Forex trading

-

Competitive pricing

Enjoy low trading costs – including EUR/USD from just 0.5 points

-

Trade 84 global FX pairs

Including majors, minors and exotics.

-

Awarded

Awarded “Best in Class” 2023 by ForexBrokers.com

Why trade forex with City Index?

-

Institutional-grade liquidityBenefit from Tier-1 bank liquidity and 40 years’ experience in forex trading.

-

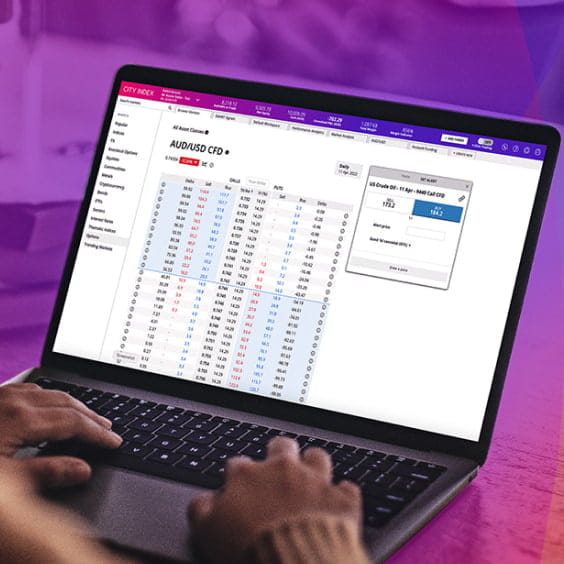

Advanced chartingTake advantage of the industry-leading TradingView charting package to trade global currency markets, with 80+ indicators and one-click trading.

-

A globally trusted brokerTrade with a trusted market leader, regulated in Singapore since 2006.

Competitive pricing

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

Major FX moves and news

Latest research

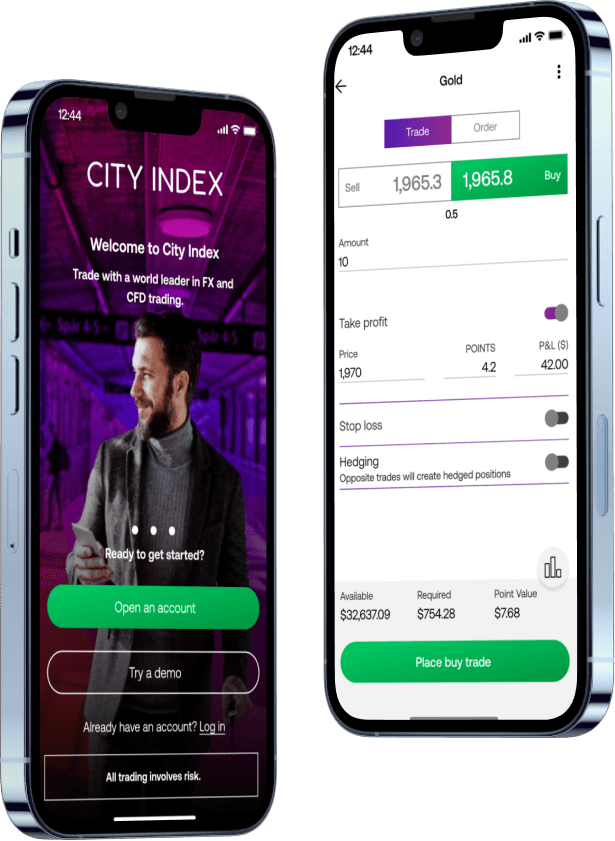

Mobile trading app

Seize trading opportunities with our easy-to-use mobile apps, with simple one-swipe trading, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charting

Complete with in-chart trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access insightful market data on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

How to trade FX with City Index

Currencies always trade in pairs – one against the other. If one appreciates in value, it does so at the expense of the other. If EUR/USD is rising, for example, then the euro is going up against the US dollar.

If you think a currency is going to go up in value, you go long or ‘buy’. If you think a currency is going to go down in value, you short or ‘sell’ it. Ready to start trading now? Get started with your application.

Start forex trading with City Index

To begin forex trading with City Index, simply follow our three-step guide to open an account and you could be placing your first forex trade in minutes.

What is forex trading?

Learn why leveraged forex trading is popular with investors, and how the FX market works.

Forex trading example

Take a look at how an FX trade looks in practice with our step-by-step guide.

Over one million account holders* use us to trade the financial markets. Here's why.

*StoneX retail trading live and demo account holders globally since Q4 2020.

Over 99% of trades using our award-winning trading platforms are executed in less than a second.

99.99% of all valid trades are executed by our market-leading trading technology and trading platforms.

We’re backed by Nasdaq-listed StoneX, a Fortune 100 company with over a century in the financial markets. Combined with our four decades of heritage, you’re in good hands.

Enhance your trading experience with our exclusive Performance Analytics technology and comprehensive risk management tools. From Knockout Options to Guaranteed Stop Loss Orders, our tools are designed to help you manage risk effectively and make informed decisions.

Frequently asked questions

Why do people trade currencies?

People trade currencies for lots of different reasons. You’ve probably traded a currency if you’ve ever bought goods overseas, for example, or gone on a foreign holiday. However, the vast majority of FX trading is done for profit.

Currencies are constantly moving in value against each other. On any given day, the pound might be rising against the dollar, while the euro falls against the Swiss franc. Forex traders buy and sell currency pairs to try and take advantage of this volatility and earn a return.

For instance, if the euro is rising against the US dollar, you might buy EUR/USD. When you buy this pair, you’re buying euros (EUR) by selling the US dollar (USD). Then, if the euro continues to outpace the US dollar, you can sell the pair to exchange your EUR back for USD and keep the difference as profit.

Confused? See more examples of how FX trading works.

When is the forex market open for trading?

The forex market is open for trading 24-hours a day, 5 days a week. That means with FX, you can build your trading strategy around your schedule, instead of having to conform to when a stock exchange is open.

However, there are times when the market is much more active, and times when it is comparatively dormant. To learn the best times to trade forex, read our dedicated page.

Where is forex traded?

Forex is traded via a global network of banks in what’s known as an over-the-counter market – unlike shares and commodities, which are bought and sold on exchanges. Because of this, you can trade forex 24-hours a day five days a week.

FX trading is split across four main ‘hubs’ in London, Tokyo, New York and Sydney. When banks in one of these areas close, those in another open, which is what facilitates round-the-clock trading.

However, there’s no physical location where these banks and individuals trade with each other. Instead, it is entirely online.

Forex trading explained

A market that doesn’t sleep

Foreign exchange (forex) or FX trading involves trading the prices of global currencies, and at City Index it is possible to trade on the prices of a huge range of global currencies. Currency trading allows you to speculate on the movement of one currency against another, and is traded in pairs, for example the euro against the US dollar (EUR/USD).

Currency markets are open 24 hours a day. There is no central exchange for trading Forex: instead prices are determined by interbank trading, the exchange of currencies between banks on a constant basis, all over the world.

The currency market is much bigger than share markets. The daily volume of global forex markets is estimated at over $6 trillion.

What moves currency markets?

- Economic data - This particularly affects critical areas of a country’s economy like inflation, unemployment numbers, foreign trade or payrolls.

- Central banks - These can have a big influence over the performance of currencies, for example by changing interest rates or printing more money. Central banks can also buy and sell their own currency in order to keep it trading within a certain level.

- Political factors - Increasingly, political uncertainty can drive currency markets. For example, the Swiss Franc has traditionally been seen as a safe haven currency. Something as banal as a speech by a finance minister can have a big impact on a currency.

Currency pairs

Currencies are traded in pairs – this means you can only trade one currency against another. You can’t trade a currency in isolation. Each currency has its own three letter code, for example, the US Dollar is abbreviated to USD.

An example of a major currency pair is the USD/JPY pair.

If traders are positive on the prospects for the Yen, they would expect overall number to go down – i.e. the Yen would be getting stronger against the Dollar. Traders would be buying less Yen with a Dollar as the Yen got stronger. Similarly, if the Yen was expected to weaken, forex traders would expect the Yen number to go up, reflecting the fact that the dollar could buy more yen.

Currency markets never decline in absolute terms – for one currency to go up, there will be others weakening against it. All currencies cannot go up at the same time. There is always going to be a loser.

Who trades currency markets?

Currency markets are important to a broad range of participants, from banks, brokers, hedge funds and investor traders who trade forex (FX). Any company that operates or has customers overseas will need to trade currency. Central banks can also be active in currency markets, as they seek to keep the currency they are responsible for trading within a specific range.