Asian Indices:

- Australia's ASX 200 index rose by 34.5 points (0.5%) and currently trades at 6,892.40

- Japan's Nikkei 225 index has fallen by -578.84 points (-2.09%) and currently trades at 27,084.55

- Hong Kong's Hang Seng index has risen by 874.19 points (5.7%) and currently trades at 16,213.68

- China's A50 Index has risen by 358.14 points (3.07%) and currently trades at 12,015.30

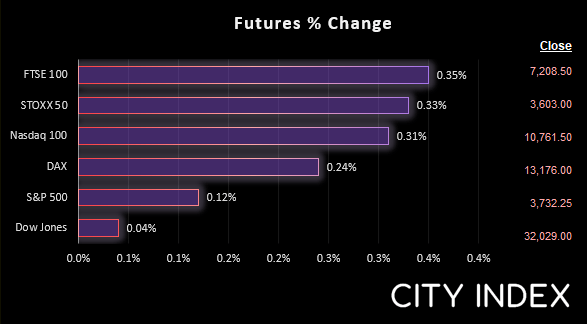

UK and Europe:

- UK's FTSE 100 futures are currently up 26 points (0.36%), the cash market is currently estimated to open at 7,214.63

- Euro STOXX 50 futures are currently up 13 points (0.36%), the cash market is currently estimated to open at 3,606.18

- Germany's DAX futures are currently up 35 points (0.27%), the cash market is currently estimated to open at 13,165.19

US Futures:

- DJI futures are currently up 31 points (0.1%)

- S&P 500 futures are currently up 45.75 points (0.43%)

- Nasdaq 100 futures are currently up 7.25 points (0.19%)

Despite softer than forecast retail sales in Q2, the Australian dollar was the strongest major overnight following the RBA’s quarterly SOMP (Statement of Monetary Policy). Inflation forecasts were broadly upgraded for 2022 through to 2024 and growth was revised lower – which is coming to be a bit of a thing recently for central banks in general. But they also noted a potential pick-up in wage growth, even if it means ‘real wages’ (less inflation) remain very much pummelled.

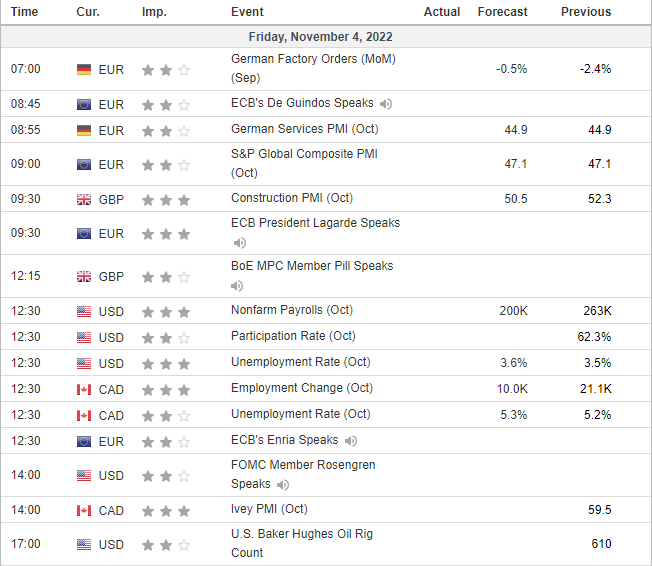

Nonfarm payroll is the main economic event tonight at 12:30 GMT, where job growth is expected to drop to a 23-month low of 200k. It’s by no means a bad number, but the trend is clearly moving lower as the US economic situation loses momentum. Unemployment is forecast to rise to 3.6% from 3.5% - which by no means tragic. But if we are to be surprised by a 2 or 3 percentage point rise, then markets will take notice and reprice a slower pace of tightening (which is likely dollar bearish and equity market bullish).

Keep in mind that Canada also release their economic data at the same time, which puts USD/CAD into the crosswinds of volatility.

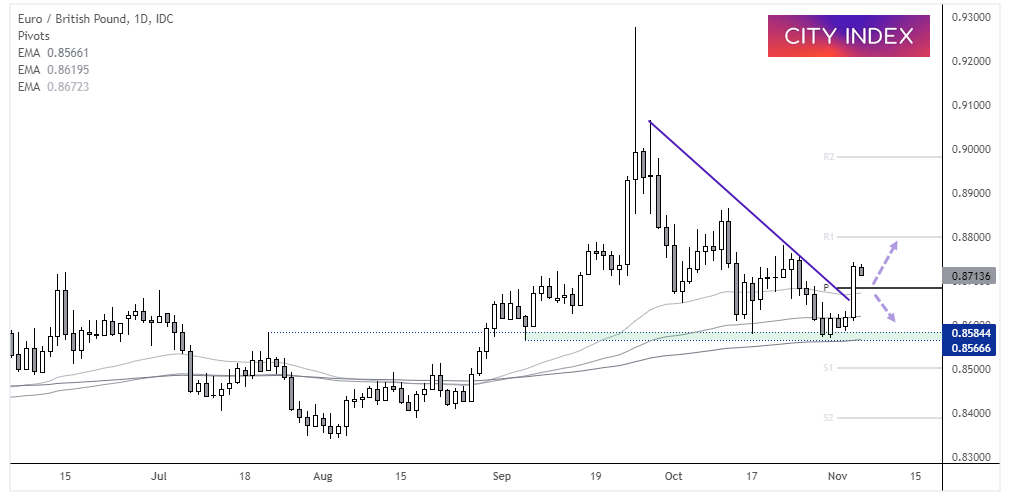

EUR/GBP daily chart:

EUR/GBP enjoyed its best day in nearly 6-weeks yesterday following the BOE’s dovish hike. Prior to the rally the cross had held above the 200-day EMA with a small consolidation around its September low, before momentum broke clearly above trend resistance and the monthly pivot point. Yesterday’s low also used the 100-day EMA as a springboard. A retracement towards the monthly pivot point would be welcomed, which may entice fresh bullish bets. The next main resistance level for bulls to target is the monthly R1 pivot or the 21st October highs around 0.8800.

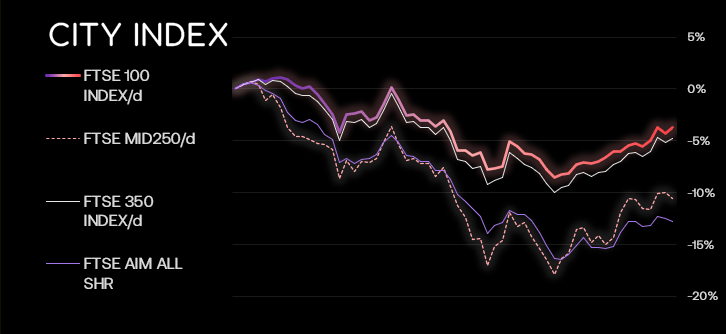

FTSE 350 – Market Internals:

FTSE 350: 3966.05 (0.66%) 03 November 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 8 stocks rose to a new 52-week high, 1 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 17.21% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- + 6.95% - J Sainsbury PLC (SBRY.L)

- + 6.39% - Ferrexpo PLC (FXPO.L)

Underperformers:

- -8.89% - BT Group PLC (BT.L)

- -8.81% - Trainline PLC (TRNT.L)

- -7.86% - Dr Martens PLC (DOCS.L)

Economic events up next (Times in GMT):

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade