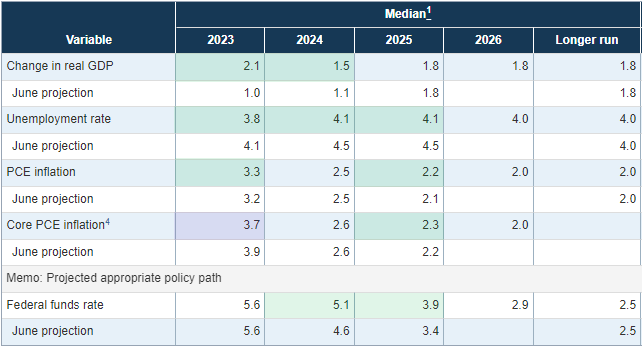

At the most basic level the Fed delivered what was expected; another policy pause with the potential for further hikes. The opening paragraph tipped noted an economy which is “expanding at a solid pace” with a slower but “strong” job growth and elevated inflation. There’s nothing remotely dovish there. And then we look at the numbers.

The median Fed fund futures rate has been increased to 5.1% in 2024 (4.6% previously) and 3.9% in 2025 (3.4% prior). Growth has been upgraded for 2023 and 2024, PCE inflation increased for 2023 and 2025, Core PCE lifted in 2025 (but lowered in 2023), unemployment is lower from 2023 through to 2025.

If there’s anything to celebrate, the Fed don’t appear to have a hike up their sleeve for this year. But now even a ‘soft landing’ seems unlikely, let a lone a recession. And the Fed are going to allow the economy to run hot.

Ultimately, incoming data remains key and the threat of further hikes continues to be dangled by a committee which is “prepared to adjust the stance of monetary policy as appropriate”. Higher for longer is here to stay. And that is quite apparent with the 2-year yield at a 17-year high and the 10-year at a 15-year high.

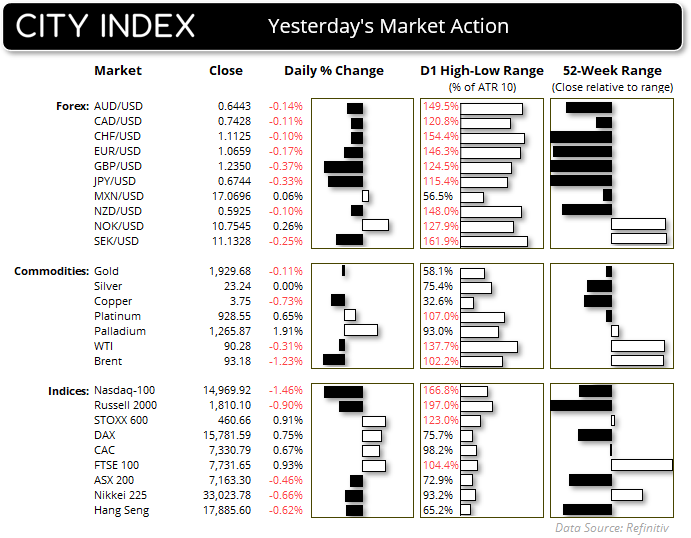

The US dollar shamelessly sucked in a few dovish bets ahead of the meeting, yet quickly reversed course post meeting to close slightly higher for the day. And that’s probably a fair finish given the Fed delivered what was expected.

- US2yr yield: 17-year high

- US10yr yield: 15-year high

- US30yr yield: Sits just beneath its 13-year high

- USDJPY: Fresh 9-month high (BOJ up next...)

- DXY: Probing its 6-month high

- GBP/USD: 16-week low, also helped by a weaker inflation report

- Nasdaq, S&P 500: 3-week lows

Events in focus (AEDT):

- 08:45 – NZ GDP (Q2)s

- 11:30 - RBA bulletin, reserve assets total

- 12:30 – HK interest rate decision

- 17:30 – SNB interest rate decision

- 21:00 – BOE interest rate decision: The BOE seem unlikely to raise interest rates today given the weaker than-expected inflation report delivered yesterday. Whilst many economists now have it down to a coin flip (and just the day prior, almost a certainty the BOE will hike), I’ll take a punt on a hold based on the fact that there is a political pressure for them to stop hiking. And the BOE have previously showed their desire to stop hiking as soon as possible in Q4 – not that rising inflation helped then do that back then.

