What is margin?

Margin is the amount of money available in your trading account to open or maintain a position.

What is leverage?

Leverage allows traders to open positions on markets without the need to cover the total exposure of that market.

As an example, if you trade a market with 20:1 leverage, that means you’ll be able to open a position with a margin requirement of 5% - so for just $1 you can open a position worth $20.

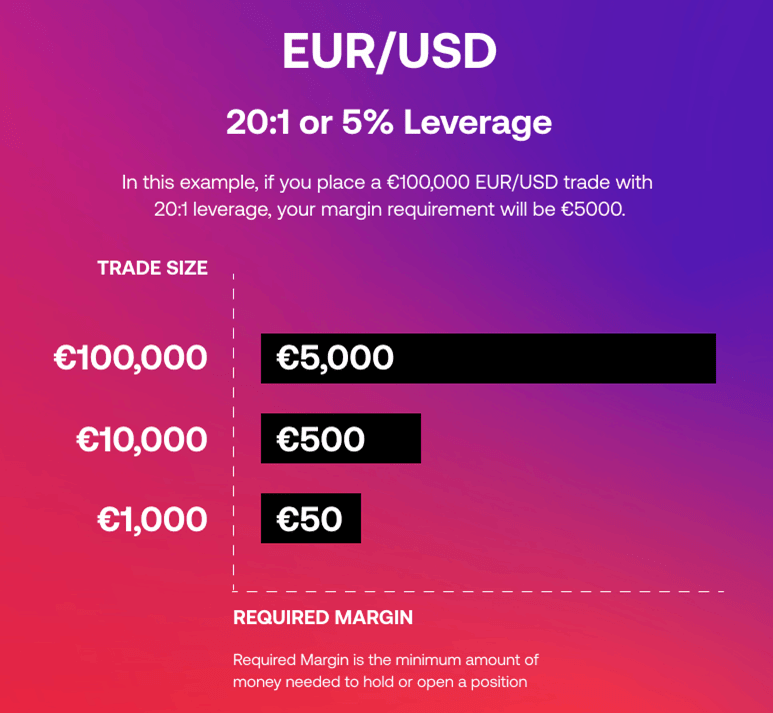

Leverage example

In our example, we’ll use the popular EUR/USD pair (which tracks the performance of the euro against the US dollar).

If we wanted to trade €100,000 in EUR/USD without using leverage, then we would need a full €100,000 to cover the position. However, if we traded EUR/USD with a leverage of 20:1 (a margin requirement of 5%), then we would only need €5,000 to open a position worth €100,000 in EUR/USD.

Magnified profits and losses

When trading on margin of 20:1, you only need 5% of the trade’s full value to open the position. However, any profit or losses made from this position would be equal to the full amount of the trade - in our example, €100,000.

Using our EUR/USD trade as an example, that means we would make a $10 profit or loss for each point the market moved either in our favour or against us, highlighting the potential magnified profit or losses when trading leverage products.

Margin requirement

Brokers afford clients margin when using leveraged products so that they can trade more efficiently, without having to cover the entire value of a given position and only needing to have a fraction of the trade size in their account.

You should ensure that your account has sufficient funds at all times when trading on leverage so that none of your open positions are subject to margin close out.

Margin close out

If your equity drops beneath 50% of your total margin requirement, one or more of your open positions will automatically be closed out to reduce the margin requirement on your account.

You should monitor your margin levels at all times so that no open positions are subject to margin call. When your account is margin called, we will contact you to notify you so that you have the opportunity to either close out the position manually or add further funds to your account should you wish to keep the position open.

Your margin level is calculated by the total Net Equity available in your account divided by the Total Margin Requirement for each position, multiplied by 100.

During periods of heightened market volatility, markets may be subject to gapping which could affect the levels at which any open positions are automatically closed out.