- Euro to US dollar analysis: disparity between US and Eurozone PMI data bodes well for euro

- US dollar rebounds slightly ahead of GDP and core PCE data

- EUR/USD technical analysis shows rates testing a pivotal area circa $1.07

Euro to US dollar analysis: EUR/USD technical analysis video

The US dollar advanced in the first half of Wednesday’s session, as the likes of the pound and euro gave back some of the PMI-related gains made in the previous session. However, the Aussie dollar was still holding onto its overnight gains after an unexpected increase in inflation data led to a hawkish reassessment of Aussie interest rates. While the EUR/USD holds below the 1.07 handle for now, it is important to see what the dollar does here, especially as we have important hard data coming up, namely GDP and core PCE this week. But the more up-to-date PMI surveys which revealed disparity between the US and Europe, is increasing the odds of a EUR/USD recovery. What’s more, today’s release of German ifo Business Climate surprised to the upside for the second month in a row, in theory boosting the appeal of the EUR/USD. In practical terms, though, the EUR/USD hardly moved on the data.

Euro to US dollar analysis: Dollar rebounds slightly ahead of key US data

Investors’ focus will also return back to the macro front with key US data coming up in the last couple of days of the week, namely GDP and core PCE price index.

Yesterday, the dollar weakened due to below-par US PMI figures, with manufacturing dipping into contraction at 49.9, and services slowing to 50.9. Although these surveys aren't as influential as the ISM in the US, markets were nonetheless surprised by the contrasting trends with eurozone PMIs, with the eurozone composite PMI surpassing its US counterpart for the first time in 12 months.

So, for the first time, we have seen a challenge to the notion of US growth exceptionalism, which increases the risk of the EUR/USD staging a counter-trend rally.

FX investors seem to have embraced the upturn in the services sector PMI in Europe. There are signs of inflation picking up in the services sector, although admittedly not at the levels seen earlier this year. Nonetheless, the continued improvement in the services sector PMI suggests better economic conditions, though this won't dissuade the ECB from rate cuts.

We had more positive news from Germany this morning, as the German ifo Business Climate printed 89.4 vs. 88.9 expected and 87.9 last.

Euro traders have therefore been focusing on the prospect of a stronger economy, leading to a rebound in the single currency from its recent lows near $1.06. The euro's strength is also evident in popular euro crosses like the EUR/JPY, which broke to a new multi-decade high yesterday. The EUR/CHF was on the rise again today.

If we witness further improvements in eurozone data or weaknesses in US data, we could see the beginning of a rally on the EUR/USD.

With that in mind a lot now hinges on tomorrow's release of first-quarter GDP data, although with the Fed mostly interested in inflation and employment figures, this may not have a major impact. That said, a much weaker or stronger print compared to expectations should move the dollar in the direction of the surprise.

Will US data trigger dovish repricing of interest rates again?

Rather than the publication of GDP on Thursday, the bigger risk events for the dollar are arguably the PCE inflation figures on Friday, followed by the jobs data on 3rd May. Strong growth and sticky inflation data have helped to rein in on rate-cut bets in recent weeks. But most of the hawkish repricing may be factored in by now. Thus, if we start to see weakness in US data again, then this will reduce recent concerns over the Fed’s ability to cut rates. The market has scaled back rate cut expectations considerably since the start of the year.

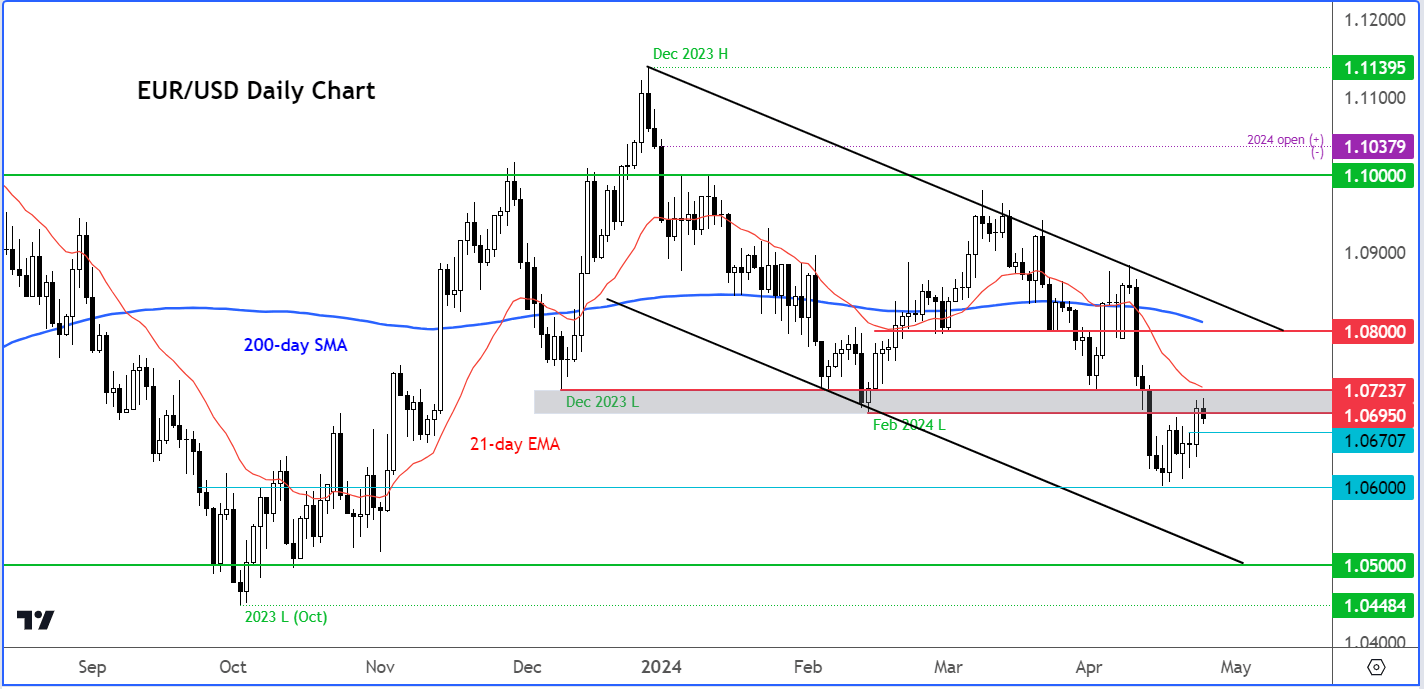

Euro to US dollar analysis: EUR/USD technical analysis

The EUR/USD’s bearish trend has weakened somewhat in the last few days. Yet, we haven’t had a clear bullish reversal pattern to declare an end to the bear trend yet. Will that change, though?

Source: TradingVIew.com

Well, the EUR/USD tested a pivotal technical area around 1.07 handle, or more specifically in the 1.0695 to 1.0795 range, yesterday. This area was support back in December and again in February, before giving way earlier this month. So far, resistance has held here, keeping the bearish trend alive, for now anyway.

However, a potential move above this zone would be a positive technical development for it will point to a possible false break scenario. This could happen should the upcoming US data releases fail to match expectations.

Meanwhile, the next potential level of support comes in at 1.0670 initially ahead of 1.0600 thereafter.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade