- AUD/USD price action in recent days points to upside risks

- Chinese markets may be influential on the Aussie’s performance on Tuesday

- Sticky underlying inflation pressures may be evident in Wednesday’s Australian CPI report

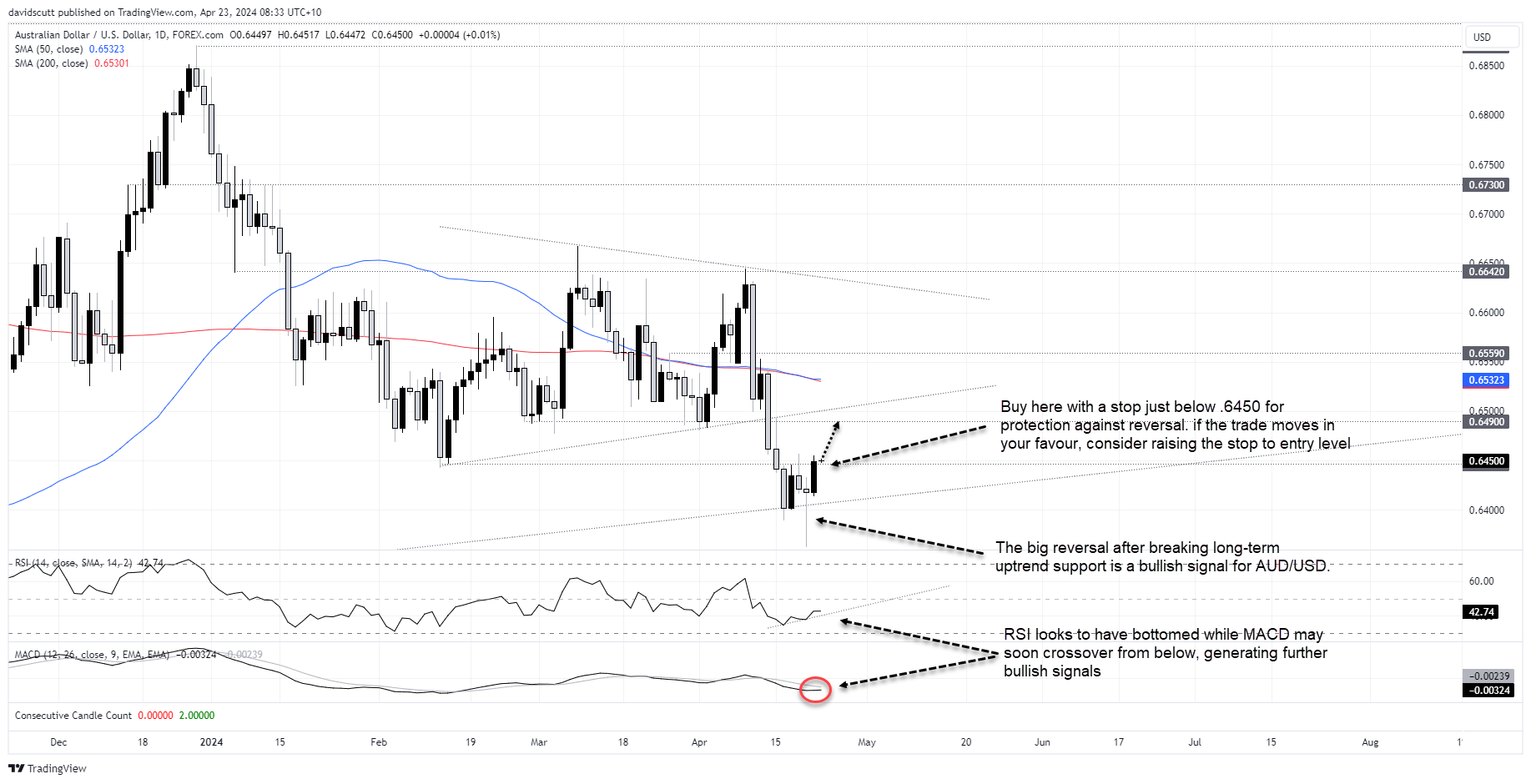

Whether you want to call it a bullish hammer, dragonfly doji, false downside break or morning star, the price action on the AUD/USD daily suggests the path of least resistance is higher in the near-term. With momentum indicators also starting to turn, the grounds for a more meaningful rebound appear to be building.

AUD/USD rebound may extend

Friday’s big reversal from below long-running uptrend support provided a strong tell on how the price fared on Monday, contributing to AUD/USD pushing back to horizontal support at .6443 which was the prior 2024 low.

The sequencing of the last three candles suggests further upside may be on the cards, putting AUD/USD on track for a retest of former support located at .6490. RSI also looks to have bottomed while MACD may soon crossover from below, generating bullish signals that suggest momentum is turning.

AUD/USD trade idea

Those considering taking on the long trade could initiate positions around these levels with a stop below .6443 for protection. The initial trade target would be .6490 with former uptrend support above .6500 the next level after that. Should the trade work in your favour, the stop could be raised to entry level, providing a free hit on potential upside.

Key near-term drivers

Near-term, the performance of Chinese markets may be influential on AUD/USD, particularly around the time of the USD/CNY fixing from the PBOC and start of trade in equities 15 minutes later. The correlation between AUD/USD and Chinese equities has often been extreme in the first hour in recent weeks on a one-minute timeframe, so keep that in mind if you’re looking for an entry level at that time.

While we get a string of flash PMI reports from around the world on Tuesday, including Australia, risk sentiment looms as the most likely driver of AUD/USD later in the session. Looking further ahead, Australia’s Q1 consumer price inflation (CPI) report will be released at 11.30am AEST on Wednesday, providing an event that could generate sizeable volatility for the Aussie.

Australia Q1 inflation report looms

Markets look for inflation to increase 0.9% from 0.6% in Q4 2023, although the year-on-year increase is expected to slow sharply to 3.5% thanks to a higher base effect. Of more importance to the RBA, its preferred trimmed mean inflation measure is seen lifting 0.9% for the quarter and 3.9% over the year. Even through the annual rate would be below the 4.2% pace recorded in the December quarter, it would still remain well above the midpoint of the RBA’s 2-3% target range.

Hinting risks for underlying inflation may be skewed higher, domestic and services inflation remained sticky in New Zealand over the same period despite the Kiwi economy being in recession. Though there are a variety of factors that determine inflation for individual economies, with the Australian economy stronger than New Zealand’s, and with strong wage pressures still evident, the price stickiness that’s plagued other developed nations further along the economic cycle may be evident in the inflation update.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade