- EUR/USD bounced last week, recovering after briefly falling below uptrend support

- The onus is now on the US data to justify the rapid unwinding of Fed rate cut bets. In contrast, sentiment towards the euro area remains weak.

US economic exceptionalism is back. US bond yields are rising as Fed rate cut bets are slashed. For an economic block with so much pessimism factored into the outlook, it’s a backdrop in which EUR/USD should be getting battered. But it’s not.

EUR/USD bounces after dip below uptrend support

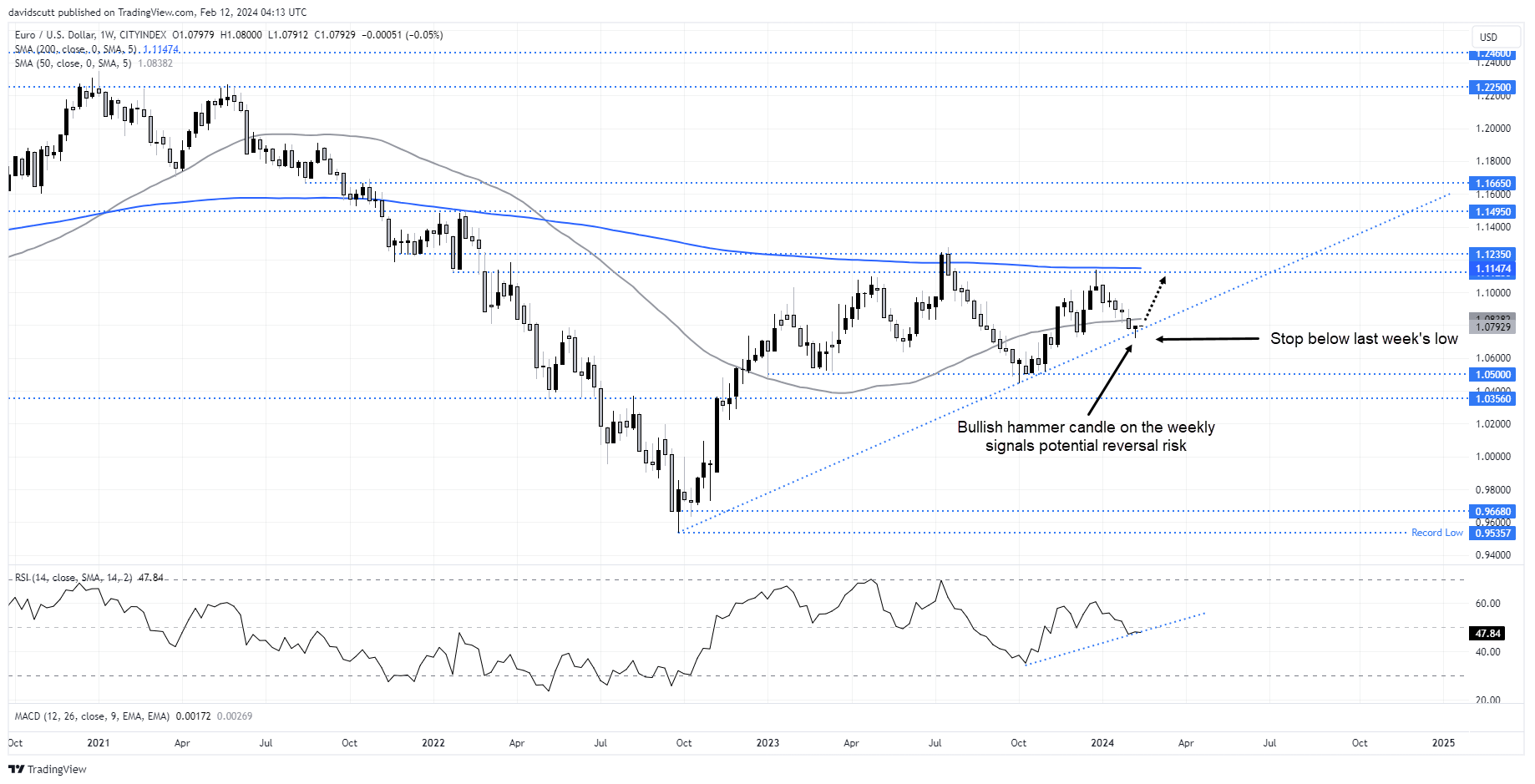

As the weekly chart below shows, while EUR/USD is down a few big figures this year, the unwind has been orderly despite the divergence in attitudes towards the US and euro area outlooks. Importantly, having broken uptrend support dating back to late 2022 last week, bulls managed push the price back above by the close on Friday, generating a bullish hammer candle which may get a few traders thinking about the potential for a reversal.

While the 50-week moving average sits just above the price, the market has shown some disinterest in the level recently, differentiating it from prior periods. Given the constructive price action last week and proximity to long-running uptrend support, the trade setup for establishing longs around these levels looks decent into what is another risk-laden week for the pair.

EUR/USD risk-reward skewed to upside

With a stop placed below last week’s low of 1.0723 for protection, traders could target a push towards 1.1125 – the high printed in late December – with only minor resistance around big figures in between likely to stand in the way.

A lot is expected from the USD but not EUR

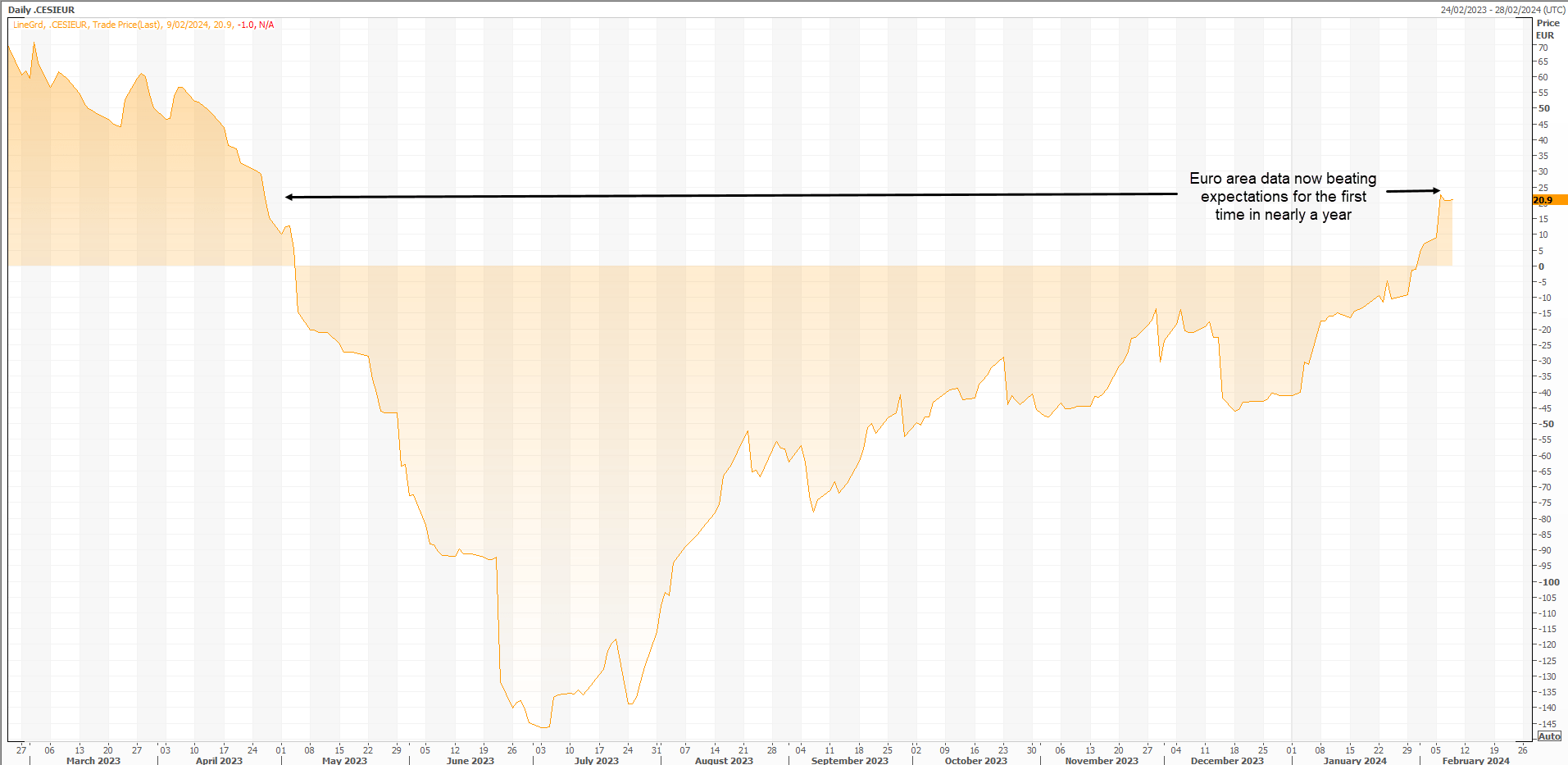

From a fundamental perspective, having repriced Fed easing expectations so aggressively, it’s now up to the data to confirm the newfound optimism. Economic resilience is expected, as are pushbacks against early and deep rate cuts from Fed officials. In contrast, sentiment towards the eurozone is recessionary even though economic data across the bloc is topping expectations at the most prevalent rate since April 2023, according to Citigroup’s surprise index.

There’s a lot expected from the USD but not from the EUR.

Source: Refinitiv

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade