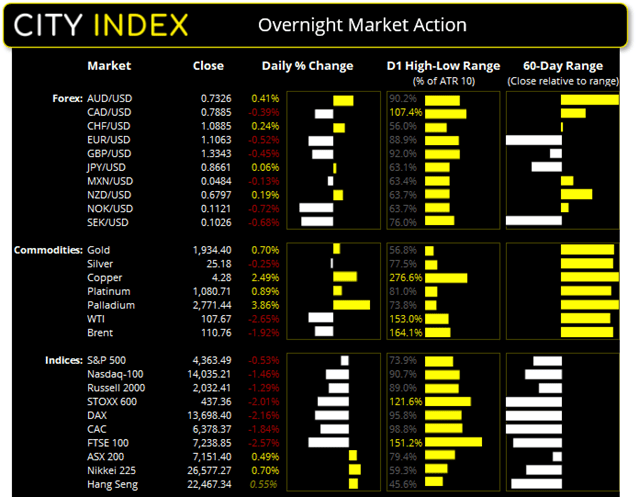

Thursday US cash market close:

- The Dow Jones Industrial fell -96.69 points (-0.29%) to close at 33,794.66

- The S&P 500 index rose -23.05 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell -208.482 points (-1.46%) to close at 14,035.21

Asian futures:

- Australia's ASX 200 futures are down -58 points (-0.81%), the cash market is currently estimated to open at 7,093.40

- Japan's Nikkei 225 futures are down -300 points (-1.13%), the cash market is currently estimated to open at 26,277.27

- Hong Kong's Hang Seng futures are down -273 points (-1.22%), the cash market is currently estimated to open at 22,194.34

- China's A50 Index futures are down -78 points (-0.53%), the cash market is currently estimated to open at 14,576.44

Temporary ceasefire draws scepticism

Russia and Ukraine have agreed to a temporary ceasefire, to create a humanitarian corridor and allow civilians to be evacuated and supplies of food and medicine to be delivered. But some experts have been quick to point out this also allows Russia to strategically resupply and regroup. Separately, French President Macron has spoken to Putin over a call and claims that his Russian counterpart has no intention of stopping the attacks on Ukraine.

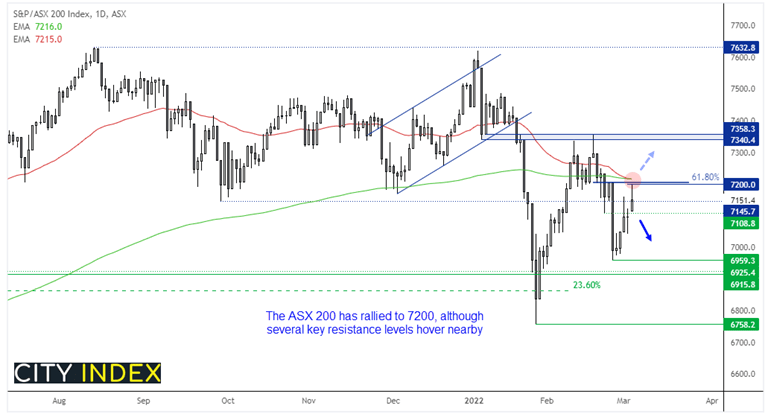

ASX 200 rallies into resistance around 7200

The ASX 200 has defied the gravity of war for five consecutive days. It would do well to make it six, with Wall Street trading broadly lower overnight. Despite oil’s wobble, it doesn’t escape the fact that its epic rally has reignited fears of stagflation (a word no popular on Wall Street). Oil stocks could struggle a little today, although they’ve risen a cool 10% over the past five days. But gold mining stocks should continue to remain supported with spot prices reaching 1940 overnight.

As for the index, the ASX 200 rally has stalled at 7200 where a series of technical levels hover nearby, including the 50/200-day eMA’s and 61.8% Fibonacci ratio. It handed back over half of its earlier gains yesterday so it could have its work cut out for an extended rally today. A break below 7108 would pique our interest for potential shorts with a view to target the lows around 6960.

ASX 200: 7151.4 (0.49%), 03 March 2022

- Materials (2.63%) was the strongest sector and Consumer Staples (-2.26%) was the weakest

- 5 out of the 11 sectors closed higher

- 6 out of the 11 sectors closed lower

- 3 out of the 11 sectors outperformed the index

- 97 (48.50%) stocks advanced, 83 (41.50%) stocks declined

Outperformers:

- +10.98% - Yancoal Australia Ltd (YAL.AX)

- +10.61% - Whitehaven Coal Ltd (WHC.AX)

- +8% - AVZ Minerals Ltd (AVZ.AX)

Underperformers:

- -5.25% - Meridian Energy Ltd (MEZ.AX)

- -4.17% - Summerset Group Holdings Ltd (SNZ.AX)

- -4.1% - Zip Co Ltd (Z1P.AX)

Oil wobbles at the highs

Reports that an Iranian deal was imminent saw a sharp reversal on oil prices overnight. It was the record scratch which paused the party for bulls, as a lot of new supply could be about to hit the market. WTI futures tapped $115 for the first time since 2008 overnight before reversing back below the 2011 high. And, dare we say, paves the way for a corrective phase, however minor that may be as war still rages on.

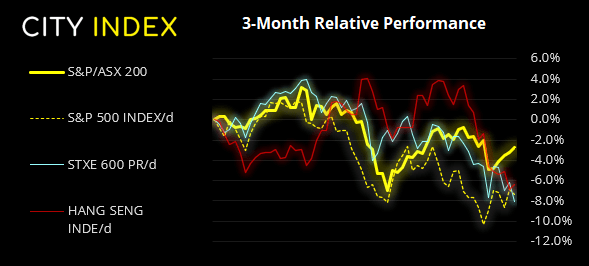

AUD strongest major this week

The Australian dollar has marked the week with its dominance and outperformed the yen despite it receiving safe-haven flows. A combination strong domestic data with surging commodity prices has served it well, all whilst the RBA remain the most dovish central bank among the FX majors. AUD/USD closed above 73c for the first time this year, AUD/JPY rose to its highest level since November and EUR/AUD hit a fresh 5-year low. This has seen the euro plummet to a 22-month low and send the US dollar index to its highest level since June 2020.

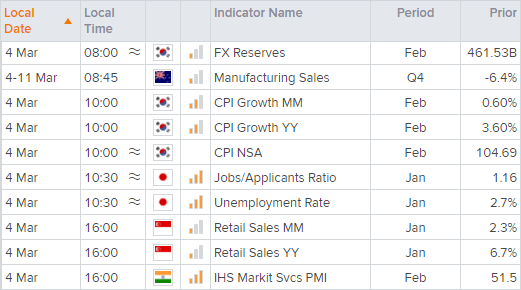

Up Next (Times in AEDT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade