Key Points

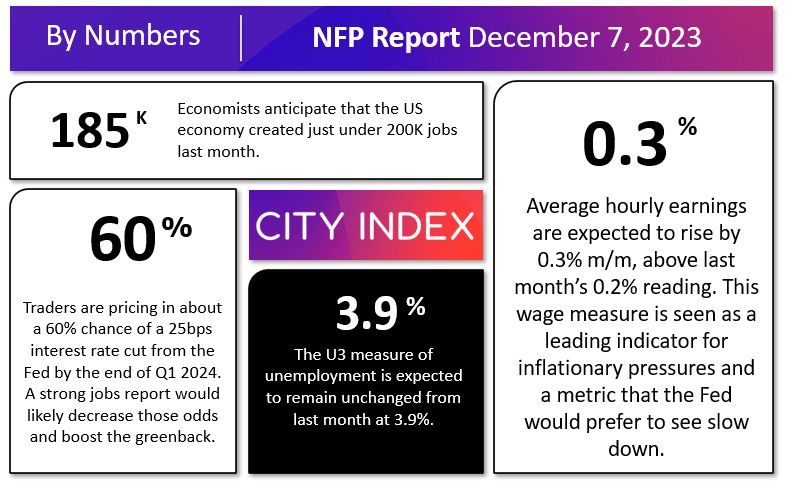

- NFP expectations are for 185K net new jobs, 0.3% m/m wage growth, and unemployment to hold steady at 3.9%

- Leading indicators point to a roughly as-expected reading from NFP.

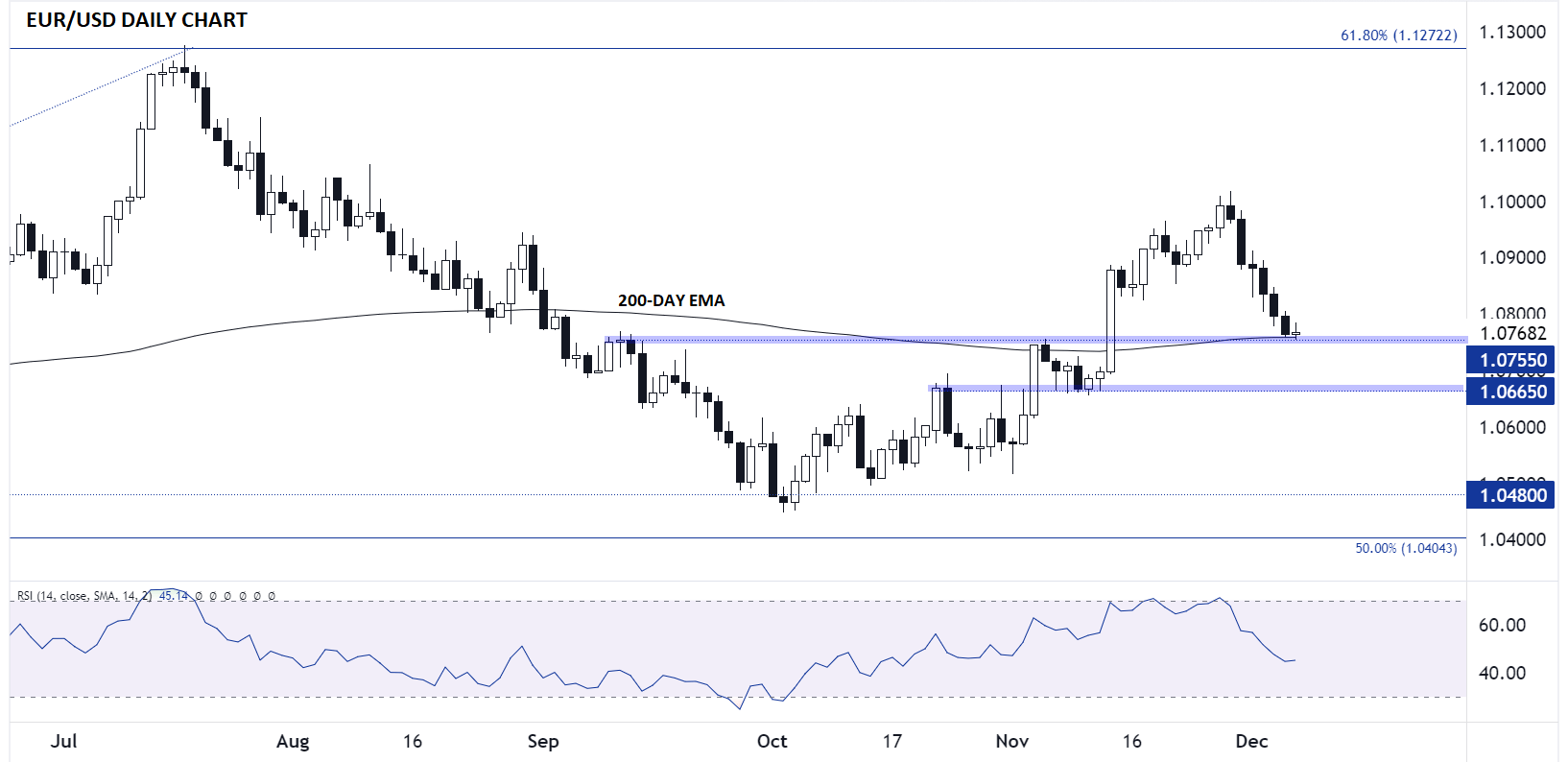

- The US dollar has recovered off its late November lows; EUR/USD traders will be watching the key 1.0755 zone.

When is the November NFP Report

The November NFP report will be released on Friday, December 8 at 8:30am ET.

NFP Report Expectations

Traders and economists expect the NFP report to show that the US created 185K net new jobs, with average hourly earnings rising 0.3% m/m (4.0% y/y) and the U3 unemployment rate remaining unchanged at 3.9%.

NFP Overview

What a difference a month makes!

This time last month, we were talking about the (albeit longshot) potential that the Fed could squeeze in one last rate hike either in December or January. Now though, after five weeks of moderating economic data and some outright dovish Fedspeak, the market is speculating that the central could be cutting interest rates as soon as March!

My view is that the market has gotten a bit ahead of itself in pricing in a Q1 pivot, but regardless, there’s no doubt that jobs and inflation data will be critical to watch in the coming months, starting with tomorrow’s big NFP report.

Source: TradingView, StoneX

Are these expectations justified? We dive into the key leading indicators for Friday’s critical jobs report below!

NFP Forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Manufacturing PMI Employment component printed at 45.8, down a point from last month’s 46.8 reading and indicating an outright contraction in service sector employment.

- The ISM Services PMI Employment component came in at 50.7, improving incrementally off last month’s 50.2 reading

- The ADP Employment report showed 103K net new jobs, below expectations and roughly flat from last month’s downwardly-revised 106K reading.

- Finally, the 4-week moving average of initial unemployment claims rose to 221K, up from last month’s 213K reading.

As a reminder, the state of the US labor market remains more uncertain and volatile than usual as it emerges from the unprecedented disruption of the COVID pandemic. That said, weighing the data and our internal models, the leading indicators point to an as-expected reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 125K-250K range, albeit with a bigger band of uncertainty than ever given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which came in at 0.2% m/m in the most recent NFP report.

Potential NFP Market Reaction

|

|

Wages < 0.2% m/m |

Wages 0.2-0.4% m/m |

Wages > 0.5% m/m |

|

< 125K jobs |

Strongly Bearish USD |

Slightly Bearish USD |

Slightly Bullish USD |

|

125K-250K jobs |

Bearish USD |

Neutral USD |

Bullish USD |

|

> 250K jobs |

Slightly Bearish USD |

Slightly Bullish USD |

Strongly Bullish USD |

The US dollar index dropped through most of November before finding a bottom and bouncing back over the last week. From a medium-term perspective, the dominant trend is in flux, but on the bright side for traders, this suggests that we could get a clear reaction to the NFP report regardless of how it prints.

US Dollar Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

Looking in detail at the world’s most widely-traded currency pair, EUR/USD is testing a key level of previous-resistance-turned-support near 1.0755. As of writing on Thursday morning, the pair has traded lower for six consecutive days, potentially setting the stage for a bounce if US jobs data comes in below expectations.

That said, with the 14-day RSI hovering around the 50 level, the pair is far from oversold on a daily basis, so a strong NFP report could well extend the US dollar’s gains from here. A break below 1.0755 support would set the stage for a bearish continuation down to the next support/resistance level in the 1.0665 zone.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX