By:

Yesterday 01:25 PM

Access over 20 different commodities markets, including gold and silver.

Trade with ultra-tight spreads from just 0.06pts on commodity markets

Speculate on commodities as futures contracts, options or on spot price

*StoneX retail trading live and demo accounts globally in the last 2 years.

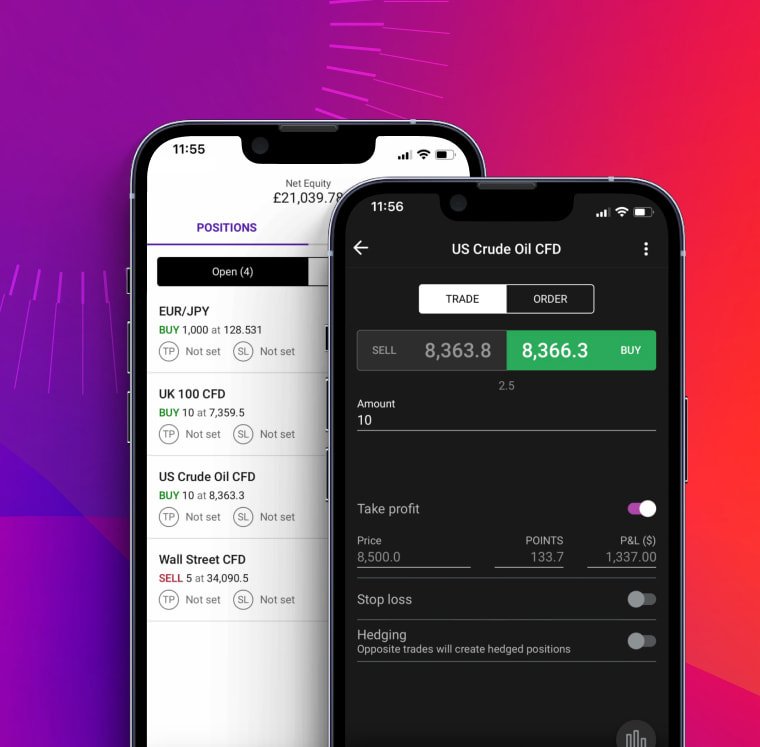

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Gain deeper insight into your trading and discover how you could improve your performance.

Whether you’re a new or experienced trader, it’s easy to open an account with City Index. All you have to do is complete our short, secure online form and you could be up and running on the live markets in minutes.

If you think an oil market like US Crude is going to go up in value, you go long or ‘buy’. If you think US Crude is going to go down in value, you short or ‘sell’ it. Ready to start trading now? Get started with your application.

How to start trading oil

Oil trading is the act of buying and selling oil to make a profit – whether this is exchanging the physical commodity or speculating on its market price.

What moves the price of oil?

Global oil prices are determined by the forces of supply and demand, according to the model of price determination in microeconomics.

How to trade commodities

Discover everything you need to know about commodity markets, such as gold, oil and natural gas, including both hard and soft commodities.

The margin requirement for City Index’s oil markets – including US Crude and UK Crude – is 10%. That means you’ll need 10% of your position’s total value in your account in order to open a trade.

Say, for example, that you want to buy three UK Crude CFDs at $8653. Your total position is worth (8653 * 3) $25,959, so you’ll need $2,595 in your account as margin. The City Index will automatically convert that figure into your base currency, and display it on the deal ticket, so you’ll always know how much you need to make a trade.

You can find margin requirements for every market we offer in the City Index platform, which you can access with a free demo account.

The best way to trade oil all depends on your individual goals, style and strategy. There are numerous ways to take your position on oil prices, and each brings its own unique benefits and drawbacks.

Most global oil trading takes place on futures markets. These financial derivatives facilitate the buying and selling of oil using contracts in which you trade oil at a set price on a set future date.

While retail traders can participate in the oil futures market, many choose to trade on futures prices using CFDs and spread bets instead. These products enable you to take a position on oil markets without ever owning the underlying asset itself.

An oil benchmark is a crude oil market that acts as a reference point for the prices of oil drilled around the world. The two best known oil benchmarks are US Crude (otherwise known as WTI) or UK Crude (known as Brent Crude).

Beyond these two headline markets, there are dozens of oil benchmarks that are used around the world. They help facilitate oil trading by acting as a guideline for the different varieties and grades of oil that are produced.

Different oil benchmarks will trade at different prices, according to the lightness and sweetness of the oil they represent. They will, however, tend to move in parallel – so if Brent Crude is moving up, chances are WTI will be up too.

If you have more questions visit the FAQ section or start a chat with our support.