GBP/USD falls after UK inflation cools & ahead of the Fed

- UK CPI eases to 3.4% YoY in Feb from 4%

- BoE interest rate decision tomorrow

- Fed rate decision is later today

- GBP/USD falls to 1.27

GBP/USD is falling as investors digest weaker-than-expected UK inflation and look ahead to the Federal Reserve interest rate decision.

The ONS data showed that CPI rose 3.4% YoY in February, down from 4% in the previous month and lower than the expected level of 3.5%. This marked the lowest level for inflation in 2 1/2 years and keeps the Bank of England on track to reduce interest rates this year.

The timing of the first rate cut remains unclear. The Bank of England meets tomorrow but is expected to leave interest rates unchanged. Bank of England governor Andrew Bailey has signaled that he needs further evidence that prices will cool back towards the 2% target before starting to loosen monetary policy.

Data shows that inflation is heading in the right direction and could hit the 2% target in the coming months. However, services inflation was ahead of expectations, and the Bank of England has been watching this area closely.

The central bank will likely want to see April's inflation and wage data before deciding on the timing of the first rate cut.

The market is currently pricing in a 25 basis point rate cut in August, with just one other move of that size by the end of the year. This is more conservative than the expectations for the Federal Reserve, where the first rate cut could come as soon as June.

The Federal Reserve's interest rate decision later today will shed more light on the Fed's next steps. A more hawkish-sounding Fed could pull GBP/USD lower.

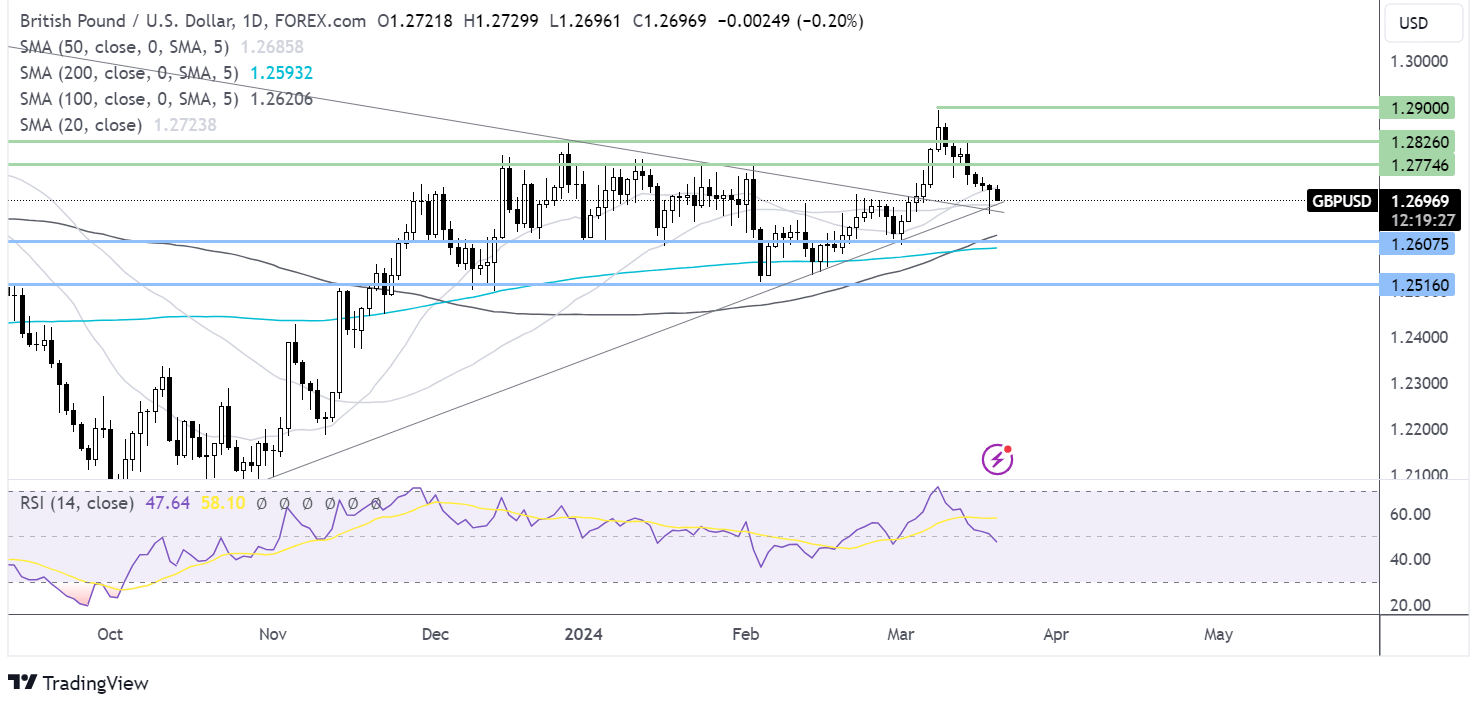

GBP/USD technical forecast

GBP/USD is falling, extending the drop from the 1.29 2024 high. The price is testing the multi-month rising trendline at 1.27. A break below here and 1.2670, the March low, opens the door to 1.26, a level that has acted as support and resistance on several occasions over the past few months. Below here, the 200 SMA at 1.2580 comes into play.

On the upside, should the trendline support hold, buyers could look for a rise towards 1.2770, the February high, ahead of 1.2830, the December high.

EUR/USD falls ahead of the Fed rate decision, ECB Lagarde’s speech

- Fed rate decision at 18:00 GMT

- No rate change is expected, but a more hawkish tilt is possible

- ECB President Lagarde speaks

- EUR/USD tests 200 SMA support

ER/USD is heading lower on USD strength ahead of the keenly awaited Federal Reserve interest rate decision and a speech by ECB president Christine Lagarde.

This week has been a big week for central bank meetings, and today is the Federal Reserve’s turn. Policymakers are not expected to adjust the interest rate; however, following two straight months of hotter-than-expected inflation, they could adopt a more hawkish stance.

Attention will be squarely on the new projections and the dot plot, which lays out the Fed’s expected path for rates over the coming 12 months. In December, the dot plot signaled three rate cuts this year; there is a possibility that this could be downgraded to two.

Heading into the meeting, the market is just pricing in a 60% probability of rate cuts starting in June and an 80% probability of a rate cut in July. Should the Fed adopt a more hawkish tilt, pushing back rate cut expectations, the US dollar could get a boost.

Meanwhile, the euro will look to speeches by ECB president Christine Lagarde and chief economist Philip Lane.

Their comments will come after yesterday's wage growth data showed wage growth easing to 3.1% in Q4, down from 5.2%.

At the ECB meeting, President Christine Lagarde highlighted strong wage growth as a reason to be cautious about cutting interest rates too soon. Investors will monitor whether the fresh data has changed their outlook.

Eurozone consumer confidence is expected to improve in March to -15, up from -15.5 in a sign that the region's economic outlook could be slowly improving.

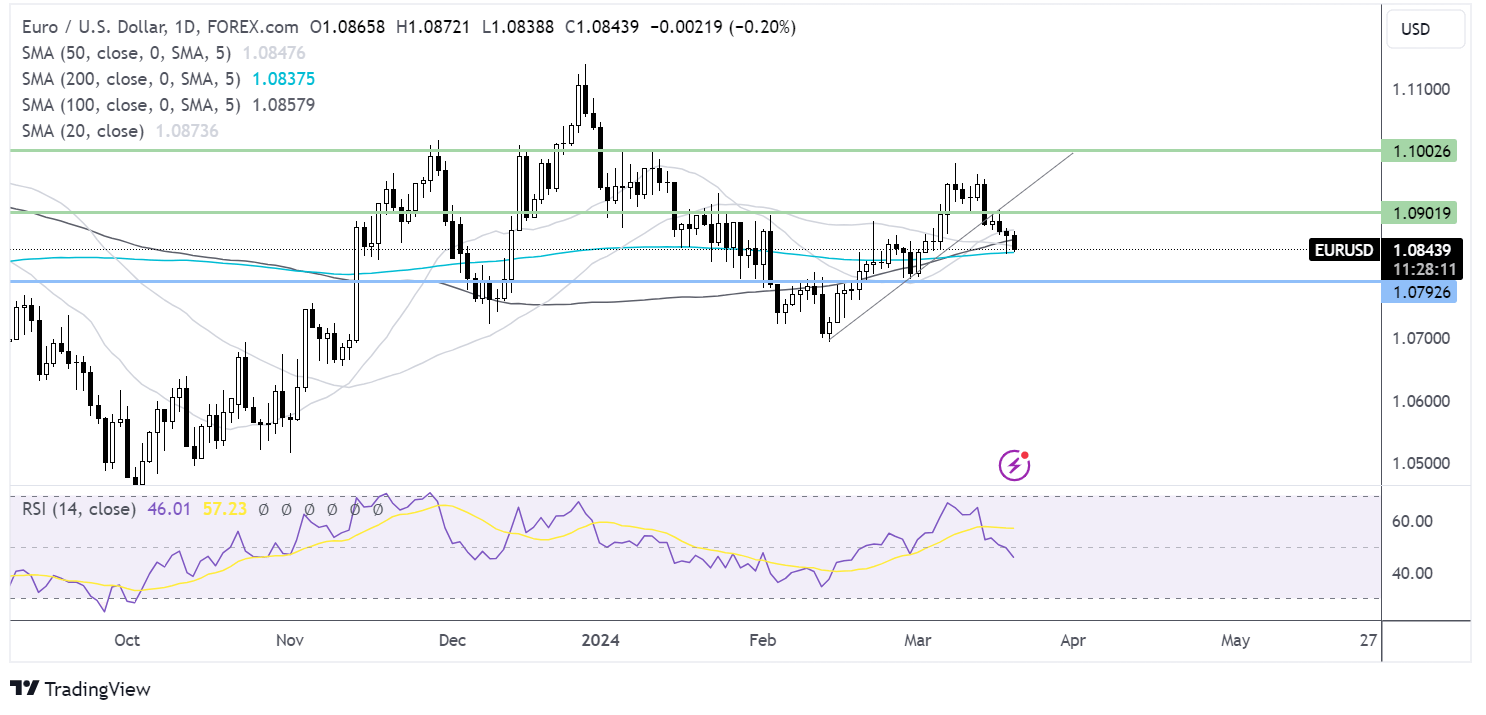

EUR /USD forecast – technical analysis

EUR/USD continues to fall away from the March high of 1.0980, falling below the 6-week rising trendline. Yesterday, it tested support of the 200 SMA at 1.0835.

Should sellers gain traction and break below the 200 SMA, the selloff could accelerate towards 1.08, the March low.

Should buyers successfully defend the 200 SMA, resistance can be seen at 1.09, the weekly high, ahead of 1.0980, the March high, and 1.10, the psychological level.