US futures

Dow futures -0.18% at 34196

S&P futures +0.08% at 3993

Nasdaq futures +0.2% at 11517

In Europe

FTSE -0.14% at 7849

Dax -0.08% at 15141

Learn more about trading indices

China GDP drops sharply.

US stocks are set to open in a mixed and muted fashion after the long weekend as investors digest more quarterly earnings and a sharp drop in China’s GDP.

Data from China shows that growth in the world's second-largest economy slumped to one of its worst levels in almost 50 years. Q4 GDP grew at 2.9%, down from 3.9% but ahead of forecasts of 1.8%.

Turning to corporate earnings, the banks are once again in focus with results from Goldman Sachs and Morgan Stanley.

S&P500 earnings are expected to fall this earnings season, and revenue rise marginally as companies struggle in a challenging, inflationary environment. A big focus will be on the outlook and the likelihood of a recession.

At the World Economic Forum in Davos, a survey revealed that two-thirds of those questioned expect a global recession in 2023.

Corporate news

Goldman Sachs is falling pre-market after the investment bank missed profit estimates owing to a steep decline in asset and wealth management. GS reported EPS of $3.32, well below the $5.48 forecast. Revenue was $10.59, below the $10.83 expected.

Morgan Stanley is rising after the bank beat forecasts after its trading business was boosted by market volatility which offset the hit from sluggish dealmaking.

Coinbase rises 6.6%, as the crypto exchange benefitted from a 2 week rally in the Bitcoin price.

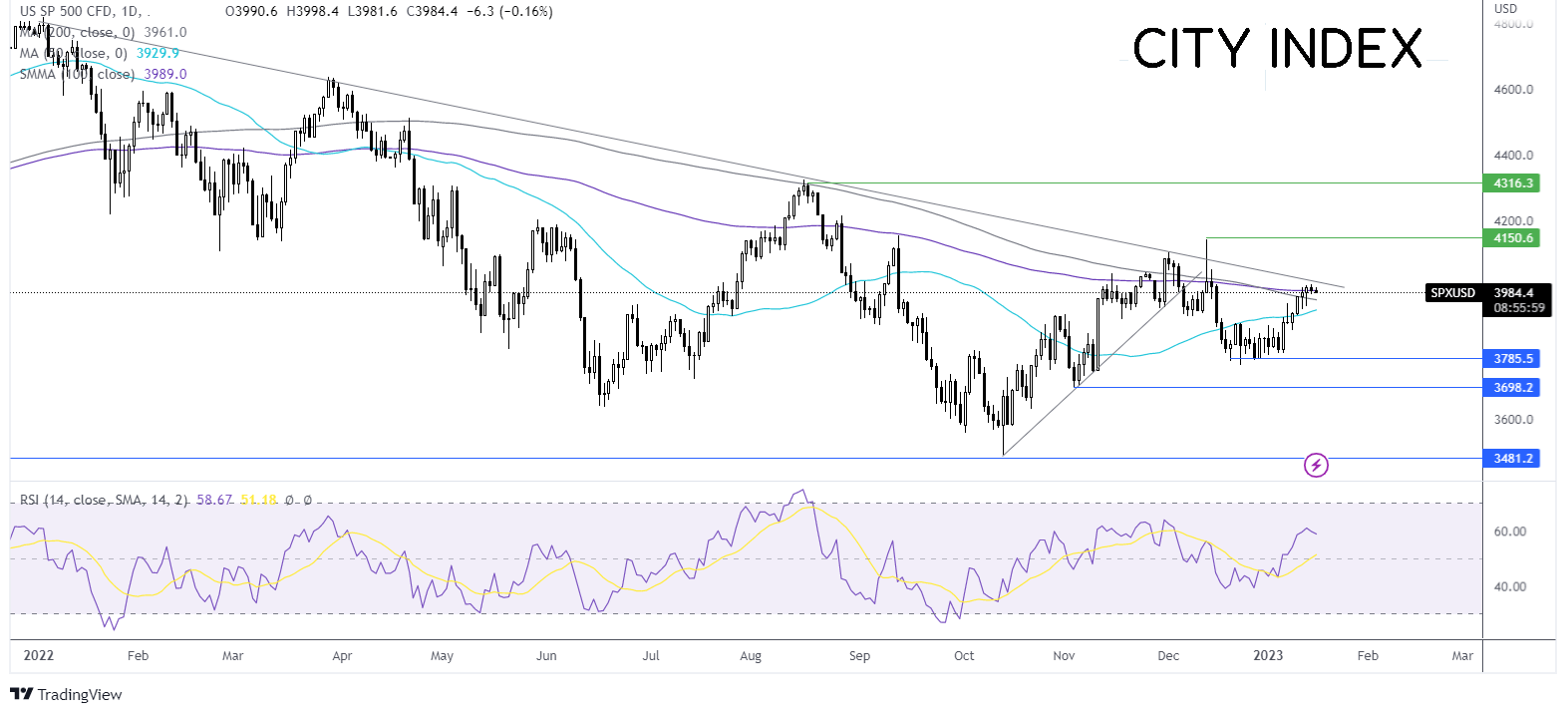

Where next for the S&P500?

The S&P500 extended its rebound from 3790, the year-to-date low, and pushed higher towards 4000, which is proving to be a tough nut to crack. The index has risen above its 50 sma, which, combined with the bullish RSI keeps buyers optimistic about further gains. Buyers need to rise above 4000, the 100 & 200 sma and the psychological level, to test 4020, the multi-month falling trendline resistance, to extend the bullish run towards 4150, the December high. Failure to rise above 4000 could see the price rebound lower to 3930, the 50 sma ahead of 3790 the 2023 low.

FX markets – USD falls, GBP rises

The USD is falling, giving up earlier gains. The broad trend for the US dollar remains downwards as inflation continues to cool in the USA and the market prices in a less hawkish Federal Reserve.

GBP/USD is rising above 1.2250 and outperforming its peers following stronger-than-expected UK jobs data. while the UK unemployment rate held steady in November, close to record lows at 3.7%, average wages excluding bonuses rose by more than expected to 6.4%, up from 6.1% at a near-record pace, as the labour shortage forces companies to raise pay to retain staff. Higher wages mount pressure on the BoE to hike rates further. There were some signs of the jobs market softening, with vacancies falling by 75000 in December to 1.16 million, the seventh monthly decline.

EUR/USD is rising after stronger-than-expected German economic sentiment, which rebounded firmly in January to 16.9, up from -23.6 and we above forecasts of -15.5. German economic sentiment has turned positive for the first time since the start of the Ukraine war. this suggests that the recession that is expected in the first quarter could be milder than initially feared.

GBP/USD +0.6% at 1.22270

EUR/USD +0.2% at 1.0838

Oil rises despite weak Chinese growth

Oil prices are on the rise after falling around 1% in the previous session. The oil markets are taking the sharp drop in Chinese economic growth in its stride. The rolling back of the zero-Covid measures and the expected economic recovery is overshadowing the data which showed the Chinese economy stagnated in the final quarter of last year.

Recession worries could limit the upside in oil. Expectations of a global recession are on the rise. Slowing global growth would weigh on the oil demand outlook.

Looking ahead, OPEC and the IEA are due to release their monthly supply and demand outlook on Wednesday.

WTI crude trades +1.65% at $80.45

Brent trades at +1.45% at $83.80

Learn more about trading oil here.

Looking ahead

20:00 Fed Williams to speak