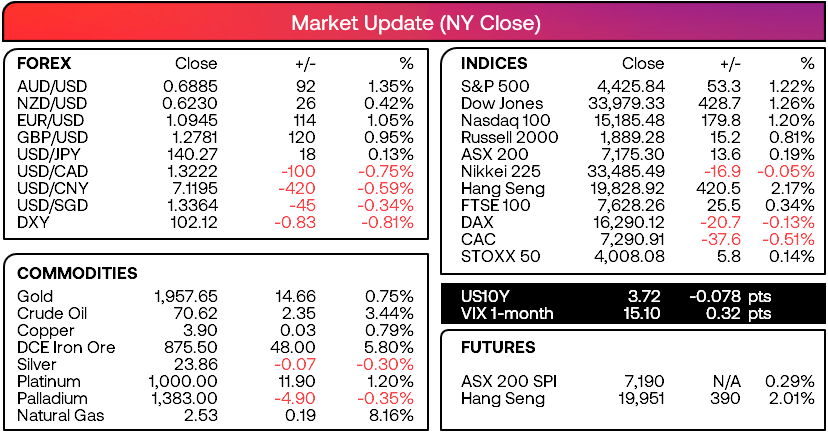

Market summary

- The ECB hiked interest rates by 25bp to a 22-year high of 4%. It was their eight consecutive hike this cycle, with ECB President Lagarde saying “it is very likely we will continue to increase rates in July”

- Markets are only pricing in a single 25bp hike from the Fed (not the 50bp by EOY the dot plot suggested), which weighed on yields and dragged the USD lower and supported Wall Street

- US retail sales and the NY empire state manufacturing index beat expectations, raising hopes that the US can achieve a soft landing and the S&P 500 to a 3-month high, and the Nasdaq to a 15-month high

- The combination of fresh stimulus from China and a strong employment report for Australia helped AUD/USD blow past 68c during its best day since in two months and see AUD/NZD rise back to its YTD high

- The general risk-on tone sent AUD/JPY to a 9-month high as it tracked Asian indices higher

- EUR/USD enjoyed its best day in over three months and closed at a 5-week high, just ~50pips below 1.10, EUR/JPY reached a 14-year high

- AUD and EUR were the strongest FX majors, USD and JPY were the weakest

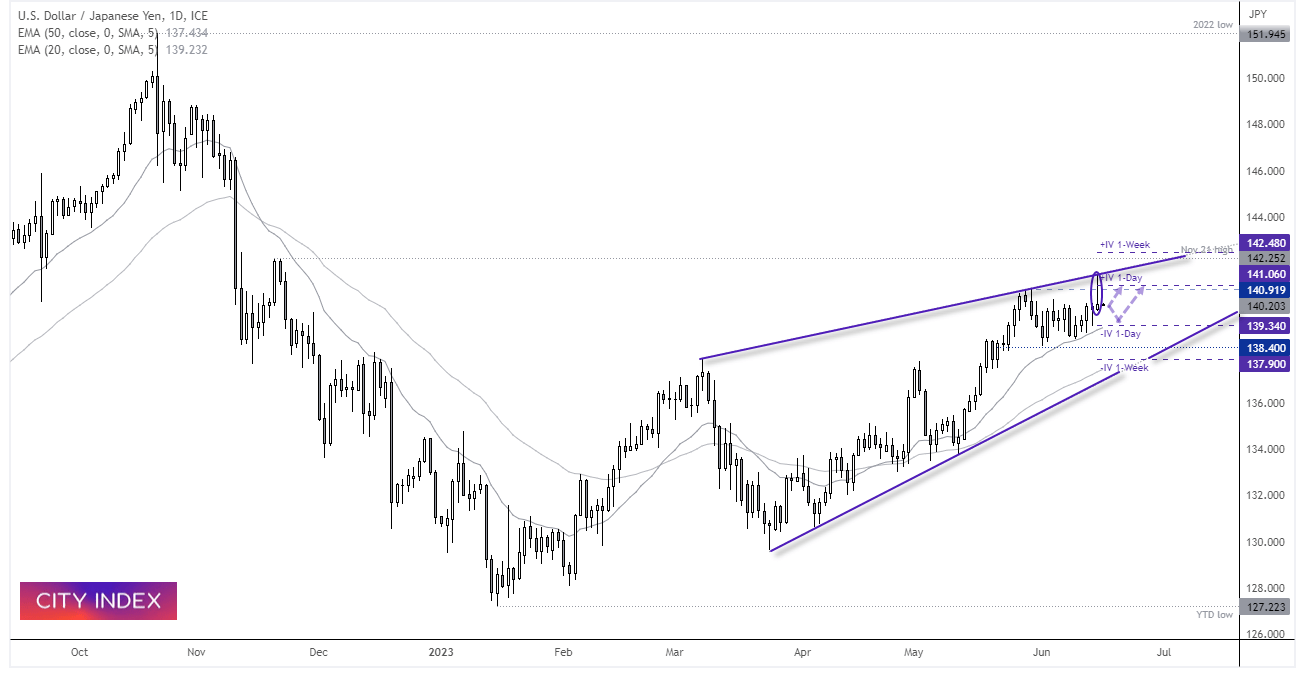

- USD/JPY’s break to a 7-month high was short-lived, with a bearish hammer forming on the daily chart which closed beneath 140

- CHF/JPY has risen to an 8-year high ahead of today’s BOJ meeting (and next week’s SNB meeting). And we’re curious to see how it reacts around this key level

- The BOJ announce their decision today, but whilst its likely no change will occur it is best to not drop your guard when the BOJ is concerned as they like to surprise once in a blue moon

- Gold formed a bullish engulfing candle following a false break of 1932.2 support, with large buyers seemingly stepping back in 1932

Events in focus (AEDT):

- 08:30 – NZ business PSI

- 13:00 – BOJ interest rate decision

- 19:00 - Eurozone CPI

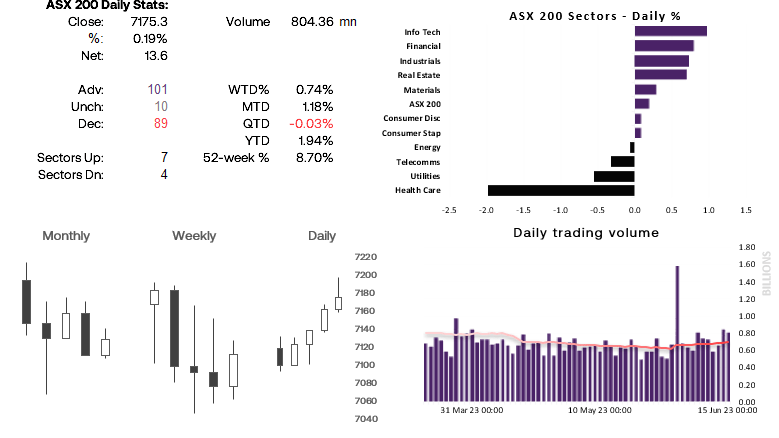

ASX 200 at a glance

- The ASX 200 closed higher for a fourth session

- Resistance was met around 7200 and a bearish trendline

- A small bearish hammer closed beneath the 20-day MA

- RSI (2) is also overbought to warn of near-term weakness

- Yet a strong Lead from Wall Street could be supportive

- Yesterday’s high could be a pivotal level to decide near-term direction

USD/JPY daily chart:

Yesterday’s bullish bias for USD/JPY did not quite work out, with the daily high hitting trend resistance, handing back the day’s gains and closing the day with a pinbar candle. If the BOJ surprises with a wider YCC band it could weigh heavily on USD/JPY and send it towards the 138.40 lows (it would likely be quite a volatile day, to say the least). It’s an outside chance, but it would be an exciting day none the less. For now, prices are meandering around the 140 handle, a break beneath which could see it drift towards the 20-day EMA 135.965, at which point we’d consider near-term bullish setups on lower timeframes. But if we can see evidence of a swing low above or around 140, then we’d consider intraday long setups heading into the weekend, but we’re not expecting a break above the 140.92 highs without a fresh USD-bullish catalyst.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade