- Gold outlook: Metal holds losses as CPI makes biggest increase since June 2022

- Hot inflation boosts ‘higher for longer’ narrative

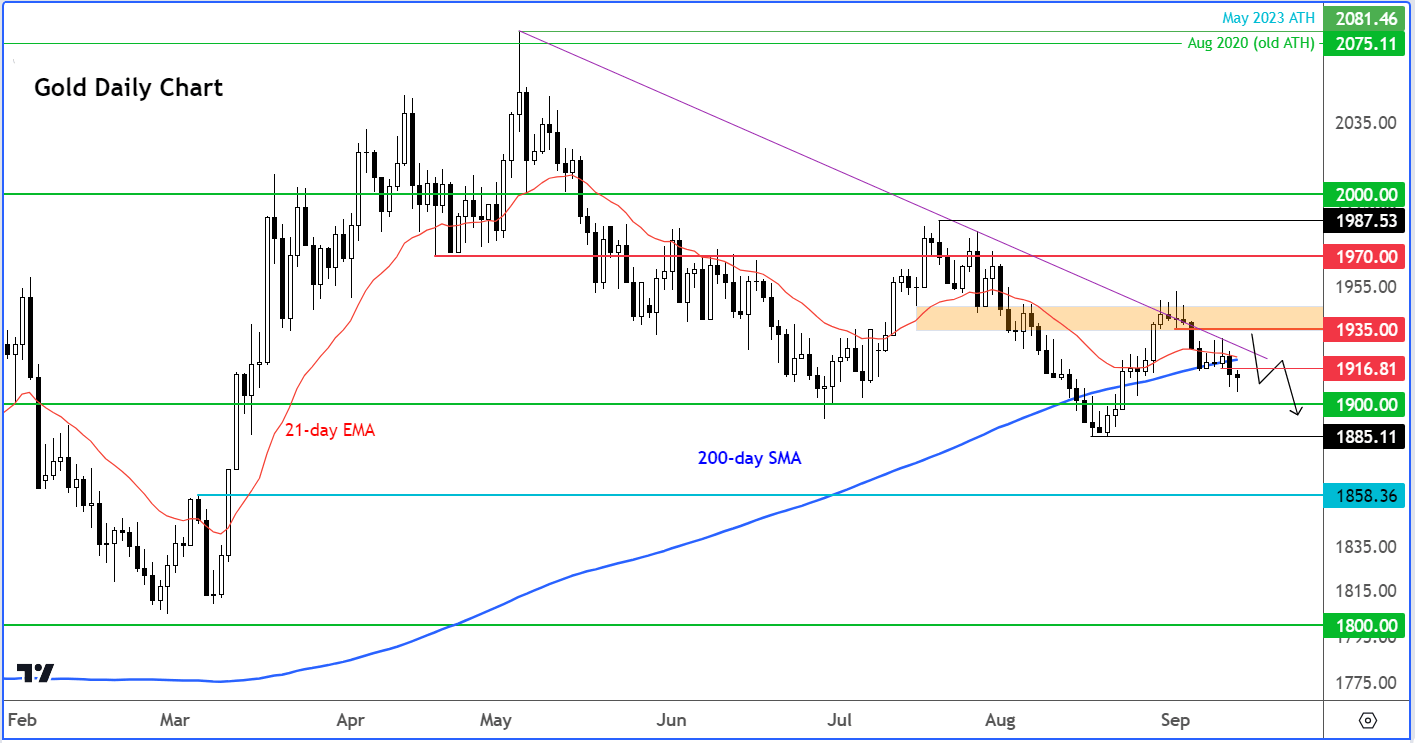

- Gold outlook bearish while it holds below 200-day average

So, the inflation battle continues for the Fed as the latest CPI data come in stronger. This should keep the dollar supported against currencies where the central bank is expected to turn dovish. The likes of the euro and pound come to mind. Gold and possibly stocks may also struggle as the renewed surge in inflation may force the Fed to hike interest rates perhaps one more time before the end of the year. And with oil prices rising, this will further encourage them to keep monetary policy in contractionary mode and rates at these high levels for longer.

Gold outlook: Metal holds losses as CPI makes biggest increase since June 2022

In case you missed it, CPI rose 0.6% month-on-month, which was the biggest increase since June last year. This caused the annual CPI to accelerate to +3.7%, reaching its highest level since May, above expectations for +3.6% and up from the +3.2% y/y increase in July. The monthly core CPI was also stronger at +0.3% vs. +0.2% eyed, although the annual pace of core CPI slowed to +4.3% Y/Y from +4.7% in July, in line with estimates.

So, the key takeaway is that inflation is still too high for the Fed to relax, keeping alive the possibility for one more rate hike this year. This should keep the dollar supported on the dips, potentially causing gold to break further lower and the likes of the EUR/USD and GBP/USD to turn lower again, as I explained in this video earlier:

As far as gold is concerned, well the metal is still printing bearish price action, so the path of least resistance remains to the downside for as long as gold maintains its bullish bias. Where gold goes from here will depend on the direction of the US dollar. After rising for the 8th consecutive week, the Dollar Index has been slightly weaker so far this week. But today’s inflation data could influence the Fed to maintain hawkish. The market appears convinced that the Fed won’t hike in September. However, probability of a hike in November has now risen. Even if the Fed opts against hiking this year, traders will be expecting interest rates to remain at current levels longer than they had previously been expecting. This is what has helped to keep the dollar underpinned in recent weeks.

Gold outlook bearish while it holds below 200-day average

Gold is finding itself about $10 above $1900 again after its latest attempt to move higher failed. The precious metal has broken below its technically important 200-day moving average and held there after the US CPI came in stronger, despite some of the major FX pairs finding some support. If gold continues to hold below the 200-day, this will encourage the bears even more in the days ahead, while a move back above could trigger follow-up technical buying. All told, a break below $1900 looks like a strong possibility now, with the bears eyeing liquidity below the August low of $1885 next.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade