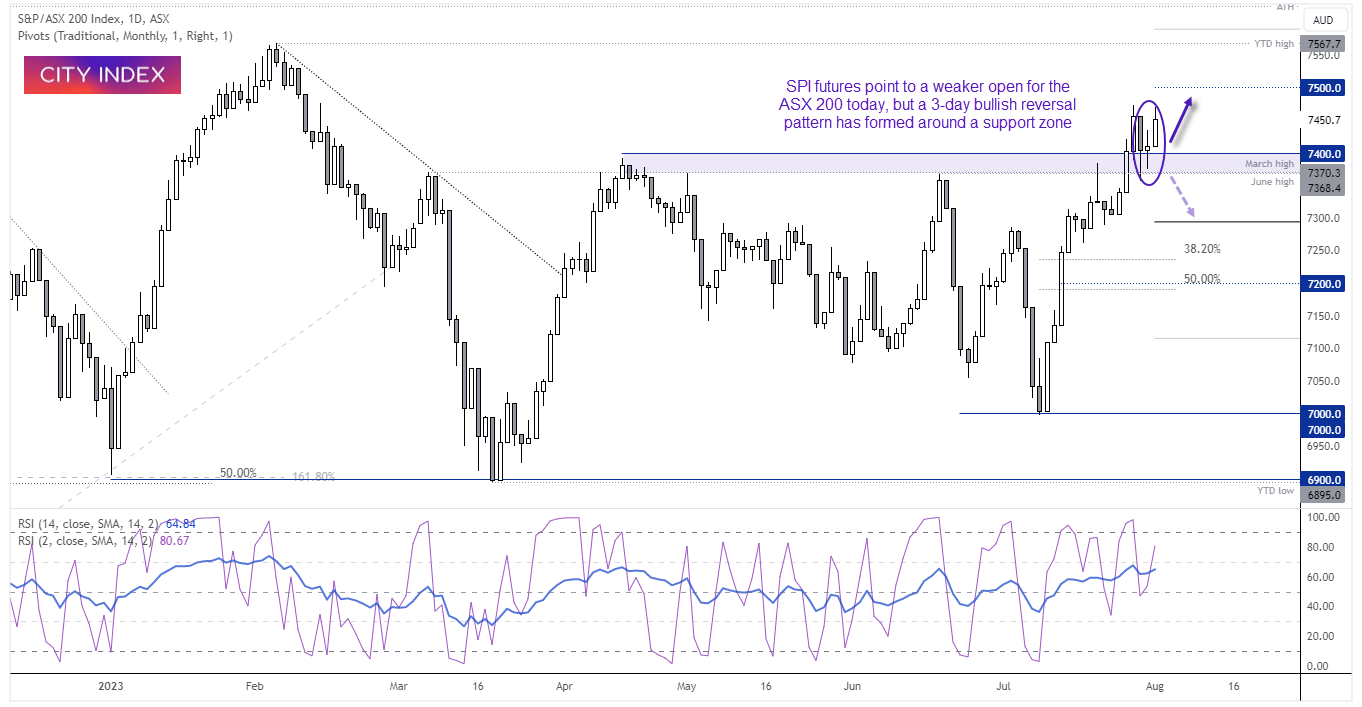

ASX 200 at a glance:

- The ASX 200 closed to a 2-day high after the dovish RBA meeting

- It also formed a 3-day bullish reversal pattern (morning star reversal) around the 7370 – 7400 support zone

- SPI futures point to a weak open, and Emini futures also suggest some stress may come from the US downgrade

- Today, we want to see if the ASX can build another base above the 7370 – 7400 support zone for a potential long towards 7500

- If it holds above 7400, it suggests the fallout from the US downgrade is less significant

- A break below 7370 assumes a move back towards 7300

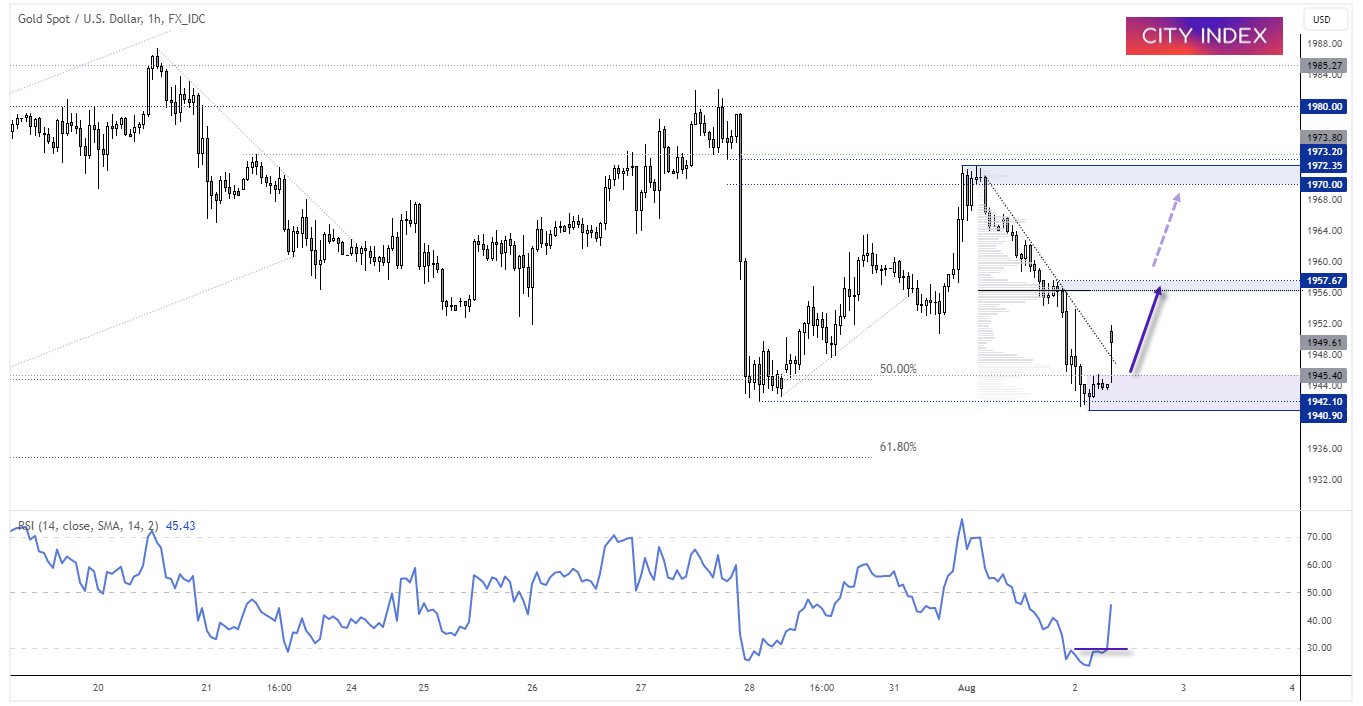

Gold 1-hour chart:

Whilst gold prices breached last week’s low and formed a bearish engulfing day, news of the US ratings downgrade has seen gold prices gap higher just after the futures open. They also gapped above trend resistance but are now trying to fill that gap, and RSI (14) has moved out of oversold to suggest a cycle low has formed. From here, we think it has the potential to move towards 1960 / the volume node around 1957, a break above which brings the cycle high around 1970 back into focus. And it success likely depends on the performance of the US and how seriously markets deem the ratings downgrade to be. A break below 1940 invalidates the near-term bullish bias.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade