- GBP/USD analysis: All Eyes on FOMC and Dot Plots

- Pound Faces Additional Test with BoE, CPI, and Retail Sales Ahead

- GBP/USD technical analysis shows bullish trend losing momentum

In the upcoming week, the economic agenda brims with significant central bank gatherings and key economic indicators from various countries including Australia, China, the UK, Eurozone, US, and Canada. Expect increased market volatility across asset classes. Major central banks scheduled for announcements include the Bank of Japan and Reserve Bank of Australia on Tuesday, followed by the US Federal Reserve on Wednesday, and concluding with the Swiss National Bank and Bank of England on Thursday. Notably, global manufacturing PMI data will take centre stage in economic reports. Additionally, the UK will release CPI and retail sales figures, while China's industrial production and retail sales data will draw attention due to recent optimism surrounding Chinese demand, contributing to a surge in commodity prices. Among the major currency pairs to watch is the GBP/USD, particularly in the second half of the week.

GBP/USD analysis: All Eyes on FOMC and Dot Plots

GBP/USD and other FX traders will closely scrutinise the upcoming FOMC meeting on Tuesday. The fact that the dot plots will be update, this makes crucial even in the absence of any rate cuts on Wednesday.

Following an unexpected surge in last week's CPI report, Thursday's notable increase in producer prices appears to have cemented the stance on Fed policy for previously undecided traders. Despite these developments, Fed fund futures still indicate a nearly 60% likelihood of a rate cut in June. The Producer Price Index (PPI) recorded its swiftest growth in six months, hitting 1.6% year-on-year, surpassing expectations of 1.1%. Core PPI reached 2% year-on-year, exceeding the expected 1.9%, or 2.8% excluding food, energy, and transportation. Although retail sales rose by 1.3% year-on-year, core retail sales only saw a 0.3% month-on-month increase, lower than the expected 0.5%. Nevertheless, considering Thursday's data alongside elevated levels of consumer inflation and core CPI nearly double the Fed's 2% target, the likelihood of a rate cut in June seems like a coin-flip to me.

The Fed is set to update its economic forecasts during its Tuesday meeting. While the December dot plot projected a median estimate of 3 cuts this year, the strength in inflation may potentially reduce this to 2 cuts, potentially bolstering the US dollar. Conversely, if the plots indicate 3 or more cuts, it could lead to a decline in the dollar, and a sharp rally in the GBP/USD pair.

GBP/USD analysis: Pound Faces Test with BoE, CPI, and Retail Sales Ahead

The Bank of England meeting is scheduled for Thursday, March 21, following the Federal Reserve meeting the day before. The outcome of the Fed meeting could significantly influence the GBP/USD exchange rate, potentially overshadowing the impact of the BoE meeting. However, market dynamics remain highly unpredictable, and we must remain cautious. Additionally, key PMI data from both sides of the Atlantic, along with UK CPI and retail sales figures, will be crucial considerations as far as trading the cable is concerned.

Regarding the BoE decision, market expectations do not anticipate any rate cuts at this meeting. In its first meeting of 2024 in February, the UK central bank maintained the Bank Rate at 5.25%, in line with projections. However, dissent within the committee emerged, with two policymakers advocating for a 25-basis point hike, while one member preferred a decrease. This is something to watch closely to see if there will be any more dissenters and whether the split has widened.

Although inflation indicators remain elevated, there was a greater-than-anticipated decline in services inflation and wage growth. The Bank foresees gradual GDP growth recovery, attributed to the diminished impact of previous rate hikes. CPI inflation is forecasted to briefly reach the 2% target in Q2 before increasing in Q3 and Q4. While no policy changes are expected, attention will be on any indications of future cuts.

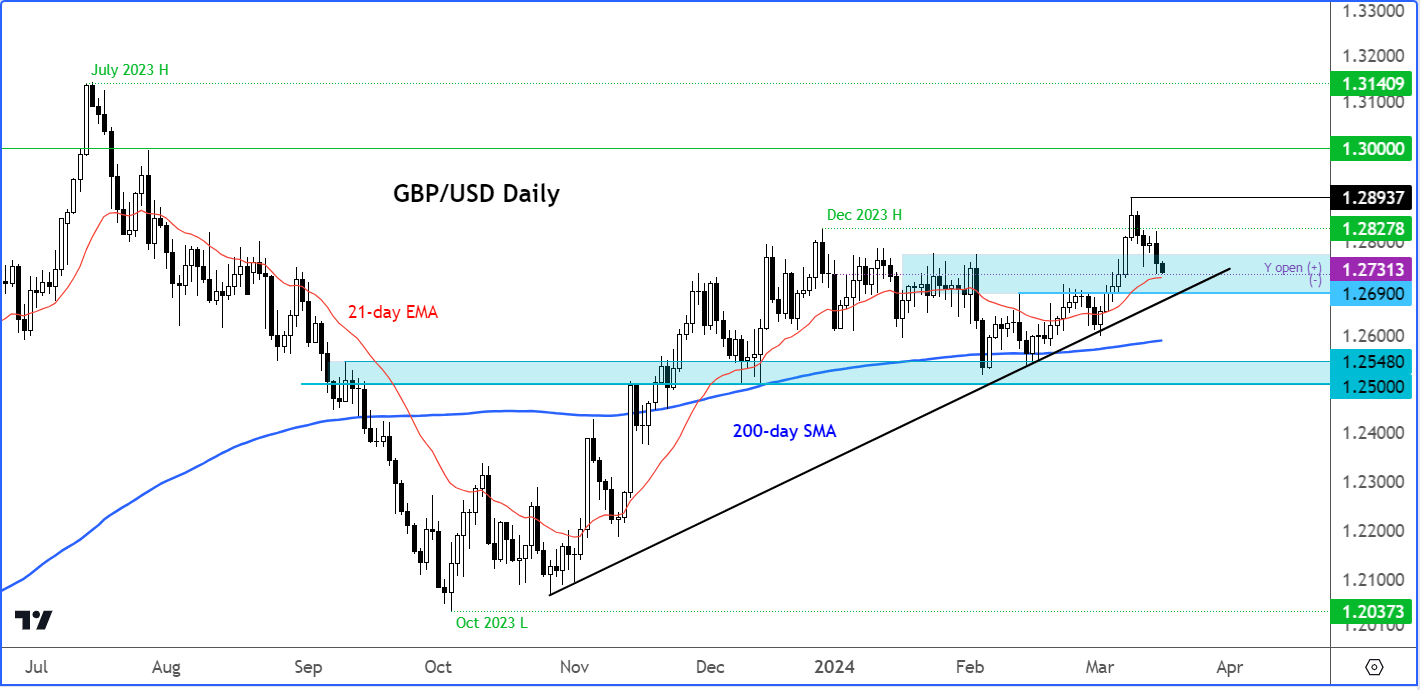

GBP/USD technical analysis

Source: TradingView.com

The trend is still arguable bullish on the GBP/USD ahead of the upcoming macro events, but the momentum has been lost following recent falls. It is worth watching key support in the 1.2690 area closely, where we also have a bullish trend line converging. The bulls will need to see the formation of a clear bullish candle here to tip the balance back in their favour, while the bears will be eying a breakdown to potentially pave the way for a drop towards the 200-day average at just below the 1.26 handle.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade