NFP Report Key Points

- Traders are expecting the October NFP report to show 179K net new jobs and average hourly earnings rising 0.3% m/m.

- The immediate market impact of this week’s jobs report may be smaller than usual with another NFP report and two CPI reports scheduled before the Fed’s next meeting.

- A weaker-than-expected NFP report could accelerate the selling in the US dollar (buying in EUR/USD) for a move up toward the top of the flag pattern above 1.0700.

When is the October NFP Report?

The US Non-Farm Payrolls report for October will be released at 8:30 ET on Friday, November 3.

October NFP Report Expectations

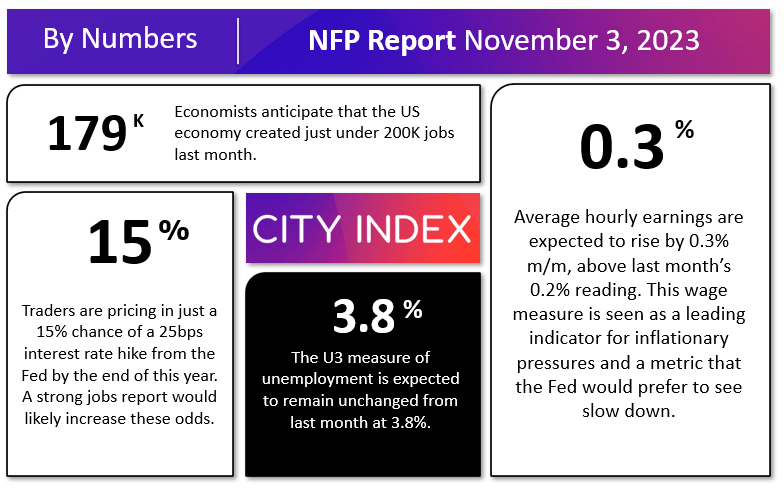

Traders and economists expect the NFP report to show 179K net new jobs were created in October, with average hourly earnings rising 0.3% m/m and the unemployment rate holding steady at 3.8%:

Source: StoneX

October NFP Report Analysis and Forecast

Coming on the back of a relatively noncommittal monetary policy meeting from Jerome Powell and the rest of the Federal Reserve, the October Non-Farm Payrolls report is unlikely to provide a decisive reading on the health of the jobs market and the US economy more broadly. Indeed, with another NFP report, as well as two CPI reports, scheduled for release ahead of the next Fed meeting, the immediate market impact of this week’s jobs report may be smaller than usual.

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report, but due to the vagaries of the economic calendar, we won’t get access to the ISM Services PMI report until after the NFP report:

- The ISM Manufacturing PMI Employment component printed at 46.8, down more than 4 points from last month’s 51.2 reading.

- The ADP Employment report came in at 113K net new jobs, above last month’s 89K reading but below the 149K traders were expecting.

- Finally, the 4-week moving average of initial unemployment claims held steady near 210K this month.

Weighing the data and our internal models, the leading indicators point to an in-line reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 125-250k range, albeit with a bigger band of uncertainty than ever given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which rose 0.2% m/m last month, will likely be just as important as the headline figure itself.

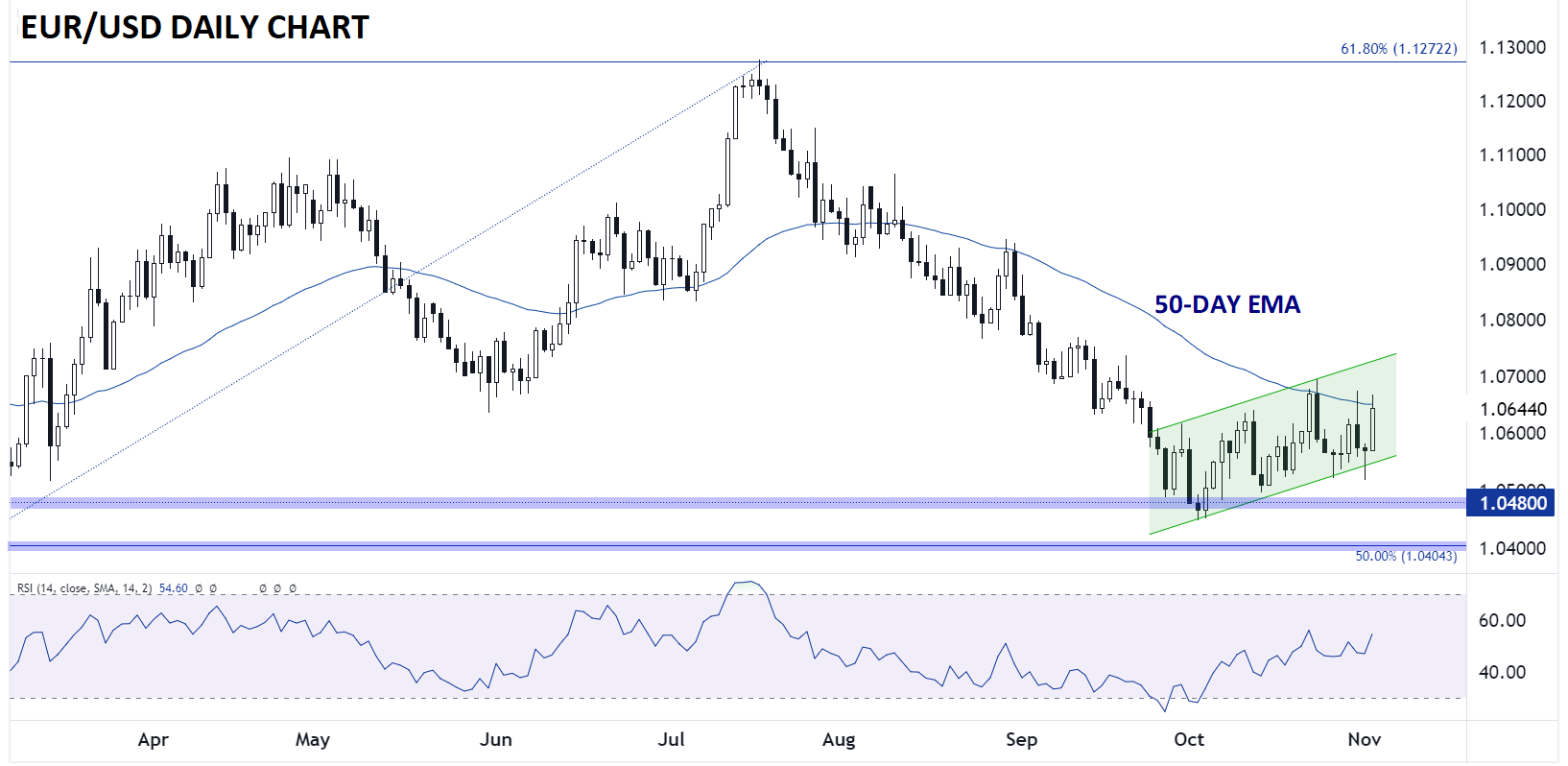

Euro Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

The world’s most widely-traded currency pair is in rally mode as of writing on Thursday, with EUR/USD on the verge of breaking conclusively above its 50-day EMA for the first time since August. From a bigger picture perspective, the pair remains within a possible “bearish flag” pattern, which could point to a continuation lower if rates drop out of the near-term bullish channel, but for now, the short-term momentum is clearly to the topside.

A weaker-than-expected jobs report could accelerate the selling in the US dollar (buying in EUR/USD) for a move up toward the top of the flag pattern above 1.0700. Meanwhile, a strong jobs report that keeps one last interest rate hike on the table from the Fed could reverse the near-term bullish momentum and take EUR/USD back to the bottom of its bearish flag pattern below 1.0600.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX