US Friday close:

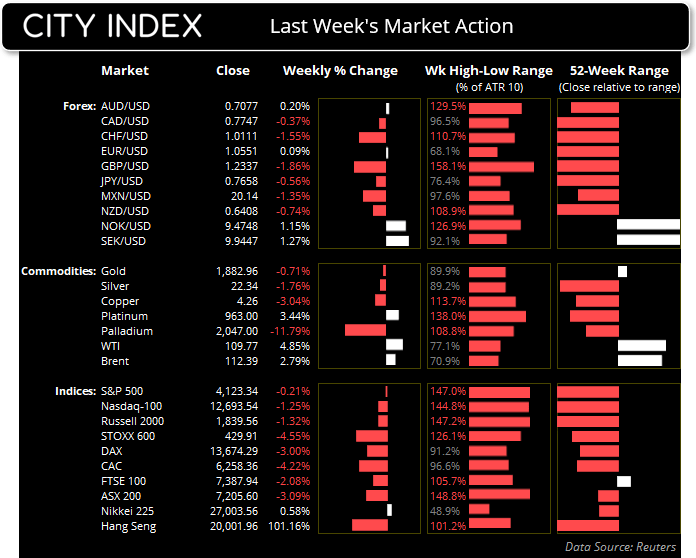

- The Dow Jones fell -98.63 points (-1.69%) to close at 32,899.37

- The S&P 500 fell -23.53 points (-0.57%) to close at 4,123.34

- The Nasdaq 100 fell -157.018 points (-1.22%) to close at 12,693.54

Asian Indices:

- Australia’s ASX 200 index closed at 7,205.60 on Friday

- Japan's Nikkei 225 index closed at 27,003.56 on Friday

- Hong Kong's Hang Seng index closed at 20,001.96 on Friday

- China'sA50 Index closed at 13,103.98 on Friday

European Friday close:

- UK's FTSE 100 index fell -115.33 points (-1.54%) to close at 7387.94

- Europe's Euro STOXX 50 index fell -67.46 points (-1.82%) to close at 3629.17

- Germany's DAX index fell -228.23 points (-1.64%) to close at 13674.29

- France's CAC 40 index fell -110.04 points (-1.73%) to close at 6258.36

Another strong NFP report sent the US dollar index briefly to a fresh 19-year high, although it pulled back and closed just beneath the 2017 high effectively flat for the session. The US 10-year yield rose to 3.14% fore the first time since December 2018, although the 2-year yield remained below Wednesday’s 3-year high. USD/JPY closed back above 130 although EUR/USD managed to hold above the April’s low.

US indices were lower again although bearish volatility was lower relative to Thursday’s post-FOMC selloff. The Nasdaq fell to a 14-month low although the S&P 500 managed to remain above the March 2021 low. It’s possible we may see a corrective bounce but just how large (or if at all) remains to be seen.

Natural gas fell around -8.6% on Friday on news that the EU is considering tweaking its plan to embargo Russian energy supplies, and allow Poland, Slovakia and the Czech Republic more time to change their supplies.

ASX 200: Market Internals

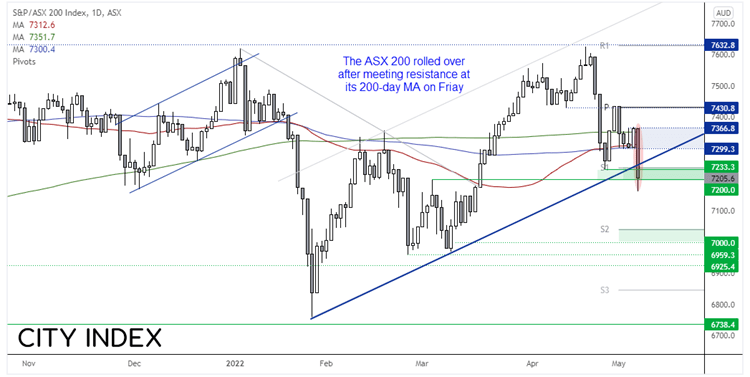

91.5% of the ASX 200 stocks declined on Friday during what was its worst session in 10-weeks. The index has fallen for three consecutive weeks and fallen over -6% since the May high. Friday’s close invalidated the bullish channel and briefly below 7200, before rising to 7205.6 by close of business. It was a bearish open Marabuzo candle, which means it opened at the high of a volatile, bearish day.

From here we would prefer to fade into minor rallies or enter on a break of new lows. Perhaps the broken trendline can act as resistance, but we’d consider bearish setups up to or below 7300, which marks the small consolidation prior to Friday’s selloff. 7100 is the initial target, then the monthly S1 pivot at 7040 and of course 7,000.

Read our guide on the ASX 200 trading guide

ASX 200: 7205.6 (-2.16%), 08 May 2022

- Consumer Stap (-0.17%) was the strongest sector and Info Tech (-4.47%) was the weakest

- 11 out of the 11 sectors closed lower

- 6 out of the 11 sectors outperformed the index

- 183 (91.50%) stocks advanced, 11 (5.50%) stocks declined

Outperformers:

- +2.27% - Fisher & Paykel Healthcare Corporation Ltd (FPH.AX)

- +1.33% - Mercury NZ Ltd (MCY.AX)

- +1.03% - Coles Group Ltd (COL.AX)

Underperformers:

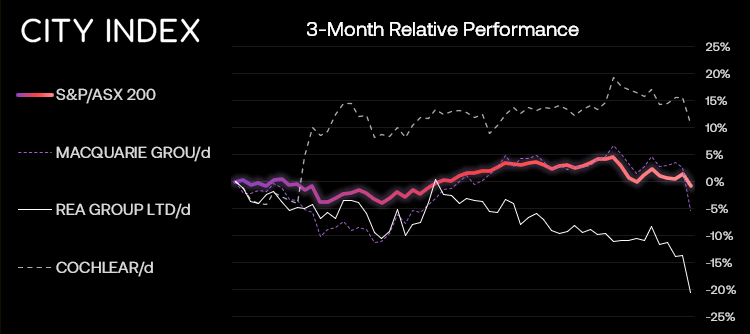

- -7.78% - Macquarie Group Ltd (MQG.AX)

- -8.07% - REA Group Ltd (REA.AX)

- -4.23% - Cochlear Ltd (COH.AX)

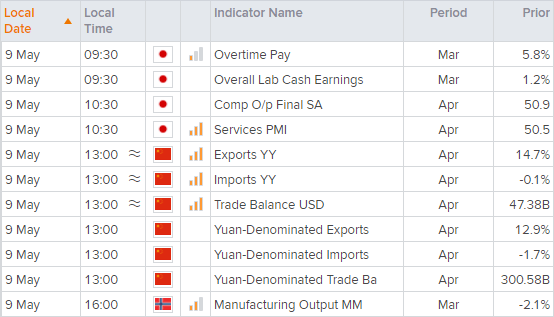

Up Next (Times in AEST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Read our guide on the ASX 200 trading guide