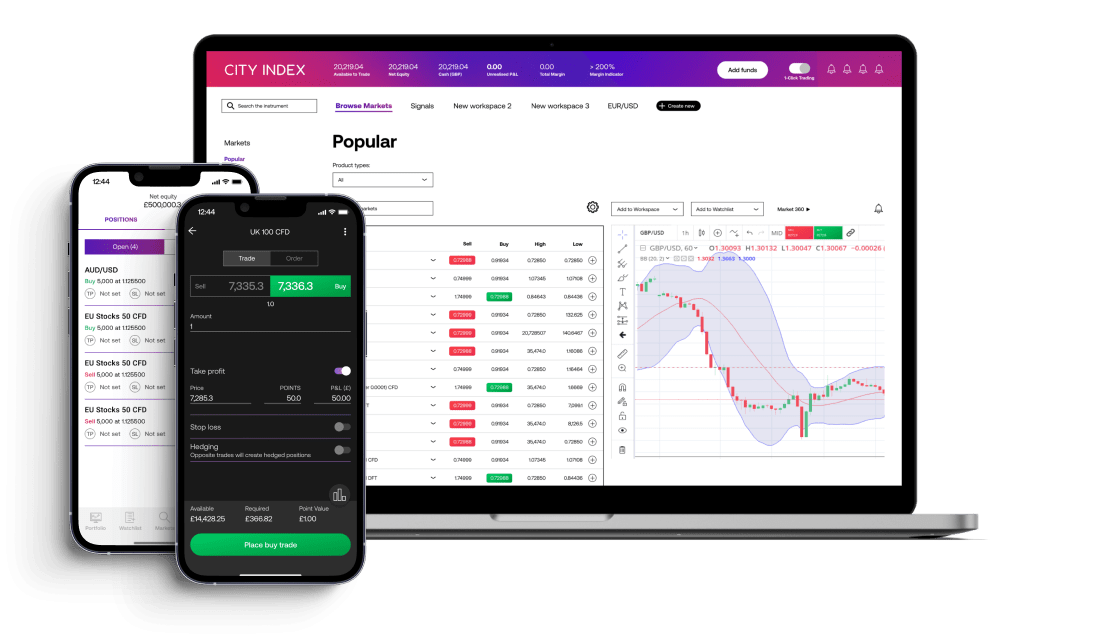

A trusted provider invested in your success

As part of the NASDAQ listed StoneX Group and with over 40 years market experience, City Index has a proven track record of financial strength and security.

StoneX Group Annual Report 2022

A track record of financial strength

City Index’s parent company is StoneX Group Inc. (NASDAQ: SNEX), a leading independent financial services provider. As a global, publicly traded company, StoneX must meet the highest standards of corporate governance, financial reporting and disclosure. With almost one hundred years’ industry expertise, you can rely on our history of financial strength and stability.

-

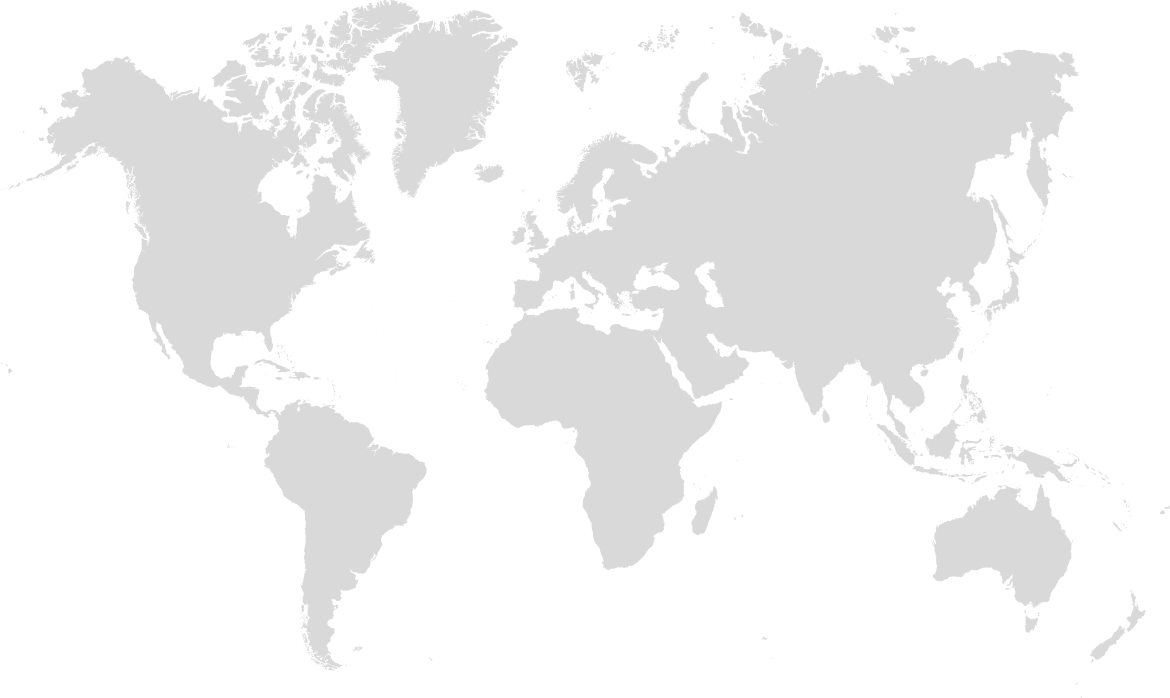

1

Canada

Canadian Investment Regulatory Organization (CIRO)

-

2

Cyprus

Cyprus Securities & Exchange Commission (CySEC)

-

3

USA

The National Futures Association (NFA)

Commodities Futures Trading Commission (CFTC) -

4

Cayman Islands

Cayman Islands Monetary Authority (CIMA)

-

5

UK

Financial Conduct Authority (FCA)

-

6

Hong Kong

The Securities and Futures Commission (SFC)

-

7

Japan

The Financial Services Agency (FSA)

-

8

Singapore

The Monetary Authority of Singapore (MAS)

-

9

Australia

The Australian Securities and Investments Commission (ASIC)

Fund security

We’re fully authorised and regulated in the UK by the FCA and hold client funds in accordance with their client money rules, meaning your funds are always protected in segregated client accounts.

We only use our own funds to manage hedge positions, and do not engage in proprietary trading .

City Index is a member of the Financial Services Compensation Scheme (FSCS). In the event of liquidation, clients may be compensated up to £85,000 by the FSCS.

Customer margin

We continuously monitor and calculate margin for retail client accounts. If your funds are at risk through margin call, we’ll automatically close out your positions to help protect your funds.

We’ll automatically close out any positions on margin call at the best possible market price.

Margin settings are all fully compatible with all existing FCA and other regional regulators and are reviewed regularly.

Risk management

City Index supports regulatory oversight and transparency, and we undergo regular audits. We are fully committed to communicating any changes with our clients clearly.

We constantly review practices across our business, including:

- Business continuity and disaster recovery

- Risk management

- Supervision of electronic trading systems (i.e. platforms)

- Information security

- Anti-money laundering

- Customer complaints

- Trade reporting