EUR

Stay in step with market opportunities and get insights, actionable trade ideas and dedicated support.

Sort by:

- Newest

- Popular

EURUSD Outlook: FOMC Minutes and Flash PMI on the Horizon

EURUSD Outlook: Following the slight cooling of U.S inflation, markets embraced a euphoric sentiment. Will the upcoming FOMC minutes calm it down or amplify it further?

EURUSD Forecast: Charts Gear up for U.S. CPI Volatility Week

EURUSD Forecast: EURUSD price levels brace for volatility with the upcoming speech from Fed Powell, U.S CPI metrics, and ECB Financial Review.

EUR/USD forecast: Divergent interest rate outlook, geopolitics deliver potent bearish mix

With most major events scheduled outside the continent, EUR/USD direction looks set to be dictated by external influences next week. Preference is to sell rallies given the technical breakdown on Friday.

EUR/USD struggled last week when it was given an invitation to rally

EUR/USD was poor last week, finding little benefit from the Federal Reserve delivering a dovish surprise at its March FOMC meeting. With little event risk to speak of in the week ahead, and trading through its 50-day moving average, selling rallies is favoured.

EUR/AUD traders eyeing a bounce or break from 200-day moving average

The proximity of EUR/AUD to its 200-day moving average and uptrend support presents an opportunity for traders to position for either a bounce or break from this technical juncture, providing favourable risk-reward depending on which way the price moves.

EUR/AUD looking toppy following Australia’s jobs report

Having spiked to two-month highs in the immediate aftermath of Australia’s December jobs report, EUR/AUD reversed hard, generating a bearish pin candle on the four-hourly suggesting it may have seen a near-term top.

Gold grinds higher ahead of key inflation reports

Gold facing significant two-way price risk as major inflation reports loom on the horizon.

EUR/USD: upside potential as economic expectations converge

Relative economic growth expectations may soon swing back in the euro's favour.

EUR/USD: positioning for a peak in US bond yields

If you’re of the view US yields have peaked but don’t want to get involved in bonds, taking a long EUR/USD position could be for you.

European Open: EUR/USD consolidates ahead of German IFO report

Currencies saw tight ranges overnight, but we see the potential for EUR/USD to have another crack at 1.0700 whilst prices remains below 1.0800.

EUR/USD: Rally potential after hot Spanish and French CPI readings

The ECB had already planned a half-point rate move in March, and these stronger readings are likely to bolster officials who say that more big moves are needed beyond that to get inflation under control.

European Open: EUR/USD and EUR/GBP in focus for eurozone CPI

Both EUR/GBP and EUR/GBP are hugging various pivot points ahead of the open, but whichever way they break initially our bias is for a break to new lows.

Fiat Money: What is a Fiat Currency?

A fiat currency is a monetary instrument backed by a national government like the British pound or Canadian dollar. Learn how fiat currencies operate and how they compare to other types of money.

European Open: EUR/USD falls below parity ahead of the US Core PCE report

After just one day above it, the euro is back below parity. And it could face further selling pressure if US inflation comes in hotter than expected today.

European Open: EUR/USD falls below parity ahead of the US Core PCE report

After just one day above it, the euro is back below parity. And it could face further selling pressure if US inflation comes in hotter than expected today.

The contrarian case for a EUR/USD rally if rates can break above 1.00

The key area to watch for EUR/USD will be in the 0.9950-1.0000 zone

The contrarian case for a EUR/USD rally if rates can break above 1.00

The key area to watch for EUR/USD will be in the 0.9950-1.0000 zone

3 Trades to watch for today’s US inflation report: (EUR, Gold, Nasdaq)

Today's US inflation report is a key event this week for traders, who are placing bets that it will soften ahead of the report to send equities higher and the US dollar lower.

DAX: EUR/USD parity has big implications for European indices

The recent price action in EUR/USD should serve as a reminder of the importance of the FX market, even if you’re not trading it directly.

European Open: The euro perks up ahead of German ZEW report

Whilst EUR/USD remains within a 150-pip range, momentum has turned higher form the midway point and hints at a run for 1.0600.

Weekly COT report: Traders flip to net-short exposure on the euro

Traders flipped to net-short exposure to euro futures for the first time since early January last week.

Sentiment turning positive in Europe

Investors have welcomed Macron’s performance in the French election debate, while Ukraine conflict is no longer having the same impact on asset prices

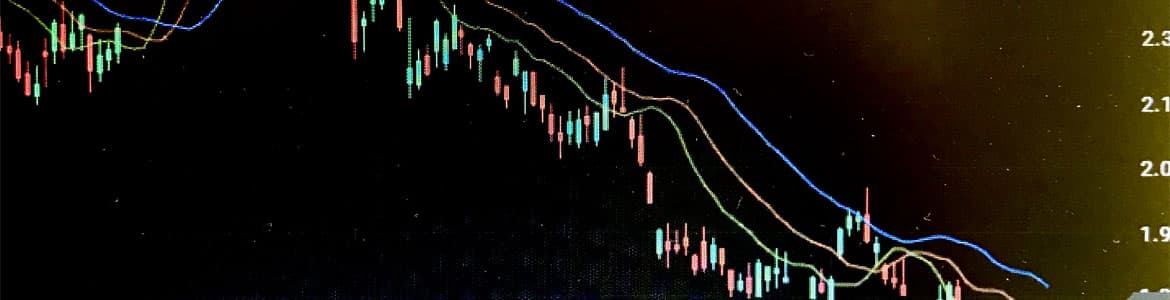

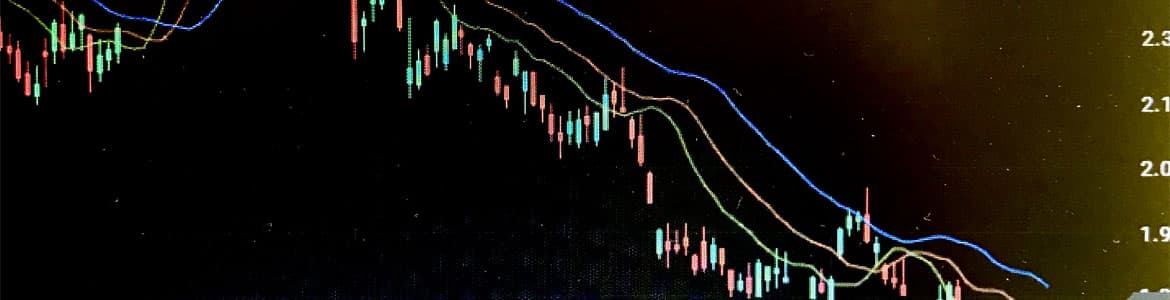

EUR/USD: Polarity principle points to plunging prices

At this point, the odds favor a retest of the 1.0800 level in the coming weeks...