U.S. Dollar Talking Points:

- The U.S. Dollar is the reserve currency for the global economy, and this comes with both benefits and drawbacks.

- More pressing for traders is what causes the U.S. Dollar to move which speaks to the composition of the U.S. Dollar, and DXY is comprised of a basket of underlying currencies.

- Because currencies are the base of the financial system, the only way to value a currency is by using other currencies. Therefore, spot Forex markets are often traded in pairs due to relative valuation. But for the U.S. Dollar as a singular asset, often tracked with the DXY contract, there’s a reliance on underlying currencies that help to make its value.

The U.S. Dollar has a unique role as the primary reserve currency for the global economy. This has been the case since the end of World War II, with the Bretton Woods Conference in 1944. At that conference the world saw the creation of the IMF and the World Bank and an exchange rate system was developed in which each country pegged the value of their currency to the U.S. Dollar, which was itself convertible to gold at $35/oz. So, in essence, this created a global currency peg to the price of gold using the U.S. Dollar as a conduit. The design was well-intended, to provide some element of stability and prevent currency devaluation regimes designed to boost a domestic economy at the detriment of trade partners (beggar-thy-neighbor strategies).

This, of course, was unsustainable as there wasn’t enough gold to account for the growing number of U.S. Dollars in circulation and by 1971 the system was beginning to break. It was replaced by the Smithsonian agreement a few months later, with ten countries attempting to salvage the rate-fixing system but this also failed and by 1973 the current floating rate regime was in-place. The U.S. Dollar’s importance in the global economy, however, did not dissipate after the dissolution of Bretton Woods, or the Smithsonian agreement; and even today there are many economies that manage their currencies as a function of the U.S. Dollar, often using a trading band or range of acceptable prices with which they’ll fix their currencies relative to the value of the U.S. Dollar.

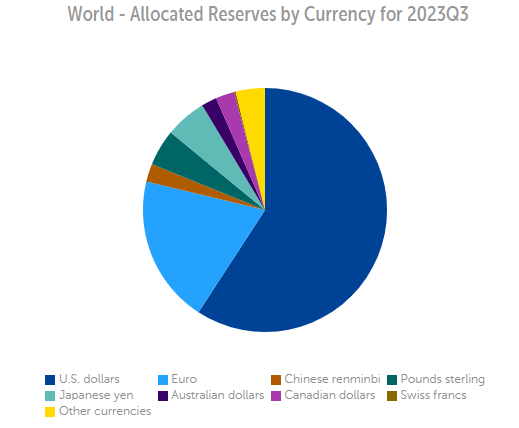

This tradition, combined with the United States’ role in the global economy, motivates many central banks and economies to hold U.S. Dollars on deposit, and the definition of a reserve currency is a foreign currency held in significant quantities by central banks as part of their foreign exchange reserves. The chart below, taken from the IMF’s COFER (Currency Composition of Official Foreign Exchange Reserves) shows how large this allocation is at 59.17%.

Foreign Currency Reserve Allocations as of Q3, 2023

Prepared by James Stanley; taken from IMF COFER

King Dollar

Being the primary global reserve currency for the world confers some benefit, but there’s also some drawback. This greater demand does give rise to the title ‘King Dollar’ which is often referenced in the media, particularly during elongated trends of U.S. Dollar-strength. And those trends can have connotations for trade partners which has also led to the term ‘The U.S. Dollar wrecking ball’ or the ‘U.S. Dollar Milkshake Theory.’

Given this greater demand for the currency from neighboring central banks and trade partners, there’s also the benefit of lower interest rates. As global demand for U.S. Dollars remains high this affords the U.S. government the ability to issue bonds at lower costs and that can help to keep rates lower in the United States. The other side of that are trade deficits, with that additional demand in the U.S. Dollar making the currency ‘relatively expensive,’ which means cheaper imports and more expensive exports. This can hinder American companies doing business overseas and it can become even more pronounced during times of economic turmoil when flows move into the U.S. Dollar as a safe-haven. U.S. Dollar strength is also a reason that manufacturing has largely been pushed off-shore, as its simply more cost effective to produce products and pay workers in a foreign currency that’s not boosted by the additional demand of the reserve status.

Also of consideration, with the lower-rate backdrop, the U.S. government has been able to issue more and more debt which, longer-term, may not end up being a great thing.

The importance of the U.S. Dollar to global trade and payments also allows the U.S. government to extend their arm into other matters. Any trade done in USD can be subject to U.S. sanctions, and by cutting off the ability to do business with the U.S. Dollar as a medium the U.S. government can, in essence, cut off an economy and force their view on a matter. The more popular that the U.S. Dollar is, the greater the effect this can bring; although it is risky as this could end up with blowback if it gives large economies a reason to begin diversifying away from USD in their foreign currency reserves. Treasury Secretary Janet Yellen has mentioned this as a risk to the Dollar’s hegemony. This is often one of the reasons cited for ‘De-dollarization’ claims, which posit that the USD may begin to lose that global reserve currency appeal given some of the dynamics behind the currency, and the economy.

De-dollarization

Since we’re on the topic we might as well mention it because this does often come up, particularly after a prolonged period of USD-weakness.

Currencies are unique as an asset class since they’re the base of the financial system. As such, the only way to value a currency is by using another currency, which is why many spot Forex markets are traded in pairs. And along with that, if the U.S. Dollar is going to lose its status as the reserve currency, some other currency will need to take its place and while we addressed some benefits above, there’s also some significant drawback, namely in the risk to the domestic economy. Changes can have reverberations, and such as we saw with the Japanese Yen after the Plaza Accord in 1985, currency strength could produce a massive chain reaction in the economy that can last for decades after.

Let’s imagine, for a moment, that the Euro is to begin taking some of that reserve allocation, and the pie chart referenced above sees the light-blue shaded area of the Euro further encroach on the darker-blue shaded area of the USD. Well, that additional demand in the currency also means a possible boost to inflation as this stronger currency value will make imports cheaper and exports more expensive. From that relationship, consumers could be motivated to buy the imported good while eschewing domestic manufacturers, and for exported products, well they won’t be as attractive as they’re relatively more expensive. So the domestic manufacturer gets hit on both accounts, for their sales outside of the country as well as those in their own economy. This could lead to slower economic growth, but given that additional demand from reserve flows, the central bank may not have the same wherewithal for cutting interest rates to stimulate economic demand.

This could entail higher interest rates for Europe simply from the additional demand for the currency, and those higher rates could act as another constraint for domestic European growth. European manufacturers would have a built-in hardship from the appreciating exchange rate and the lessened competitiveness that they could offer in the marketplace.

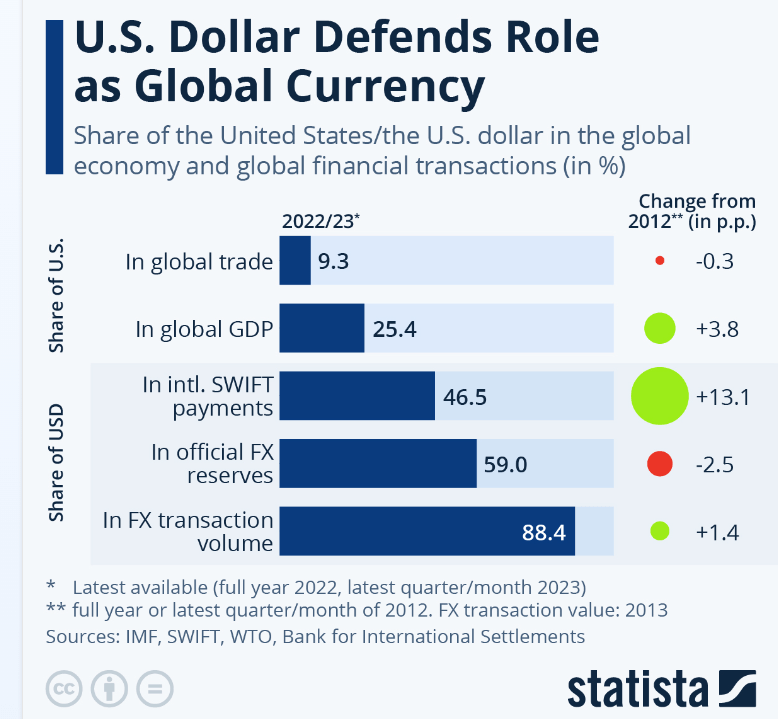

So while there is some benefit to being the reserve currency, there’s also risk, and drawback. But as for the U.S. Dollar’s role as a global payment medium, another fresh high for usage showed last year when SWIFT, the global communication and transaction medium (The Society for Worldwide Interbank Financial Telecommunication) reported that 46% of foreign-exchange payments took place in the USD. That’s 13.1% higher than a decade prior.

Prepared by James Stanley, image taken from Statista, ‘U.S. Dollar Defends Role as Global Currency.’

Trading the U.S. Dollar

A sentence in our prior section defines a remarkably unique aspect of trading the U.S. Dollar. Since currencies are the base of the financial system, the only way to value a currency is by using another currency. Given the U.S. Dollar’s role as the global reserve and its place in the worldwide economy since the end of World War II, it retains an important role in day-to-day trading operations across markets and industries. And that goes for the retail trader, as well.

A currency pair is often considered to be a ‘major pair’ if the U.S. Dollar is in the quote. So, EUR/USD, GBP/USD, USD/JPY – would all be considered major pairs. These pairs will generally retain greater liquidity and volume and for traders that do want to place a trade in a cross-pair like GBP/JPY, particularly if they want a significant allocation, could choose to create their own cross by buying or selling GBP/USD and then buying or selling USD/JPY. If the trader buys the USD in one pair and sells it in another, they’ve effectively created their own cross-pairing with exposure into GBP/JPY.

For a major pair like EUR/USD, the quote can simply be read as ‘the value of one euro in terms of U.S. Dollars is (quote).’ This can make matters simple for those learning the pairing aspect of the Forex market, but what about the trader that wants to make a trade on the U.S. Dollar on its own?

Well, this is where matters begin to get more difficult as there is no individual U.S. Dollar traded in the spot currency markets; because the only way to value the U.S. Dollar is with some other currency. The one market often considered as representation for the U.S. Dollar is the futures contract of DXY.

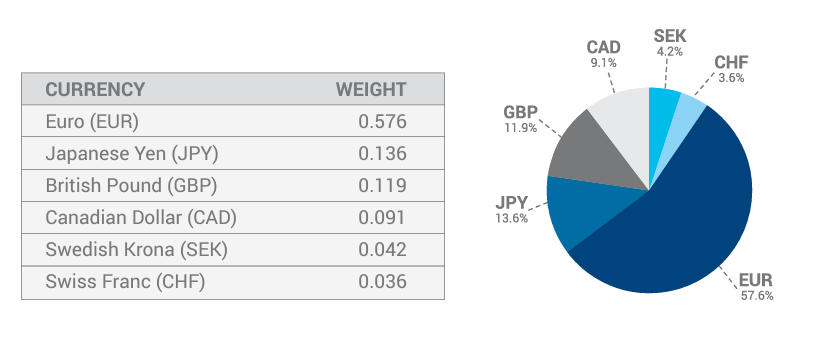

The U.S. Dollar Index as ‘DXY’ is a basket of six currencies that comprise the value of the U.S. Dollar. Six currencies might sound like very little, and it is as the DXY basket was initially created in 1973, when the currency was allowed to freely float against global currencies after the dissolution of the gold standard and the Smithsonian agreement referenced earlier. At the time, there was no Euro, and China did little international trade, so the basket was heavily comprised of European currencies, like the West German mark and the French Franc; but the Euro replaced five of the ten currencies that were in DXY when it came into inception in 1999.

At this point it can be argued that the DXY composition doesn’t adequately reflect global trade flows as there’s no Chinese Yuan and the sole allocation to Asia is a mere 13.6% in the Japanese Yen. The table below shows the full breakdown of the DXY currency basket, taken directly from the product guide of the Intercontinental Exchange (ICE).

U.S. Dollar as ‘DXY’ Composition

Prepared by James Stanley; taken from ICE U.S. Dollar Index Contracts Product Guide FAQ

What Drives the U.S. Dollar?

Like most other currencies the large driver can often be drawn back to interest rates. As interest rates move up, the attractiveness of holding that currency also increases as there’s a higher rate attached to it. This can show directly in swap or rollover credits/debits for holding that pair past the 5PM ET cut-off. But perhaps more important for the market participant, is that if others also implement that view then the value of the asset can rise from the additional demand.

A prime example is the trend taken from 2021 and the first nine months of 2022. The U.S. Federal Reserve was quickly adjusting interest rates, and this increased the desirability of the U.S. Dollar. Meanwhile, the Bank of Japan was more uncertain around growth and inflation, and they didn’t share the same motivation with rate staying low. This deviation between the economies created greater and greater rollover payments and this led to enhanced demand.

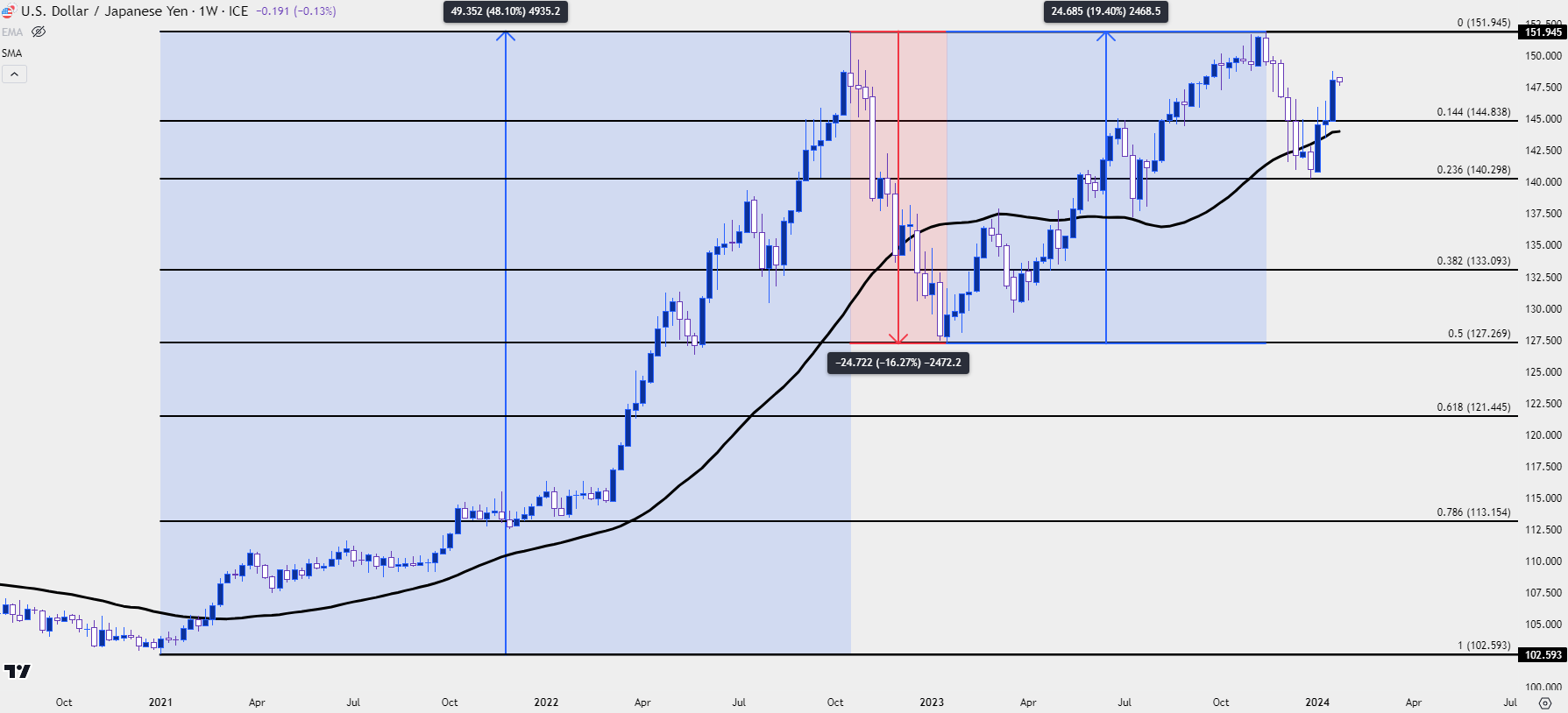

The USD/JPY pair set a low in the first week of 2021 at the price of 102.59. In October of 2022, the pair set a fresh 32-year high at 151.95. That’s a move of 48.1% in a non-levered currency pair, and as noted earlier this is a currency that we’re talking about rather than a cryptocurrency or some small cap tech stock: A move of this nature can have reverberations, and that can lead to considerable volatility.

In the three months after that fresh high was notched, 50% of the prior trend was retraced as there was fear that the rate picture may shift in the months and years ahead. That didn’t pan out, as support held in early-2023 at that 50% retracement, and buyers came back into the market as the Federal Reserve had to keep the door open for additional rate hikes.

But it’s important to point out the red section on the below chart because interest rates continued to favor the U.S. throughout that period. What had changed was expectations and where rates may move, so this illustrates well that while interest rates and particularly interest rate divergence is a primary driver of currency trends, it’s only one part as the overriding drive simply emanates from supply and demand.

USD/JPY Weekly Chart (Oct, 2020 – Jan, 2024)

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

Trading Strategies for the U.S. Dollar

For spot Forex markets, USD trading takes place as part of major Forex pairs. So, if the trader wants to buy or sell the U.S. Dollar, they need to take another step in deciding which currency they want to buy or sell the USD against. This can raise opportunities as well as risks: If the U.S. Dollar does remain generally strong but the trader decided to buy the currency against, say the Japanese Yen, there’s the possibility that the Yen was even stronger than the USD (and, in-turn, the Euro, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc), and that trader could still end up taking a loss. So, it’s not enough to simply take a stance on the U.S. Dollar on its own as traders then need to find the proper pairing for their setups or strategies.

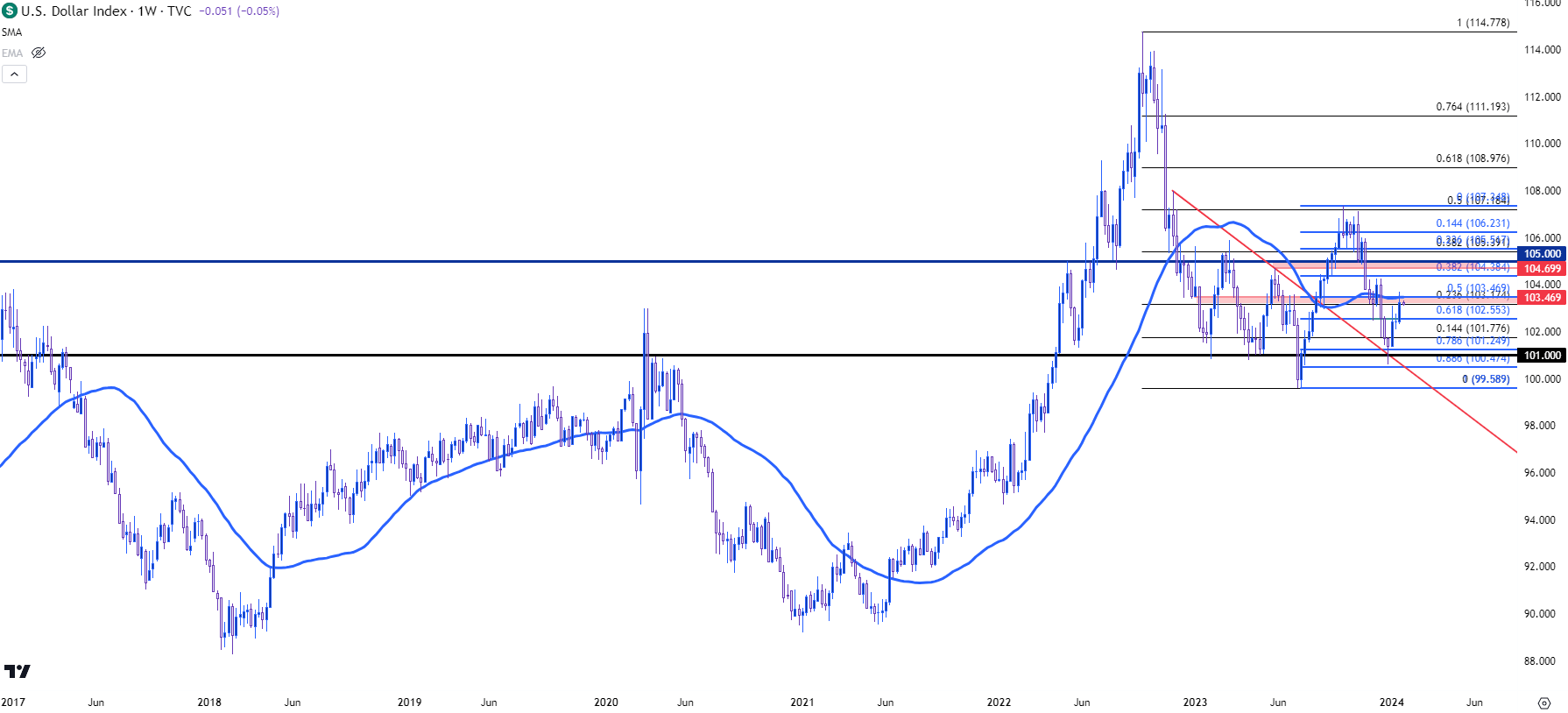

To that end, given the importance of the U.S. Dollar in the global economy, it can often play a role in larger macro trends showing around the World, and that trend biasing can then be used as a part of a larger trading strategy. On the below weekly chart, I’ve added the 200-day moving average, and this can be used as a form of trend-biasing, as discussed in the educational article on the topic. If the U.S. Dollar is trending higher as defined by its relationship with the 200DMA, then traders can look to bias towards USD-strength in their strategies. This could entail looking for lower-high resistance in EUR/USD, or perhaps attempting to buy a bullish moving average crossover in a pair like USD/JPY or USD/CHF. The trend biasing itself could be used in conjunction with an entry strategy in the effort of trying to align with market trends as well as possible given that current backdrop.

U.S. Dollar as DXY (indicative) Weekly Chart, since 2017, with 200DMA Applied

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist