EUR/USD rises on USD weakness & ahead of German inflation data

- Eurozone consumer confidence improves.

- German inflation data is due to rise 2.3% YoY from 2.2%.

- USD pressurized the yen gains on suspected intervention.

- EUR/USD rises above 1.07

EUR/USD is pushing higher, extending gains from last week as it capitalises on a weaker USD.

A sharp rise in the yen overnight amid a suspected intervention by Japanese authorities sent the yen sharply higher pressurising the US dollar.

The US dollar is falling but still held onto most of its gains across April after the market reined in Fed rate cut expectations due to sticky inflation.

On Friday, core PCE came in hotter than expected at 2.8% year on year, and personal spending remained high. The U.S. dollar will look to Wednesday's Federal Reserve interest rate decision and Friday's nonfarm payroll report.

The Fed is expected to leave rates unchanged on Wednesday. A slightly more hawkish-sounding Fed Chair Powell could lift the US dollar higher.

Meanwhile, the euro is advancing after stronger-than-expected eurozone consumer confidence data. The final reading came in at -14.7 up from -14.9 previously. However economic sentiment deteriorated to 95.6 down from 96.7. Even so, the PMI data from last week still suggests that the economic recovery in the eurozone is on track.

Attention will now turn to German inflation data, which is due later today and is expected to show a slight tick higher in CPI to 2.3%, up from 2.2%. While this might give the euro a small boost the ECB is still expected to cut interest rates at the June meeting.

Eurozone inflation data comes out tomorrow.

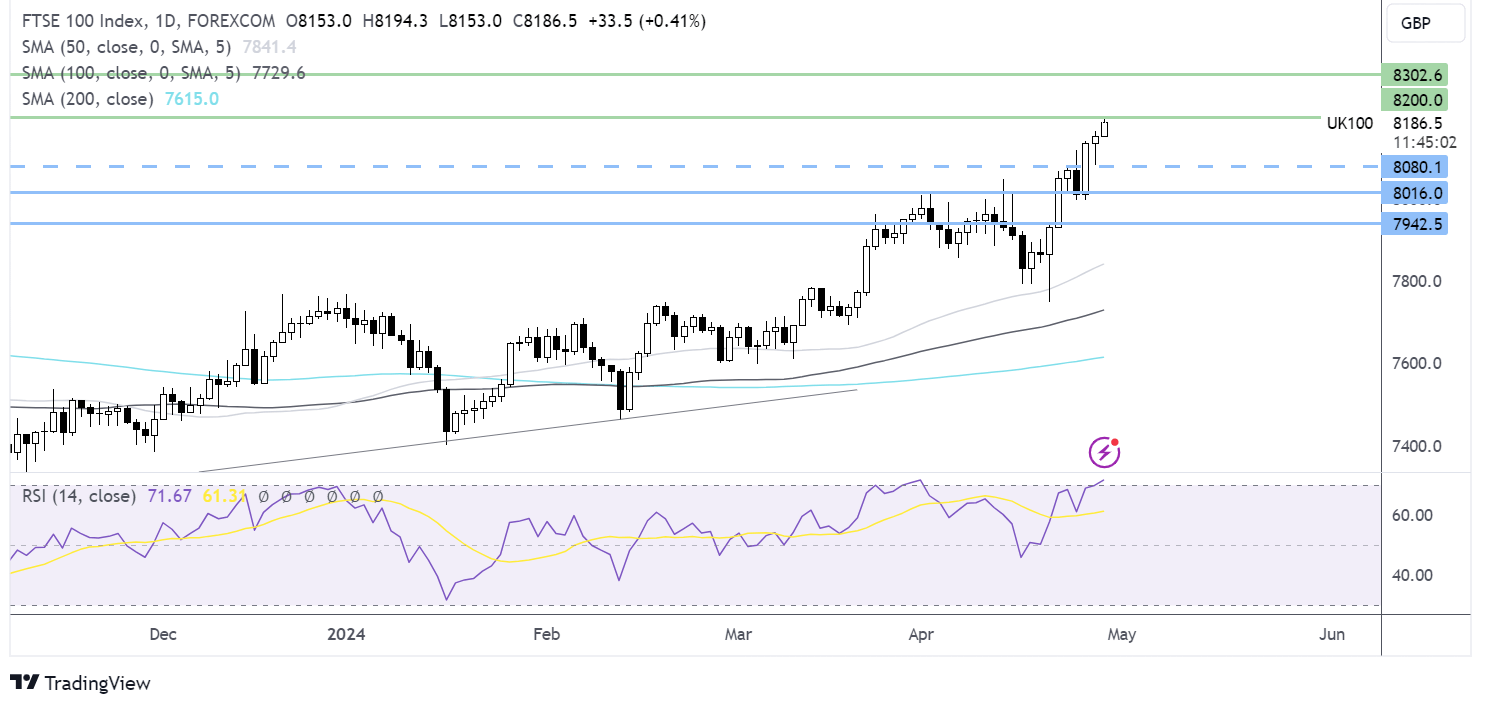

EUR/USD forecast – technical analysis

EUR/USD trades within a falling channel, indicating a longer-term downward trend. However, within the channel, EUR/USD has extended its rebound from 1.06, the 2024 low and faced resistance at 1.0750, last week’s high.

Buyers will look to rise above 1.0750 to expose the 200 SMA at 1.08. Above here, the multi-month falling trendline resistance at 1.0860 comes into play.

Meanwhile, sellers could be encouraged by the longer lower wick on today’s candle, suggesting that there was little buying demand at the higher price. Sellers will look for a break below 1.064 to extend losses to 1.06.

FTSE 100 rises to fresh all-time highs

- Anglo-American rises as BHP could revise its offer

- GBP weakness, BoE rate cut optimism & recovering economy lift FTSE

- FTSE extends gains to a fresh record highs towards 8200

The FTSE 100 has extended its record rise on Monday helped by positive corporate updates and further reports on the BHP buyout proposal for Anglo American.

The FTSE 100 is rising for the eighth session out of nine as UK stocks appear to have turned a corner after months of underperformance versus its major peers.

A weaker pound, a recovering economy, and optimism about a rate cut from the Bank of England have lifted the index.

Data this month showed that the UK economy grew again in February, increasing hopes that the UK has exited a short recession, which it tipped into at the end of last year. Meanwhile, inflation is expected to cool towards 2% in April, fuelling expectations that the Bank of England could cut rates sooner rather than later this year.

On the corporate front, news that BHP could be considering an improved offer for Anglo American has seen the latter's share price gain 1.7%. The London-listed copper miner rejected the initial £31 million offer because it undervalued the company.

If the deal did go through Anglo American would be de-listed from

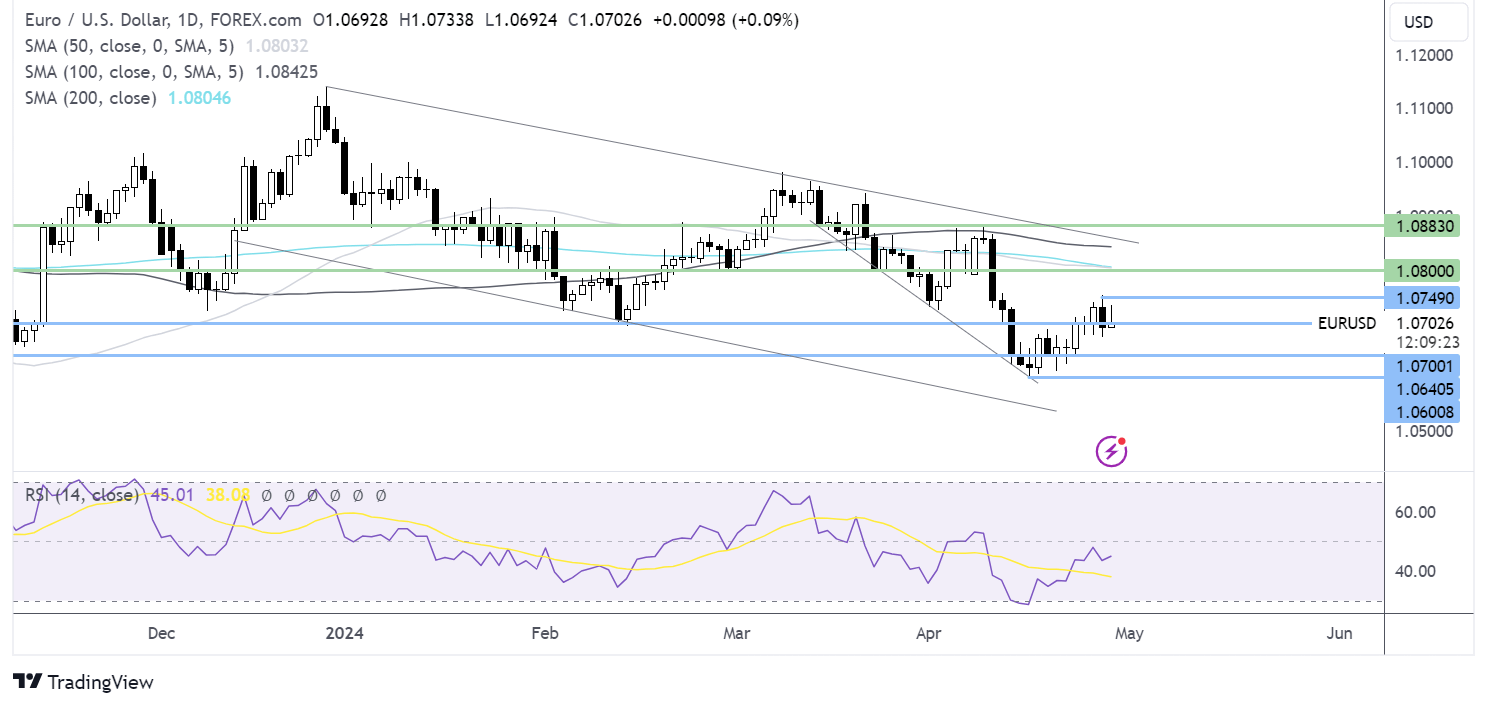

FTSE forecast – technical analysis

After breaking out above 8000 last week, the FTSE has continued to push higher, rising above 8100 to a new ATH of 8194. The RSI has slipped into overbought territory so we could see some consolidation at these levels or a pullback.

Minor support can be seen at 8080, Friday’s low ahead of 8000, the psychological level. A move below here would negate the near-term uptrend and open the door to 7940.

Meanwhile, buyers will loo to rise above 8194 to extend gains towards 8300.