Gold eases ahead of the NFP

- Gold set to rise 3% this week

- US NFP to add 180k jobs & unemployment to rise to 3.6%

- Gold remains in a well establish uptrend

Gold is pausing for breath after three days of gains and is set to rise 3% across the week as the turmoil in the US banking sector and debt ceiling worries drive safe-haven flows and as the market prices in a rate cut from the Federal Reserve as soon as July.

While the Federal Reserve chair pushed back against market expectations of a rate cut this year, the market is growing increasingly convinced that fallout from the banking sector combined with rising uncertainty surrounding the US economy will mean the Fed will cut rates several times across the year.

Attention will now turn to the US non-farm payroll report, which is expected to see 180k jobs added down from 236k in March. The unemployment rate is expected to take two 3.6% from 3.5%. Average hourly earnings are expected to hold steady at 4.2%.

While there is still plenty of data to come between now and the next Federal Reserve meeting in June, investors will still be looking at the data to assess the Fed’s next move.

The leading indicators have been mixed this week, with ADP payrolls coming in double forecasts, but job openings were weaker than expected.

Weak NFP data could fuel bets of a more dovish Fed and pull the USD lower, boosting USD-denominated and non-yielding gold.

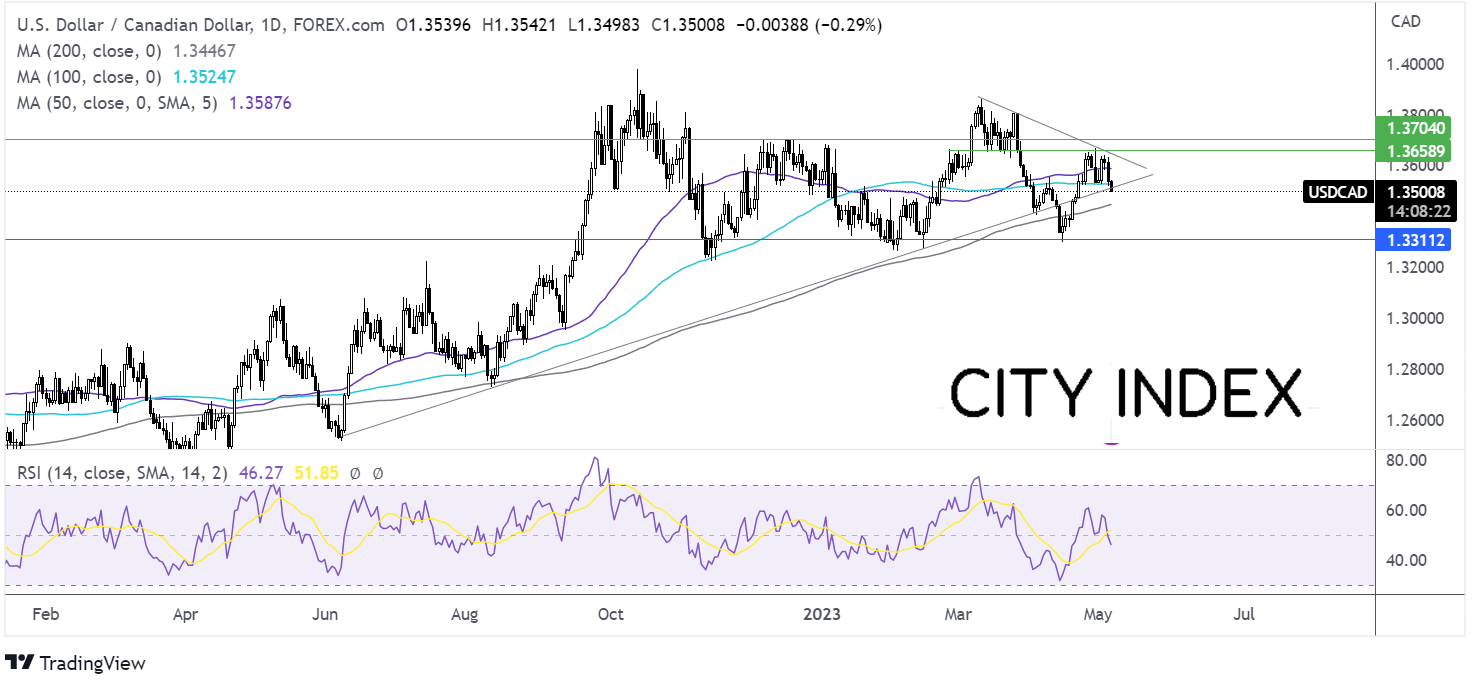

Gold outlook: technical analysis

Gold has been trending higher, in an ascending channel since November 2022, in a well-established bullish trend. This supports the view that Gold may be able to retest the 2072 all-time high touched on Tuesday and rise toward the 2090 upper band of the rising channel and 2100 round number.

However, the bearish divergence on the RSI, together with the long upper wick on Thursday’s candle suggests keeps sellers optimistic for now. The overnight swing low at 2030 offers immediate support ahead of 2010/12 the March and mid April 15 high. A break below here exposes the 20 sma at 2005.

USDCAD falls ahead of jobs data

- BoC Governor Macklem’s hawkish comments support CAD

- Canada & US jobs data is due

- USDCAD breaks below 100 sma

USDCAD is for the third straight day and trades at a two-week low amid USD weakness and after hawkish comments from BoC Governor Tiff Macklem.

In contrast to Federal Reserve chair Jerome Powell more dovish speech earlier in the week, BoC Tiff Macklem sounded more hawkish, lifting the loonie. He said that the central bank is prepared to raise interest rates further should inflation become stuck above the 2% target.

Meanwhile, oil prices are also offering support, rising for a second straight day after losing 9% across the first three days of the week.

Separately the USD is under pressure amid US bank sector turmoil and as investors price in a rate cut as soon as July.

Attention now tends to upstate are from both Canada and the US. Canada is expected to see 20k jobs added in April and unemployment tick higher to 5.1% up from 5%.

Meanwhile, the US NFP is expected to show 180k jobs added, down from 236k. Unemployment is expected to rise to 3.6% from 3.5%.

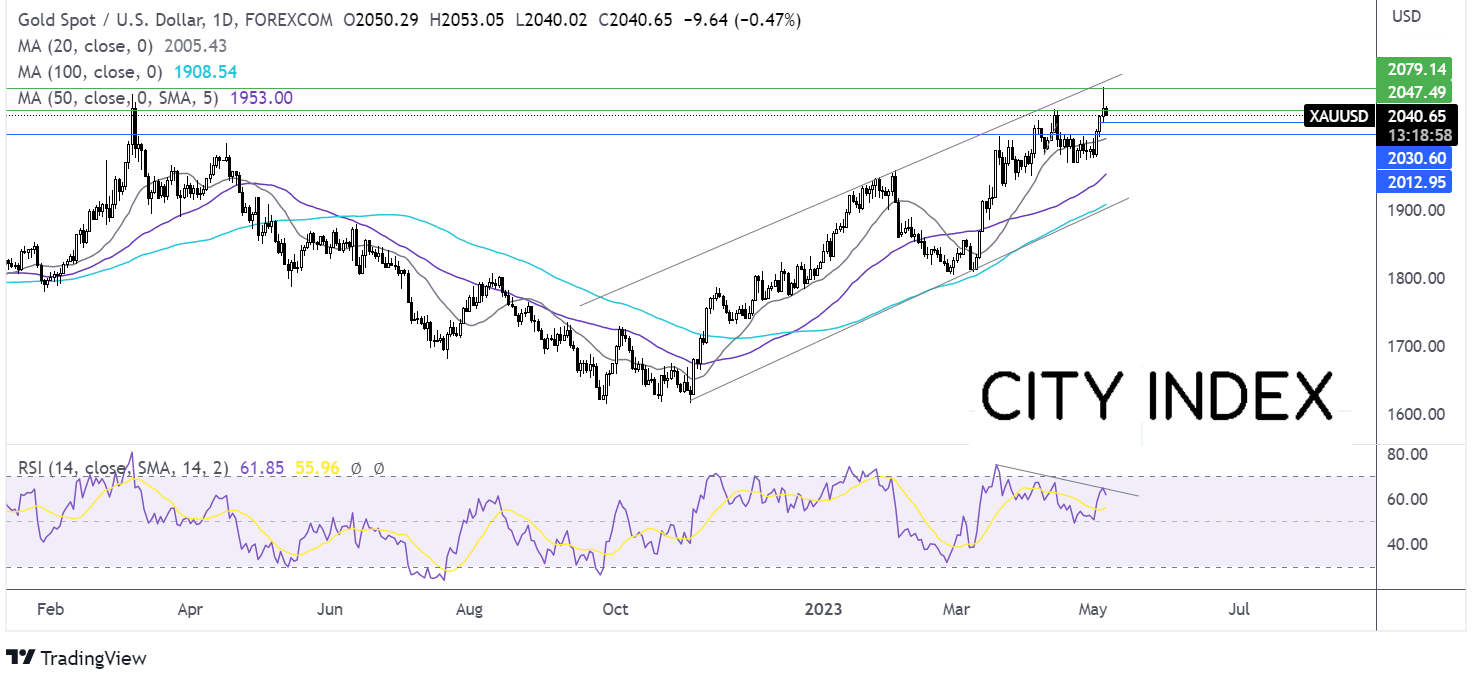

USDCAD outlook: technical analysis

USDCAD has broken below the 100 sma and is testing the rising trendline support dating back to June 2022. This combined with the RSI falling below 50 keeps sellers hopeful of further losses.

A meaningful break below the rising trendline support exposes the 200 sma at 1.3440. Beyond here, the April low of 1.33 comes into focus.

On the flip side, should the rising trendline support hold buyers could look to retake the 100 sma at 1.3525 and the 50 sma at 1.3587. Above here the 1.3650 falling trendline resistance comes into play.