Reviewed by Patrick Foot, Senior Financial Writer.

CFD trading enables you to find trading opportunities across shares, forex, indices, commodities and more. In this step-by-step guide, we’re going to cover all the fundamentals of CFD trading, so you can decide whether you want to start buying and selling contracts for difference yourself.

Skip ahead to a section below, or scroll down to start at the beginning.

- What is a contract for difference (CFD)?

- How does CFD trading work?

- Costs of CFD trading

- CFD trade example

- The advantages of CFDs

- Which financial instruments can I trade with CFDs?

- Managing risk in CFD trading

- Spread betting vs CFD trading

- CFD trading FAQ

Want to try out trading CFDs with zero risk? With a City Index CFD demo account, you get £10,000 virtual funds to trade our full range of markets. Open your City Index demo account for free.

What is a contract for difference (CFD)?

The meaning of a contract for difference (CFD) is that it is an agreement between two parties to exchange the difference in a market’s price from when the contract is opened to when it is closed. You can use them to trade 1,000s of global markets, without taking ownership of any physical assets.

CFD trading means that you don’t own the underlying asset, unlike traditional investing. It enables you to speculate on the price movement of a whole host of financial markets such as indices, shares, currencies, commodities and bonds – regardless of whether prices are rising or falling. And because you are speculating on price movement rather than owning the underlying instrument, you will not pay UK Stamp Duty on any profits*.

* Spread betting and CFD trading are exempt from UK stamp duty. Spread betting is also exempt from UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

How does CFD trading work?

CFD trading works using contracts that mimic live financial markets. You buy and sell these contracts in the same way that you'd buy and sell the underlying market, but with several extra benefits: including the ability to go short as well as long, leverage and hedging.

Instead of choosing how much of a particular asset you would like to invest in – such as 100 HSBC shares – you pick how many contracts to buy or sell.

If the market moves in your favour, your position will earn a profit. If it moves against you, it will incur a loss. You realise your profit or loss when you close the position by selling the contracts you bought at the outset. Just like traditional investing, your return from a trade is determined by the size of your position and the number of points that the market has moved. If you buy 100 HSBC CFDs at 400p then sell them at 450p, you will make (100 x 50p) £50. If you sold them at 350p instead, you would lose £50.

Learn more about how to trade CFDs.

Going long vs going short in CFD trading

In traditional share dealing, you can only buy markets, which opens a long position. One of the key benefits of CFD trading is that you can sell an asset if you think it will fall in value. This is known as going short and enables you to make a profit from falling prices.

Shorting with CFDs works in the same fundamental way as going long. But instead of buying contracts to open your position, you sell them. In doing so, you’ll open a trade that earns a profit if the underlying market drops in price – but a loss if it rises. You’ll see two prices listed for every CFD market: the buy (or ask) price and the sell (or bid) price. To open a long position, you trade at the buy price. To go short, you trade at the sell price.

When you want to close, you do the opposite to when you opened. So if you’d bought, you would sell. If you’d sold, you would buy.

Leverage and margin in CFD trading

Leverage

CFD trading is a leveraged product, which means you can open a trade by paying just a small fraction of its total value.

In other words, you can put up a small amount of money to control a much larger amount. This will magnify your return on investment, but it will also magnify your losses. So, you should make sure to manage your risk accordingly.

Margin

The capital that you need to have in your account to open and maintain a leveraged position is called your margin. Typically, margin is written as a percentage of your total trade size, and the amount you need varies from market to market.

To open a forex position, for instance, you might need to have 5% of its total value in your account. To open a share position, it might be 20%.

As an example, buying five oil CFDs at 5325 would give you a total position size of (5 x 5325) $26,625. If oil requires 10% margin, then you’d only need 10% of $26,625 in your account as margin to open your trade: $2,662.50.

Hedging with your CFD trades

As CFDs allow you to short sell, they are often used by investors as ‘insurance’ to offset losses made in their physical portfolios. This is known as hedging.

For example, if you hold £5,000 of Barclays shares and you concerned that they are due for an imminent sell-off, you can help protect your share portfolio by short selling £5,000 of Barclays CFDs.

Should Barclays’ share price fall by 5% in the underlying market, the loss in your share portfolio would be offset by a gain in your short trade. In this way, you can protect yourself without going through the expense and inconvenience of liquidating your stock holdings.

Costs of CFD trading

At this point, you might be wondering how you’ll pay for your CFD trade. The cost of CFD trading depends on three factors:

- The spread and commission

- Your CFD deal size

- The trade duration

Spread and commission

When you trade a CFD market, the buy price will always be slightly higher than the market’s current level, while the sell price will be a little bit below. The difference between the two is called the spread and is usually how you’ll pay to open a position.

There is one significant exception to that rule, though. With share CFDs, you pay a commission to open your position – just like when you buy physical shares with a stockbroker.

Choosing your contract size

You decide the size of a CFD position by setting the number of contracts you want to buy or sell. The more CFDs you trade, the more margin you’ll need – and the more spread or commission you’ll pay.

The size of a single CFD will change depending on your asset class. With equities, for example, buying one contract is the same as buying one share. With forex, it’s the equivalent of a single lot.

Choosing your CFD duration

There are two main types of CFD you can choose to trade, depending on your strategy.

- Daily CFDs have the tightest spreads, but you’ll pay overnight financing for each day you keep your position open – so they might not be suitable for longer-term positions

- Forward CFDs have wider spreads, because all the financing costs are built in. They can be a better option if you’re taking a longer view

Learn more about the costs of CFD trading.

CFD trade example

CFD trading on a rising market

For example, say you think the price of oil is going to go up. So you place a buy trade of five oil CFDs at its current price of 5325.

The market rises 30 points to 5355. You close out your position by selling your five contracts. When you close a CFD position, you exchange the difference in the asset's price from when you opened it (5325) to now (5355).

The difference is 30 points, so you would make $30 for each contract you bought: a $150 profit (5 x 30).

Why is your profit in dollars?

With CFD trading, your profit is always calculated in the currency of your underlying market. Oil is traded in dollars, so your profit or loss is calculated in USD.

However, if the market moves against you instead, then you would have to pay the difference to your provider. So if the price of oil falls 30 points to 5295, you would lose $150.

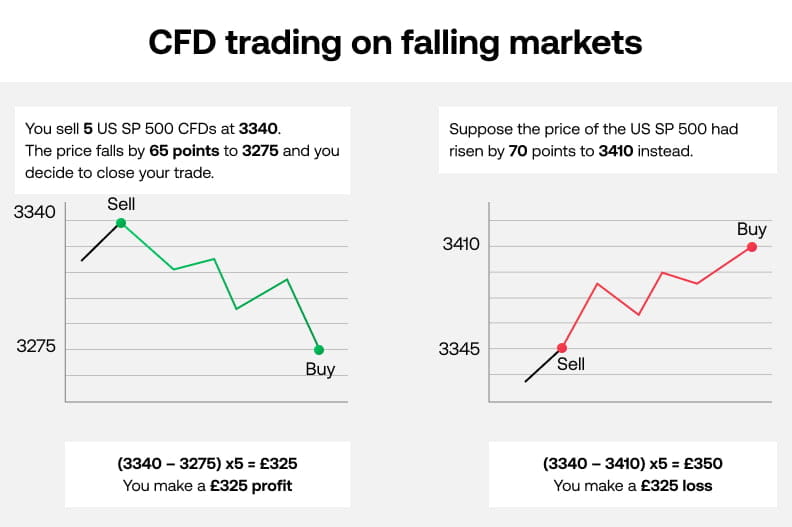

CFD trading on a falling market

The US 500 (which is a US market, and therefore valued in $) is at 4000, but you believe that it is about to fall as you expect the forthcoming US earnings season to disappoint.

So, you sell five US 500 CFDs at 4000.

Your prediction is correct, and the US 500 falls to 3935. When you sell CFDs, you’re still agreeing to exchange the difference in an asset’s price, but you earn a profit if the market falls and a loss if it rises.

The US 500 has fallen 65 points, so you earn $65 for each of your five contracts – a profit of $325.

But what would have happened if the index had risen 70 points instead? You would lose $70 for each of your five CFDs, a total loss of $350.

The advantages of CFDs

CFDs are a popular way for investors to buy and sell a range of financial markets, bringing several benefits for active traders:

- Tax efficiency

You are not required to pay UK Stamp Duty - Flexibility

You can trade on falling markets as well as rising ones, without borrowing any stock - Leverage

By using a small amount of money to control a much larger value position, you don’t have to tie up lots of capital - Hedging

As we’ve covered, you can use a CFD to mitigate losses in an existing portfolio - Suitability for any strategy

You can hold a CFD open for as long as you want – whether that’s seconds or months

Which instruments can I trade?

City Index offers a choice of 1,000s of CFD markets, including:

- The world’s leading indices: the FTSE 100 (UK 100), Dow Jones (Wall St), DAX 40 (Germany 40) and dozens more

- GBP/USD, GBP/EUR, EUR/USD and 80+ more FX pairs

- Global Shares such as Tesla, Amazon and Apple

- Commodities including oil, gold and cocoa

- Other markets such as bonds, interest rates and options

Managing risk in CFD trading

As CFDs are leveraged, it’s a good idea to manage your risk carefully when trading with them. Two key tools to help control risk on each trade are take profits and stop losses.

Take profits – also known as limit orders – will automatically close your position if it hits a certain profit level. In doing so, they help you stick to your plan when you may be tempted to hold onto a winning position, despite the risk that it may reverse.

Stop losses also automatically close your position, but they do it once it hits a specified level of loss. They help limit your total risk from any given trade. However, standard stop losses aren’t 100% effective as they can be subject to slippage if your market ‘gaps’ over your stop.

To ensure that your position will always close if your stop level is reached, you’ll need to upgrade to a guaranteed stop.

Learn more about CFD trading risks.

Spread betting vs CFD trading

Like CFD trading, spread betting enables you to open leveraged buy or sell positions on a range of markets without taking ownership of any assets. But these two leveraged products work in slightly different ways.

Instead of buying or selling contracts, when spread betting you bet a set number of pounds per point on the direction in which a market is headed. Your profit will increase for every point that the market moves in your direction, in which you think a market is headed.

Learn more about the difference between spread betting and CFDs.