Gold has enjoyed a solid rebound over the past two weeks, adding over 3% as a softer US dollar and falling nominal and real bond yields made for a more palatable environment for broader commodity markets. But with major inflation readings from the Eurozone and United States released during Thursday’s session, gold faces the prospect of significant two-way price risk.

Significant data risk looms for gold

Stickiness in German and Spanish core inflation readings on Wednesday have traders on alert for similar trends in the Euro area survey, bolstering the risk of the ECB delivering another 25 basis point interest rate increase in September that’s priced around 50%. Core inflation is seen decelerating from 5.5% to 5.3% in July, still well above the ECB’s 2% target.

In the US, core personal consumption expenditure (PCE) inflation – the Fed’s preferred measure of underlying price movements – is forecast to accelerate from 4.1% to 4.2%, in part reflecting a low base effect from 12 months earlier.

We focus on core inflation as it influences central bank monetary policy decisions far more than headline numbers which are often impacted by price swings in volatile items. In the Fed’s case, you also watch the “supercore” inflation rate which measures services inflation excluding housing-related costs. This category is influenced by changes in household income and is difficult to slow when price increases begin. It’s expected to accelerate in July due to higher financial services charges.

Gold not necessarily an inflation hedge

When it comes to how gold is likely to perform after the data, keep a close eye on fluctuations in benchmark 10-year European and US government bond yields, along with the US dollar, as they are the two key drivers that influence bullion prices. Even though it’s seen as an inflation hedge, hotter-than-expected inflation readings could easily scupper gold’s uptrend, potentially making yields push higher, lessening the appeal of low or no yielding assets. Placid inflation readings have typically been the best result for bullion in the current era.

Gold rangebound for now

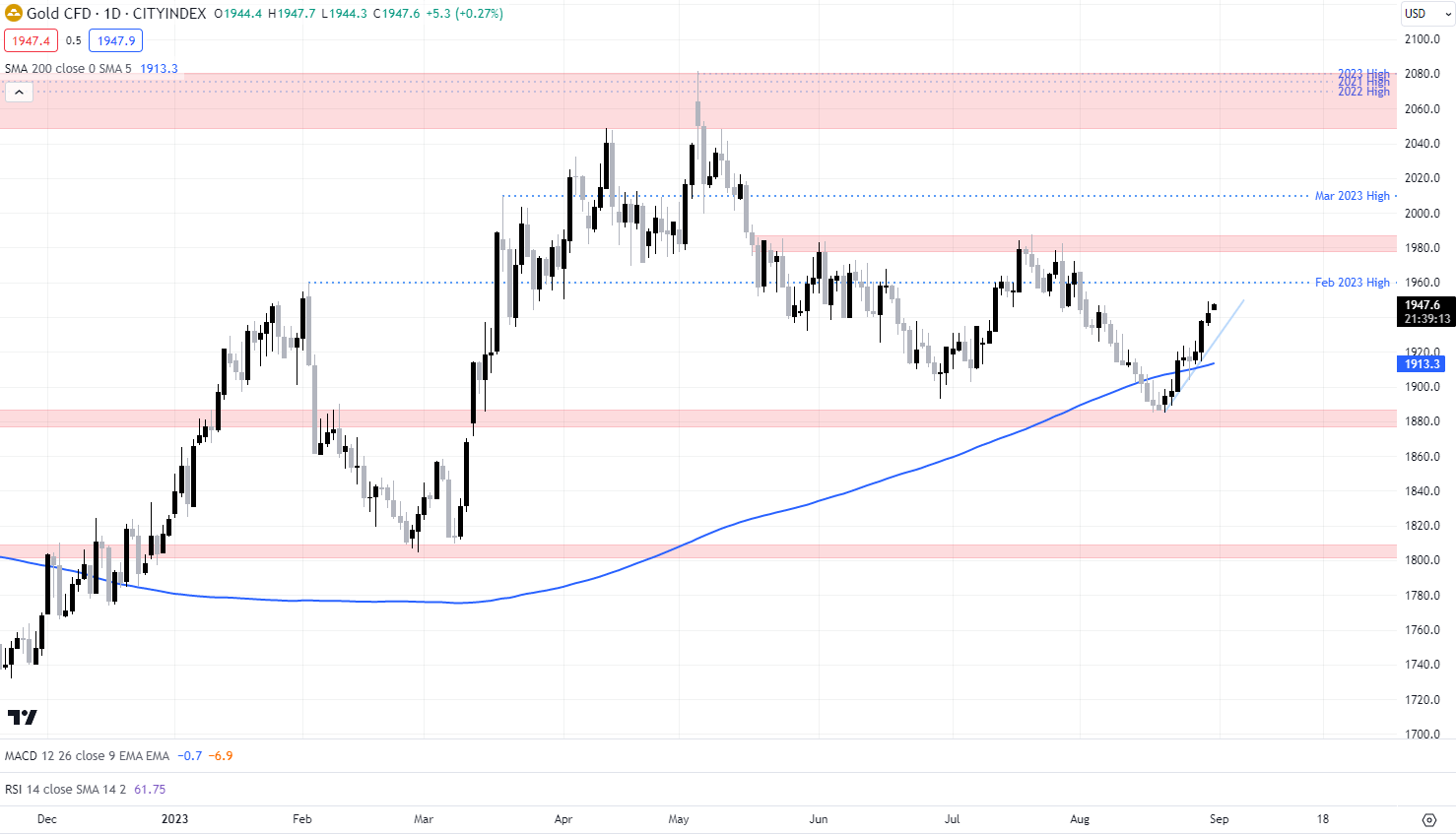

On the charts, gold remains in a solid uptrend, grinding higher over the past fortnight from $1,885/oz to $1,949/oz on Wednesday. That’s the first topside target for gold longs heading into the inflation reports. Beyond that, minor resistance is located around the February 2023 high of $1960/oz and again at $1970/oz. A more prominent resistance zone starts from just below $1,980/oz.

On the downside, uptrend support is currently located at $1,927/oz. The 200-day MA is also found at $1,913/oz. Should those levels go, a retest of the support zone below $1,887 may be on the cards.

Source: Trading View

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade