Knockout Options

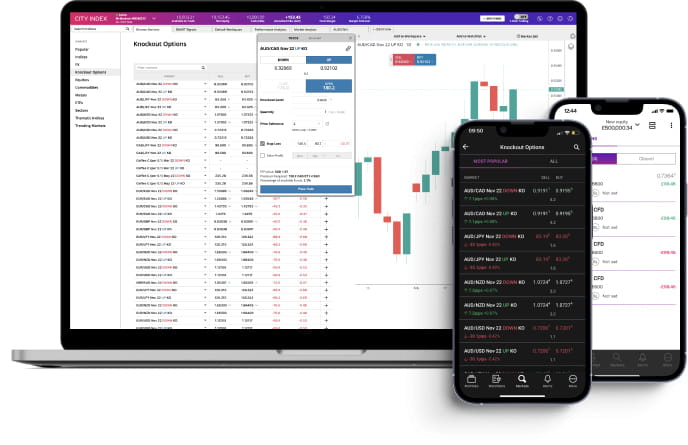

An innovative and simple way to trade major FX, indices and commodities markets, Knockout Options have a range of unique benefits including flexible margin, limited risk and guaranteed protection from slippage.

-

Higher leverage *

You determine the margin requirement and maximum risk taken, by choosing the Knockout Level and trade size.

-

Limited risk

Setting the Knockout Level upfront means your maximum risk is fixed, with potential gains remaining unlimited.

-

Zero slippage

Should the underlying market reach your Knockout Level, it is guaranteed to close at that price – irrespective of any gapping or slippage.

Knockout Options are limited-risk trades with a unique feature – their price moves one-for-one with the underlying City Index price. If the market moves against you and the price reaches the Knockout Level, your trade is guaranteed to close (or be ‘knocked out’) at that price – even during highly volatile markets when slippage can occur.

Enjoy greater flexibility and control

By setting your Knockout Level and trade size, you have complete control over your margin requirement and maximum risk for each trade. Trade with confidence knowing that your potential gains are unlimited, but losses will never exceed initial margin.

An exciting world of opportunity

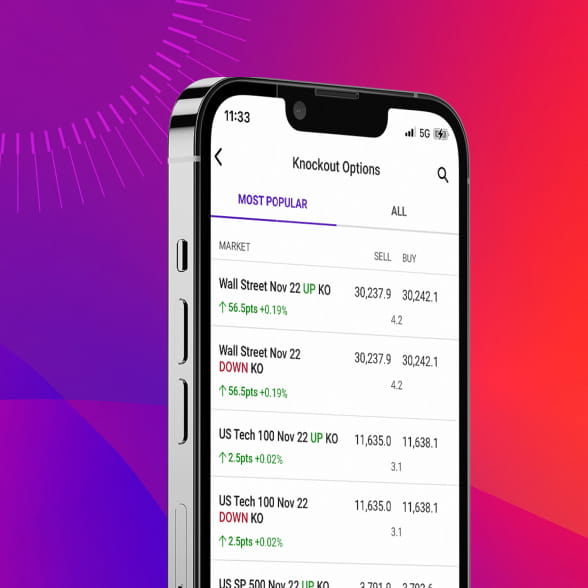

You can trade Knockout Options across a range of popular FX pairs, global indices and commodities – and take advantage of both rising and falling markets by trading either an UP KO (if your view is bullish and you think the underlying price will rise) or DOWN KO (if your view is bearish and you think the underlying price will fall).

Award-winning since 1983

Find out more about Knockout Options

Learn how to trade Knockout Options with illustrated examples, comparison tables and other key information.

Knockout Options FAQs

How long can I keep my position open?

You can keep your Knockout Option position open until market expiry – visible in the market name – unless the Knockout Level is reached, at which point your position will automatically close at 0 or until closing orders are triggered.

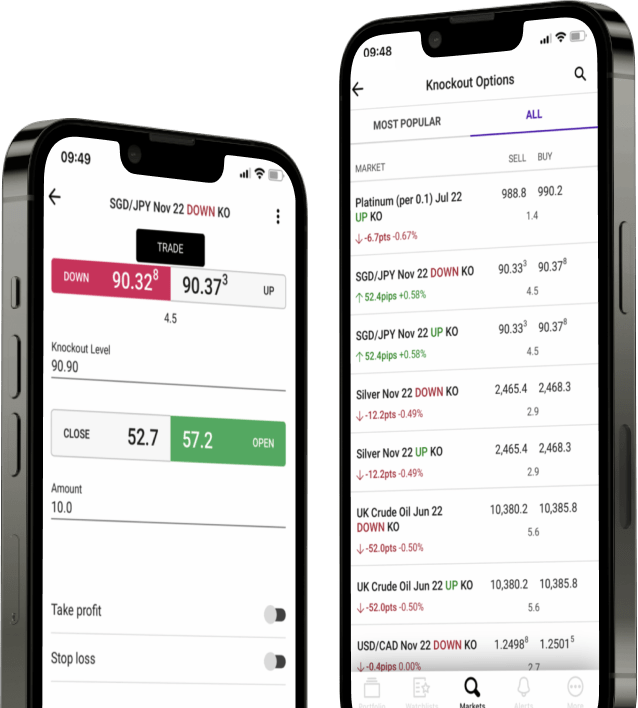

How do I determine the price of a Knockout Option?

The price of a Knockout Option at any given time is the distance between the price of the underlying market and the Knockout Level. This means that they move in lockstep. For example, if the underlying price moves up one point, the price of the Knockout Option will move exactly the same amount. Once a Knockout Option trade is opened, the Knockout Price mirrors the price of the underlying asset.

For an UP KO trade: City Index underlying ‘Ask’ price - Knockout Level

For a DOWN KO trade: Knockout Level - City Index underlying ‘Bid’ price

What markets are available to trade as Knockout Options?

Knockout Options are available across a range of major FX, indices and commodities markets. You can view the full range of available markets in our knockout options market information or in our trading platform.

*When compared to the equivalent CFD market