Market-leading pricing

Competitive, transparent pricing

Competitive pricing on 13,500+ global markets

We offer both fixed and variable spreads depending on the market you wish to trade.

Fixed spreads don't change according to market conditions such as volatility or liquidity. Fixed spreads may either be offered for a defined period of the day, or throughout trading hours.

Variable spreads may fluctuate throughout the day according to different factors such as underlying liquidity or market volatility. With variable spreads, City Index will quote you the minimum spread it could be, plus an average spread for a defined historical period of time.

Margin (Step margin)

Margin is the amount of money you need in order to open a position on a market with us. You can find out more about margin and leverage as well as the benefits of trading on margin in our Education section.

The larger the trade size, the higher the risk level associated with the trade. Therefore we may increase our margin requirements for larger size trades or any additional trades in that instrument. This table is an example of how this may work:

Our best execution policy means we will always deliver the fastest possible execution on all trades at City Index. If the price moves in your favour while your order is being processed, we will execute your order at the better price, increasing your opportunity to make a profit.

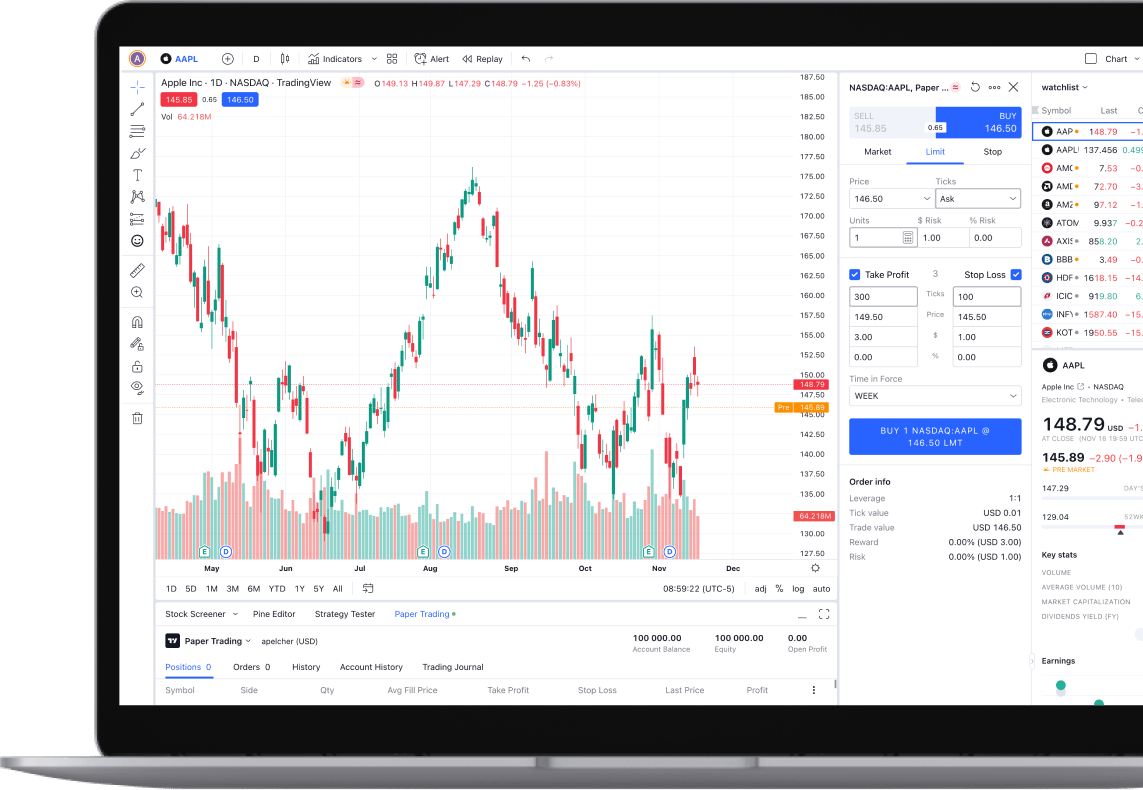

TradingView

If you’re using TradingView to place trades, then different spreads and pricing may apply to markets. Please refer to the Market Information Sheet for each market in the TradingView platform.

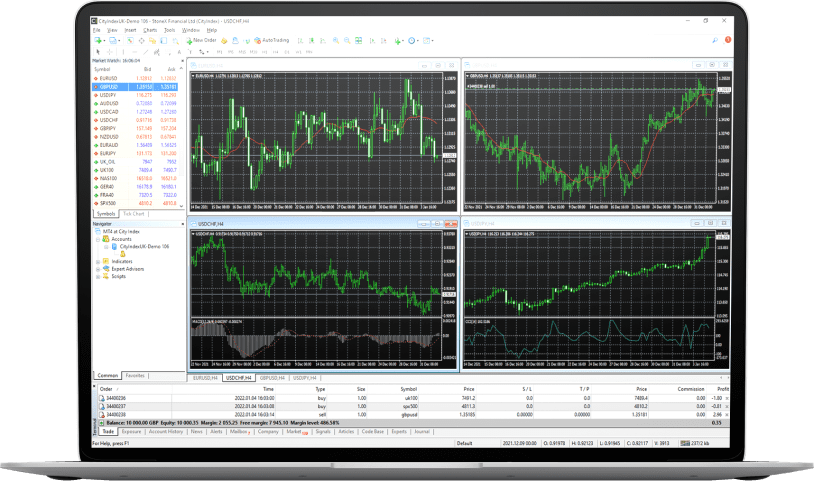

MT4

If you’re trading on the MetaTrader 4 platform, then different spreads and pricing may apply to markets. Please refer to the Market Information Sheet for each market in the MT4 platform.

Frequently asked questions

What is spread betting?

Spread betting is a financial derivative that enables you to trade on the price movements of a wide range of markets. Unlike traditional investing, you don’t take ownership of any assets when spread betting – which means you can go short as well as long, take advantage of leverage and more.

Traders use spread betting to get a range of different benefits. Some, for example, will utilise spread bets to trade when markets are falling as well as rising. Others use them to diversify their exposure by trading FX, shares, indices and commodities 24 hours a day from a single account.

What is the spread?

The spread is the difference between the buy price and the sell price of a market and is in effect the cost of trading that market. We quote a two way price on all our markets, the bid price at which you can sell and the offer price at which you can buy. The tighter the spread between the two, the quicker the trade can move into profit earning territory.

What spreads does City Index charge?

City Index may offer both fixed and variable spreads, depending on the market you wish to trade.

Fixed spreads don't change according to market conditions such as volatility or liquidity. Fixed spreads may either be offered for a defined period of the day, or throughout specific trading hours. Spreads may be wider in less popular and during less liquid trading hours.

For example, the UK 100 has a fixed spread of 1 point between 8-4.30pm. Outside of these hours, the spread will widen to other fixed amounts. See Indices for details.

Variable spreads may fluctuate throughout the day according to different factors such as underlying liquidity or market volatility. With variable spreads, when City Index lists a spread we will quote you the minimum spread it could be, plus an average spread for a defined historical period of time.