After four years of construction, the Trans Mountain oil pipeline expansion is finally poised to boost Canada’s crude oil exports this week, coinciding with the Fed’s rate decision and economic outlook, as well as leading economic growth figures across the economic calendar. From a geopolitical perspective, conflicts seem to be finding equilibrium with easing tensions between Israel and Hamas against persistent tensions between Russia and Ukraine.

Several significant volatile factors are in play concerning WTI Crude Oil charts this week. Breaking down the puzzle:

- Inflation figures continue to exceed expectations, while the prospect of prolonged higher Fed rates threatens economic growth and oil demand potential

- ISM Manufacturing PMI and ISM Services PMI indicators are closely monitored for Wednesday and Friday results for leading insights into U.S economic growth and resilience

- Canada’s Trans Mountain pipeline is poised to tap into crude oil supply levels, targeting Indian and Chinese market demand

- Non-Farm Payroll results are expected to ripple high volatility across indices, currencies, and commodities markets on Friday, preceding the ISM Services PMI. Concerning crude oil, an uptick in employment indicators could add bullish momentum towards Crude Oil’s bullish trend, signaling heightened growth and demand potential, and vice versa.

Energy Select Sector ETF (XLE) Insights – Weekly Time Frame – Logarithmic Scale

Moving at a positive correlated pace with WTI Crude Oil, both XLE and WTI Crude Oil traced a positive rebound to their latest bearish corrections. XLE soared towards a 0.618 retracement of its drop with a high of 96.92, and WTI Crude Oil climbed a 55% retracement with an 84.42 high. Current weakness is in sight this week amidst bearish fundamental pressures from uncertain demand outlooks, with two price tracks in sight. A break above the 96.92 high would pave the way for two potential resistance levels near the 98 high, and back to the 101.51 all-time-high. From the downside, potential supports can be held near 94.21 and 93.27 levels given the break below the 94.77 low.

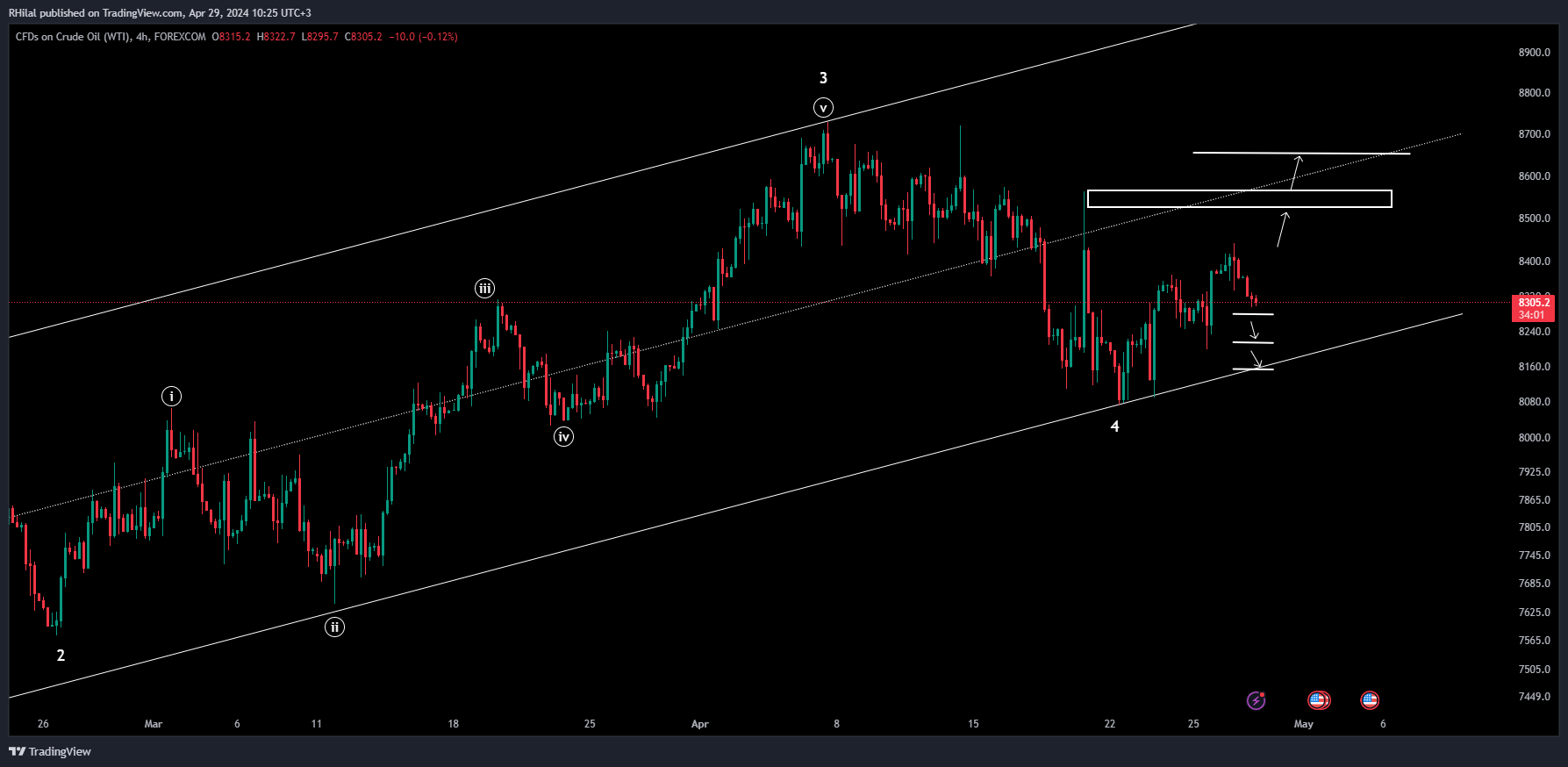

WTI Crude Oil Outlook - 4H Time Frame – Logarithmic Scale

Oil has retraced from Friday’s 84.42 high towards the 82.93 level so far. Although the year’s primary trend and current minor trend favor bullish grounds, potential supports can be seen within this week’s forecasted volatility near the 82 and 81.50 levels. Deeper bearish momentum can retest the lower boundary of the channel near the 80 zone. From the upside, a break above the 84.42 high can pave the way for the 85.20-85.60 zone near the mid-channel area. Steeper bullish momentum would potentially pave the way towards the year’s high near 86.60 and 87.20, and further towards the upper boundary of the yearly channel back to the 90 zone.