Technically Speaking:

- A bearish pinbar / shooting star formed just beneath 1950 on gold, and a move towards 1920 now seems feasible with its series of lower highs alongside higher yields

- USD/JPY has broken above 148 to a fresh 9-month high, although its volatility seems supressed – perhaps by the fact that the BOJ meeting is pending

- WTI crude oil pulled back into the 91 handle before reversing and closing just above 89. With a second day lower, I continue to suspect a move towards $87 is on the cards

- Nikkei 225 futures were lower overnight and it does not look set to embark upon a breakout above its 33-year high

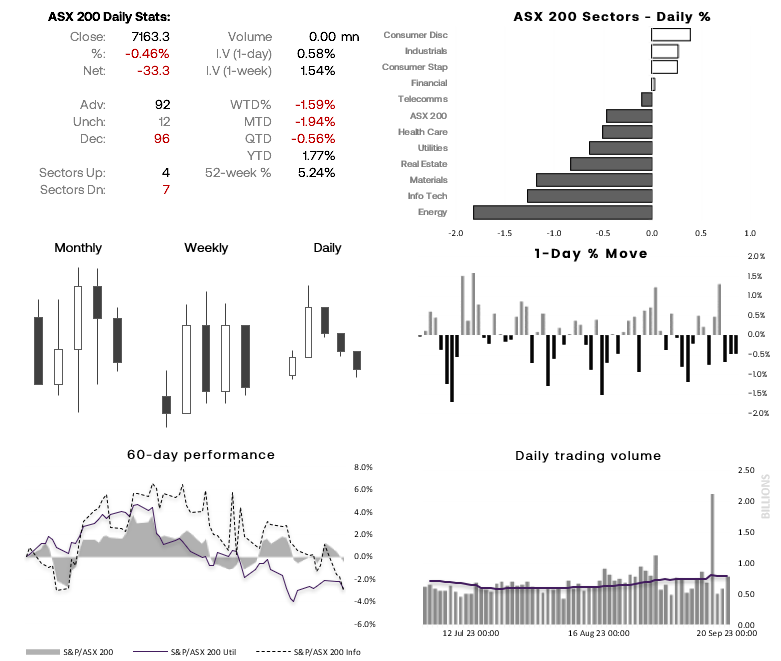

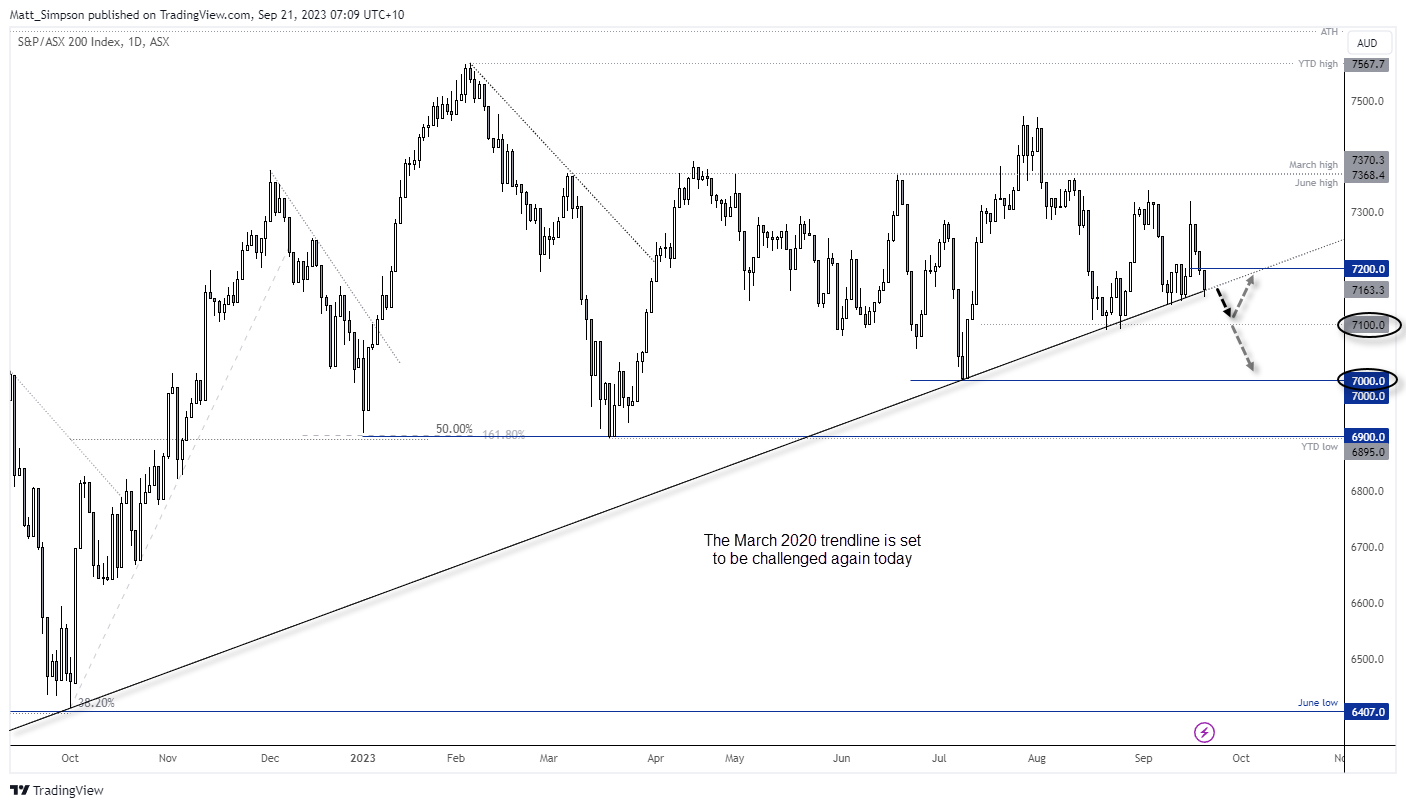

- And that means we can expect weak sentiment across APAC stocks, with the big question being whether the ASX 200 can hold above a key trendine

ASX 200 at a glance:

We’re not expecting miracles on the ASX 200 today, but given it fell three days leading into the meeting and SPI futures are just -0.2% lower, it may not be a complete disaster today either. The key question is whether it can cling on to trend support from the March 2020 low, as failure to do so likely brings the 7100 and 7000 handles into focus.

AUD/USD technical analysis (daily chart):

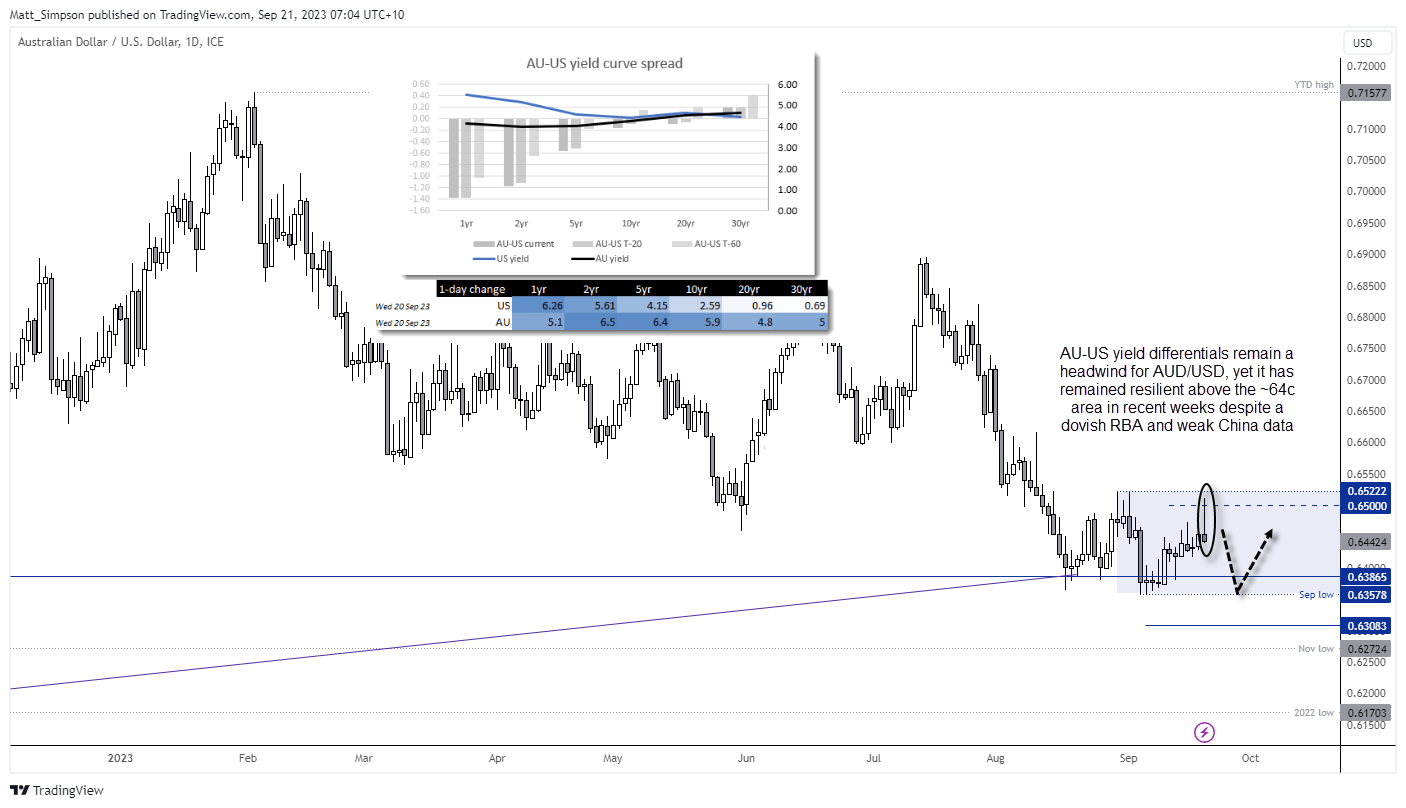

AUD/USD high-fived 65c in what was the ‘last hurrah’ on Wednesday as it essentially marked the high of the day. Momentum quickly turned and the Aussie formed a 1-day bearish reversal pattern beneath 0.6450. Yield differentials make it hard to justify a rally, yet its resilience above 64c means we may have to contend with some sticky trade in muddy conditions between 64-65c.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade