Like a gust of strong wind that dissipates a few moments later, the retail trader mania that defined the late stages of the Covid episode has whittled away.

A bull market can make even a poor trading strategy look successful. But once markets stall or reverse or, perhaps just pull back a bit to wipe out stops, new traders soon learn that there’s more to trading than just guessing and hoping. This will often lead to a natural next step of trying to become a better analyst. It’s just logic, really, if you don’t know what’s going to happen in the future then learning how to analyze a market or fundamentals or a price chart should seem to be helpful in delivering a clue as to what might happen next, right?

The unfortunate part of this is that it makes a glaring omission. Because even a great analyst can be a terrible trader, and just knowing what might happen next on the chart isn’t enough to make you successful. This very normal logic because the goal is to produce profit by making decisions. So, naturally, making some better analytical decisions should seem to produce some improvement but, again, this misses an important point.

The goal as a trader is profitability. It’s not win rate, although that is a component of profitability. Also important and maybe even more so is the size of the average win against the size of the average loss. And with this, it could be possible for a trader to be profitable even if the win rate is only 40%. And conversely, it’s also possible to be unprofitable with even a 90% win rate.

This is vexing for many because in most other venues of life it’s the frequency of success that defines the mission: Is that football team good? Well, we look at their win-loss record, and if they’re winning percentage is above .500 then they’re probably at least okay. To win the conference or division or the championship, it’s going to be based on how much more often that they’re successful. Same thing with school, where the percentage of correct answers defines your grade or score, and, in-turn, how well you’ll do in that class. And if you do really well at those classes by achieving high scores, well congratulations, you get to take more classes in college or university. And again, your success will be determined based on how frequently you’re right. Frequency is a simple way of seeing how often one is successful and it’s a common measuring stick in many areas of life.

But in trading, the goal is profit on the bottom line and it doesn’t matter if you won 90% of the time or 10% of the time – profitability and making money is the primary goal, or it should be.

Here’s where the plot thickens: In the effort of producing a high winning percentage and optimizing for frequency of success, a trader may make several bad decisions along the way that ends up risking if not nullifying their primary goal of profitability. This can lead to behaviors like not using stops or, if using them, moving them against the position just to stay in the trade in the ‘hope’ that it might eventually work out.

That can lead to what I call a ‘catastrophic’ loss, which is a loss on a single trade or series of trades that’s difficult if not impossible to recover from. For as long as a trader fails to manage their risk, they’re vulnerably exposed to the potential for one or two trades making a lasting dent in their trading account, and the reason for this is trader math.

The catastrophic loss is a trade or few trades delivering a massive loss to the account that’s difficult to recover from.

The catastrophic loss is a trade or few trades delivering a massive loss to the account that’s difficult to recover from.

What is Trader Math?

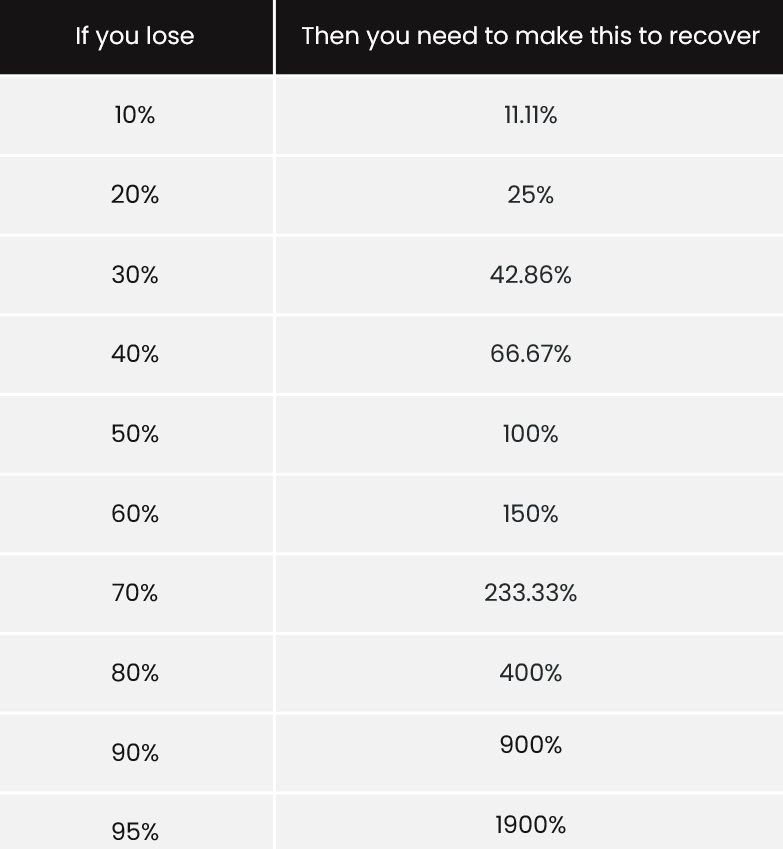

Trader math is math that traders are going to want to be familiar with. It’s simple, but possibly vexing at the same time. On the below table, I’m looking at a series of drawdowns, which is a cumulative loss for an account. But, on the right side of the table we’re looking at the return that would be required – just to get back to break-even. Why is break-even so important? Well, that’s the defining line for profitability. If you’re above break-even, you’re profitable. If your account balance is below that, you’re not. This is an important first step for the trader, attaining this claim of profitability.

The problem is, and this is where trader math comes in, once you lose capital – it’s gone. And you then have a lower capital base to work with, which would require higher and higher returns just to get back to where you had started. The table below highlights how this problem can continue to worsen and worsen.

Table created by James Stanley

What you’re looking at above is a slippery slope…

But let’s run through some numbers to make this more realistic. Let’s say you open an account with $10,000 USD, and right off the bat you lose 10%. This would mean that you have $9,000 of capital remaining as you’ve lost $1,000 (10% of $10,000 = $1,000).

If you then hit a 10% return on the next trade, well you still won’t be at break-even, because a 10% return on $9,000 would be $900, leaving you with a total of $9,900. To get back to $10,000 you would need an even higher return of 11.11% to get back to original starting balance.

This might not sound all that bad, but again, it’s a slippery slope that soon dissipates into deeper disappointment.

If you lose 20%, well then you need to make a 25% return just to get back to the starting point.

If you lose 30%, now you must hit a 42.86% return on your account.

And if that drawdown goes to 50% of your account equity, well now you need to double your account with a 100% return – just to get back to where you had started.

The problem here that you may have already noticed is that the worse the drawdown gets – the more difficult it becomes to get back to that break-even point, which makes profitability that much more of a distant concept. This then starts to bring an emotional toil as every time the trader opens their account and sees their equity balance, they’re reminded of those past mistakes that they’re still struggling to recover from. And that becomes yet another hindrance to improvement and personal growth.

It doesn’t matter if you can predict the future with 90% accuracy – if you’re running the risk of 10% of adverse scenarios wiping out a chunk of your account because there’s no stop on the trade or that the stop is too wide, well, profitability may remain as a distant goal, even if you had an otherwise strong strategy or analytical system.

Controlling Losses is Key

While you’ll never have much impact on market prices moving up or down, you do have quite a bit of control with how you speculate around that. From the above scenario it should be clear that a key component of trading success is the ability to control losses because even a 90% win rate can be deemed a failure.

You will probably never be able to perfectly predict the future, which means that you’ll continue to find yourself in situations where you’ll have to absorb a loss. And if you constantly run from that by not placing a stop or by removing your stop, well then, you’re in that cycle where just one or two ‘bad’ trades can erase the gains from numerous winners, and perhaps even tilt the account balance into negative territory or cause a margin call.

The problem is that once you’re in a trade, you’re probably going to be biased. Because as human beings we want to win, and we hate losing. And like most good sports teams the desire to win at least half the time can cause behavioral changes that impact day to day operations and before you know it, ripple effects can be seen on the bottom line.

So, traders should look to identify their risk before they’re in the trade, and one way that this can be done is by using support and resistance. That way, if the trader is bullish and looking for the trend to push higher, but price instead breaks support and sets a lower low, they can get out of the position with the goal of loss mitigation and, instead, look to re-deploy their capital elsewhere, in a trade that hasn’t already failed.

Setting Stops

As children we often take actions without thinking of the downside. And as experience allows us to experience those downsides, in time, we learn how to avoid or mitigate such scenarios. This can have wide-ranging ramifications on our lives but it’s with this experience that we learn to manage risk in our own personal existence.

In markets, new traders often want to avoid the idea of the downside scenario much like children trying to sneak a cookie from the cookie jar. This can lead to opening trades without stops, for the hope that they don’t have to realize a loss and that price will, eventually, make its way to their profit targets.

Not only is this unrealistic, but it’s also dangerous. This is an invitation for a catastrophic loss because you make wake up one morning down by 5 or 10%, and then you have to figure out what to do with that since there was no stop placed on the trade at entry. This is often where bargaining or negotiation comes in: “If only this trade gets back to break-even, I’ll close it and never do this again!”

But, if you’re already down by a significant amount the prospect of price getting back to your original entry point is, again, another exercise in trying to time the market. And that trade setup has already been a failure, so doubling down by risking more just to get back what you’ve already lost could be seen as an ill-advised risk.

Once you’re in the trade – you’re already biased. You want to win, and that’s okay, that’s by design! But this does make the practicality of managing your risk that much more daunting because now you have to practically beat your own DNA.

It’s probably best to identify your risk levels before you enter the trade, before you have any emotional or psychological attachment to the outcome. Not only does this allow you to draw a line in the sand, but it also gives you an idea of what the required risk outlay will be, and that’s a necessary component for our next item.

Reward Targeting

If you’re walking through a casino and you see a game that advertises a prize as 50% of what it costs to play – would you take that risk?

Even if you have a decent probability of success, for many that risk wouldn’t seem to be worth its while. Mathematically you would need to win more than 66.66% of the time to make that type of model profitable over enough iterations – but would you really want to iterate that much?

To be sure you can see thousands of denizens pumping the crank on a slot machine but in those cases the perceived prize or reward could be significantly higher than their iterative cost to play. So, the point stands, would you really opt to play a game in which your total top-end payoff is simply half of the cost to play?

Oddly many retail traders do this willingly every day. This is usually driven by that thought I had mentioned earlier in the article, where this trader is treating their trading account like it’s a football team just trying to make the playoffs and is using winning percentage to do it.

But this isn’t the Super Bowl. It’s a trading account, and the goal should be profitability, with winning percentage a subordinated variable to that. Otherwise, that trading account may not be around for long as it can only absorb so much of a net loss, even if those losses are only occurring on 10% of the trades that are being placed.

To make the math work where the trader can be potentially profitable at a 40% win rate, the size of the average gain would need to be larger than the size of the average loss. This is what leads to the phrase, ‘cut your losers short, let your winners run.’ This is also a way to harness the sheer unpredictability of markets and perhaps even get that working for you to a degree, as opposed to purely against you. And what I’m referring to here is the fact that of the trades you take on that do work out, there may be more potential upside to work with. Which brings on the question of finding the balance between aggression and passiveness.

One common metric referred to here is the one-to-two risk-reward ratio. This would imply looking for $2 of profit potential for every $1 of risk that’s taken on. So if the trader was risking $1,000 in such an arrangement, using the stop to set risk levels on the trade, they would also seek $2,000 on the upside to justify the risk that they’re taking on.

With a model of this nature the trader would need to win at least 33.33% of the time to be profitable. If using a three-trade sequence and taking on two losing trades at $1,000 each, one winner at $2,000 will offset much of that loss, but we also have to consider the possibility of slippage, so the trader would probably need to be winning more than 35% of the time to account for any miscellaneous items of this nature.

If the trader is winning 40% of the time with this arrangement, they can see an attractive profit on the bottom line; and if their analysis is strong and they can win 50% of the time or more, they can find themselves in an attractive position.

The Role of Analysis in Trading and Financial Markets

The future is uncertain, and that will remain to be the case. This can be difficult to remember and, in some cases, may seem downright counter-intuitive because the goal of analysis, after all, is to anticipate what might happen in the future.

So, this sets up an awkward arrangement. Your job as a trader is to anticipate what may happen, yet your ability to predict will always be imperfect, regardless of how strong of analyst you ever become. So how does one reconcile this quandary?

First, we can start by breaking down the analysis types that are available, and then seeing how they can fit together. Because again analysis will always retain a degree of imperfection if we align it through the lens of prediction. Fundamental analysis seeks to anticipate based on inputs. So, for an economy this is focusing on inflation or employment data in effort of anticipating how the central bank might respond, which can then have repercussions throughout capital markets. In equities, tops-down analysis is usually looking at factors like cash flows or market share to discern how that company might continue to operate or grow in the future.

This is just possibility, but it’s the factors that can remain relevant with the pricing structure in those markets. But it’s also obvious how quickly those types of items can change, thereby making fundamental analysis a series of projections based on relationships.

Technical analysis, on the other hand, is just a study of the past. That’s really it, it’s looking at a chart to see what trends exist or have taken place, along with support and resistance levels that have shown a reaction of some type in the past.

So, neither school of analysis is perfect, but they can be combined in effort of giving even more insight to the trader. They can be used in a complimentary manner that doesn’t ascribe too much perfection to either. Fundamental analysis helps to bring ideas or potential setups based on what’s happening and what may continue to happen based on the inputs for those drivers. Technical analysis can be used to identify market structure, along with support and resistance levels.

This is where the discussion on analytical methods can deepen, as its support and resistance structure that can assist with risk management, and this can begin to move traders towards looking for larger targets than their risk outlay by incorporating analysis. Because if support is going to hold, well then, the trader knows where to place their stops on long positions – below support – so that if the trend continues and prices continue their trajectory of higher-highs and higher-lows, these traders can find themselves in an attractive position. But if that support breaks, then the bullish trend they were looking to work with doesn’t look as bright when price is pushing a fresh low, and at that point they can begin to prioritize loss mitigation.

At FOREX.com, our analysis is provided every day with support and resistance levels identified, along with context around trends and various market themes. You’re welcome to join myself or the rest of the team in weekly webinars in which we share our analysis and how we’re looking to incorporate the most recent market moving data into our approaches.

We host free webinars every week, and you’re invited to join myself and my team in these events to learn more about analysis and trading education.

To join my webinar every Tuesday at 1 PM, the following link will allow for registration:

James Stanley - Price Action Webinar, Tuesdays at 1PM ET

My colleague Michael Boutros hosts a webinar every Monday morning at 8:30 AM ET to get the week started, and you’re welcome to register for that weekly event from the below link:

Michael Boutros - Weekly Strategy Webinar, Monday 8:30 AM ET

David Song focuses heavily on fundamental analysis and he hosts a webinar every Wednesday at 10 AM ET, and you’re welcome to join from the below link:

David Song's Weekly Fundamental Market Outlook - Wednesdays, 10 AM ET

--- written by James Stanley, Senior Strategist