Gold Key Points

- Gold closed the week on an 8-day rally into record territory, boosted by a mixed US jobs report and expectations of a Fed rate cut in May or June.

- China’s central bank continues to accumulate gold a torrid pace, providing support for the yellow metal.

- Gold is overbought on a short-term basis, but the long-term returns hint at more room to run higher from here.

As is often the case, gold was driven over the past week by expectations for central banks moves, which in turn were driven by economic data.

The marquee report of the week was the US Non-Farm Payrolls (NFP) reading. At first glance, the data indicated strong job growth in February, with nonfarm payrolls increasing by 275,000. However, the unemployment rate rose to 3.9%, and there was a moderation in wage gains, signaling potential easing in inflation pressures. We also saw big negative revisions to past jobs reports and wage figures. These factors have contributed to heightened expectations that the Federal Reserve may adopt a more accommodative monetary policy, including potential interest rate cuts.

This year’s big surge in gold prices, fueled by expectations of lower interest rates, reflects the metal's appeal as a non-yielding asset when compared to yield-bearing investments like bonds. The prospect of lower rates reduces the opportunity cost of holding gold, making it more attractive to investors.

Moreover, geopolitical tensions and uncertainty, such as those in the Middle East and Ukraine, continue to support gold's status as a safe-haven asset. Additionally, a weakening dollar, partly due to anticipations of Federal Reserve policy adjustments, has made gold cheaper for overseas buyers, further bolstering its price.

Market dynamics suggest that investment funds and traders are increasingly betting on gold, viewing it as a hedge against potential economic instability and inflation. While the immediate response to the US jobs report and Federal Reserve expectations has been a sharp increase in gold prices, market analysts suggest that gold may continue to trade higher due to ongoing safe-haven demand and geopolitical risks.

However, there might be short-term consolidations as the market digests the Fed's comments and the implications of the employment data. Overall, the outlook for gold remains generally bullish, driven by a combination of lower expected interest rates, dollar weakness, and continued demand as a safe-haven asset.

China’s Voracious Appetite for Gold

Meanwhile, the Red Dragon continues to gobble up the yellow metal.

China's central bank, the PBOC, added to its reserves for the 16th consecutive month, showcasing a sustained commitment to bolstering its bullion holdings. In February, the bank acquired approximately 390,000 troy ounces, bringing its total reserves to around 72.58 million troy ounces or about 2,257 tons.

This consistent buying spree by China, alongside other central banks, has been pivotal in supporting the recent surge in gold prices to record highs. The trend reflects broader central bank actions worldwide, with a collective move towards gold as a hedge against economic uncertainty and as a strategic asset, underscoring growing global monetary system shifts and increased demand for safe-haven assets amid uneven economic landscapes. With the US dollar weakening and global yields poised to fall across the board this year, expect central banks to continue to diversify their holdings into gold in the near term.

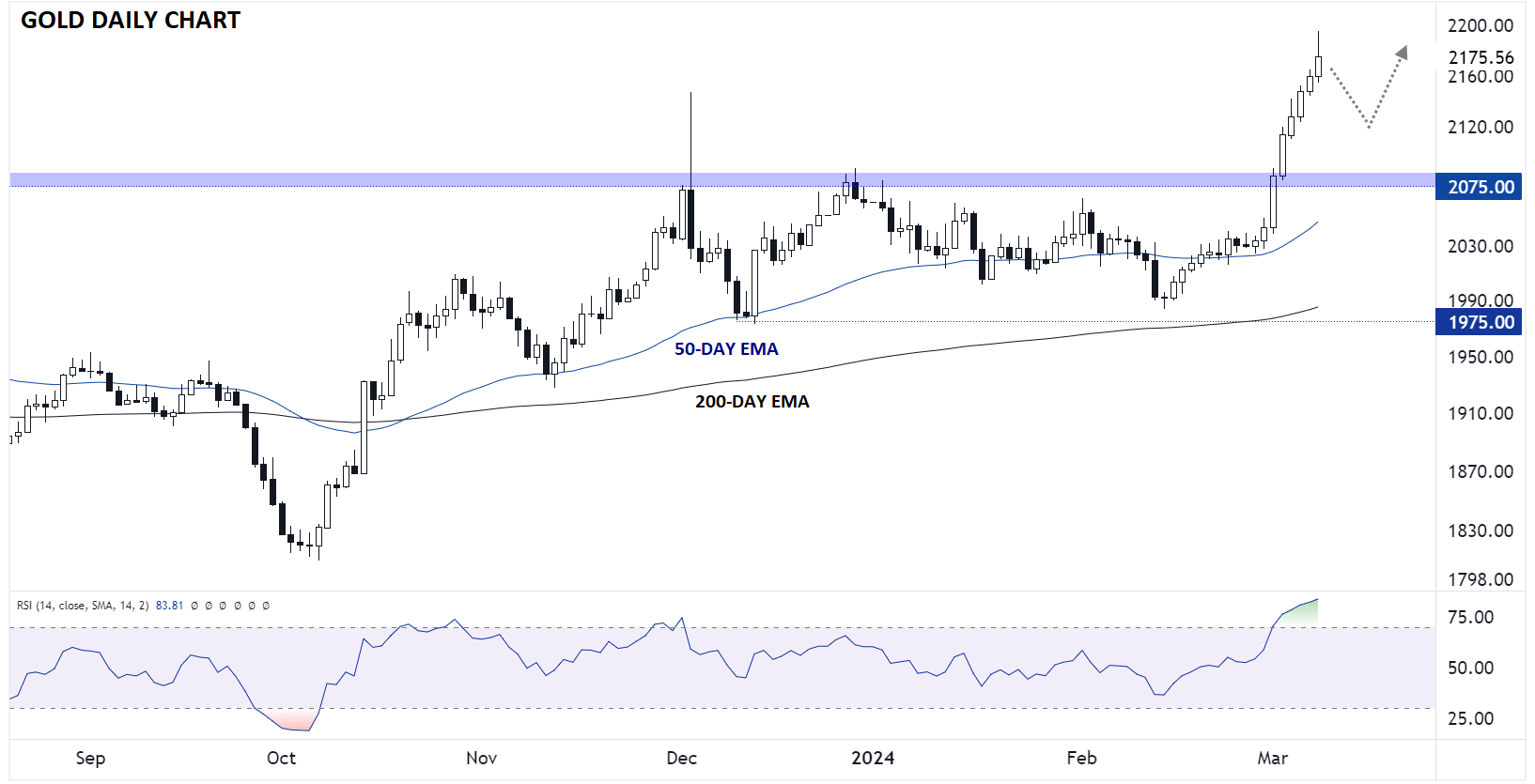

Gold Technical Analysis – XAU/USD Daily Chart

Source: TradingView, StoneX

As the chart above shows, Gold burst definitively above its long-term resistance zone below 2100 this week, extending its streak of consecutive gains to eight days. From a purely technical perspective, the yellow metal is clearly overbought on the daily timeframe, but it’s worth keeping the bigger picture in mind too: Gold has spent the last 3.5 years consolidating below that key resistance area (and you could argue that consolidating actually dates all the way back to 2011, when the yellow metal first hit $1900).

In other words, it’s difficult to argue that gold is overheated from a LONG-term perspective, so any pullbacks may be relatively limited. For this week and probably for the rest of the month, the yellow metal will remain a “buy the dips” trade as long as it holds above $2075, with little in the way of potential resistance until closer to $2300.

Time will tell if this week’s economic data, including US CPI, PPI, and retail sales, as well as the UK jobs report and GDP figures, will prompt a near-term pullback or whether gold will continue its relentless march higher from here.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX