How to trade CFDs

Follow this step-by-step guide on how to trade CFDs in Singapore – including how to choose a market, pick a CFD strategy and monitor a position.

- How to start online CFD trading

- How does CFD trading work?

- Open a CFD account in Singapore

- Choose a CFD market

- Pick a CFD strategy

- Decide whether to buy or sell

- Select how many CFDs to trade

- Manage your CFD risk

- Open, monitor and close your position

- What’s the best CFD platform in Singapore?

- How to trade CFDs FAQs

How to start online CFD trading

To start online CFD trading, you first need to understand how contracts for difference work. Then, you can choose whether to buy CFDs (go long) or sell them (go short) and open your position by selecting your chosen number of contracts. You’ll realise any profits or losses when you close the position.

CFDs are sophisticated tools, enabling you to speculate on both rising or falling markets, use leverage and access thousands of instruments 24 hours a day. But to take full advantage of the versatility of CFDs, you’ll want to ensure you understand how to trade them correctly.

Follow these eight steps to open your first CFD position today:

-

Learn how CFD trading works

Understand the basics behind contracts for difference, and how they differ from other financial products -

Open a CFD account in Singapore

Get started with a demo account, or go straight to live markets -

Choose a CFD market

Decide which market you want to trade. Looking for inspiration? Head over to our research portal -

Pick a CFD strategy

CFD strategies give you guidelines for when and how you’ll enter and exit your positions -

Decide to buy or sell

Click 'buy' if you think your market will increase in value, or 'sell' if you think it will fall -

Select your trade size

Choose how many CFDs to buy or sell -

Manage your CFD risk

A stop loss is an order to close your position out at a certain price if it moves too far against you, and a useful way of limiting your risk -

Execute, monitor and close your trade

Open your position and see your profit/loss update in real time. You can exit it by clicking the close trade button

Let’s take a closer look at each step.

1. Learn how CFD trading works

CFD trading works using contracts that mimic live financial markets. You buy and sell these contracts in the same way that you'd buy and sell in the underlying market. But instead of choosing how much of a particular asset you would like to invest in – such as Tesla shares – you pick how many contracts to buy or sell.

If the market moves in your favour, your position will earn a profit. If it moves against you, it will incur a loss. You realise your profit or loss when you close the position by selling the contracts you bought at the outset.

If you want to calculate your potential profit or loss ahead of time to understand your CFD risk, our deal ticket automatically shows you P&L figures when you set stop-losses and take-profits on our platform.

Tesla CFD trading example

- You open a new City Index account and deposit $2,000

- After doing some research, you decide to trade Tesla shares

- You believe that Tesla’s $260 share price will fall, so you plan to sell the market

- You sell two Tesla stock CFDs, which means you earn $2 for each point of downward movement, and lose $2 for every upward point

- You set a stop at $300 – above the market price as this is a short position – which will close your position if it hits a loss of $80

- Tesla shares fall in value and you close at $200, a decline of 60 points, so you make $120

However, if Tesla shares had risen instead, you would have made a loss. For more in-depth examples of how CFD trading works, take a look at our CFD examples.

2. How to open a CFD account in Singapore

To buy and sell CFDs in Singapore, you’ll need an account. This is what you’ll use to research new opportunities, open and close positions, manage your risk, monitor your P/L and more.

Before you commit real capital, you can open a demo CFD trading account to try things out with zero risk. A City Index demo, for example, gives you $20,000 in virtual funds to buy and sell our full range of markets. All the price movements are real, the only part that isn’t is the money involved. So, it’s a great place to practise.

When you’re ready to risk real capital, you can open a live account, which usually takes minutes (application subject to review and approval). Then, once you’ve added some funds, you’ll be all set to get started.

3. Choose a CFD market

One major advantage of CFDs is the huge range of markets you can choose from. At City Index, we offer contracts on over 6,000 individual markets across shares, indices, currencies, commodities and more. From a single platform, you can access major global markets in the US, UK, Europe, Asia, Australia and New Zealand.

With so many choices, it’s important to find an opportunity that suits you. There are lots of research tools available in our platform to help you do just that – including, technical indicators, alerts and more.

Once you’ve chosen a market, use the search function on the platform or app to find it. You’ll be able to see its live price, view a chart and look at all the information you need to know before taking your position.

How to trade share CFDs

Share CFDs are contracts that track the price of an underlying company’s share price.

To trade share CFDs, you’ll need an account with a trading provider. Then, you’d buy the market if you thought the company’s stock would increase in value, and sell if you thought it would fall.

This process may be familiar if you’re used to investing in equities – except you deal in contracts instead of buying and selling the actual shares. This means you won’t get shareholder rights, such as voting powers.

How to trade forex CFDs

Forex CFDs are markets that enable you to speculate on the price movements of forex pairs without buying or selling any currencies. Instead, you’re trading a contract that tracks the price of a forex pair.

To trade forex CFDs, you’d need to understand whether a currency is likely to strengthen or weaken relative to another. You’d do this by looking at any news or events that impact the respective economies, and technical indicators.

4. Pick a CFD strategy

There are a lot of different ways to trade with CFDs, which makes it important to set out some guidelines for what and when you’ll trade. The aim is to find the most advantageous entry and exit points to ensure you achieve consistent returns over time.

Here are some popular CFD strategies you could consider:

Trend trading

Trend trading involves identifying the direction of a market, and opening a CFD trade that will take advantage of the movement until the trend reverses.

This is one of the longer-term CFD strategies you can take, as you’d need to hold the trade for as long as it takes the run to finish – ignoring any smaller retracements.

Hedging with CFDs

Hedging is a trading tactic that is used to reduce the risks of trading. It works by placing trade(s) that will offset the potential losses or negative balance of an already open trade.

For example, if you had an existing trade open on a specific instrument that is currently trading negatively, you may wish to place an additional trade in the opposite direction to level out your balance. Whilst this practice cannot completely remove risk and/or losses, when used correctly, it can reduce them.

5. Decide whether to buy or sell

Before you open your position, you’ll need to decide whether you want to buy or sell. If you believe your market will go up, you go long by trading at the buy price. If you believe it will fall, you can short it by trading at the sell price.

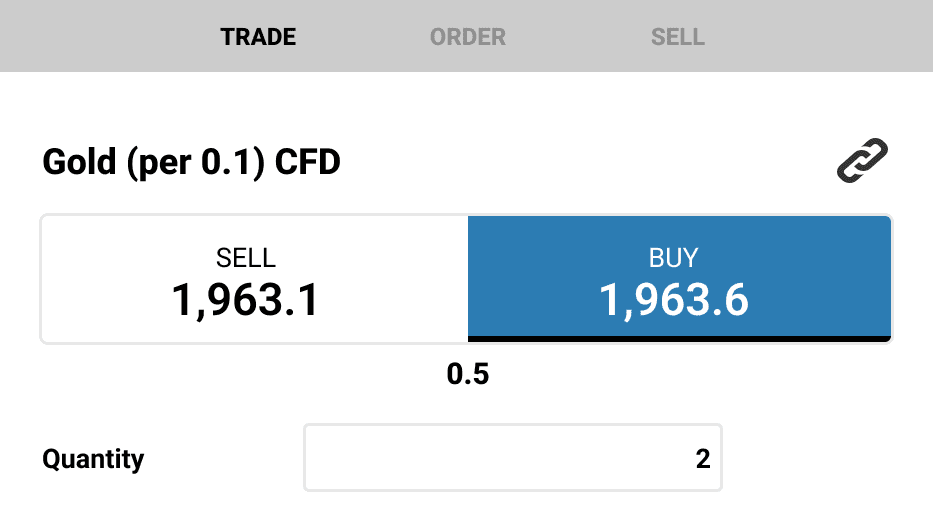

How to buy CFDs

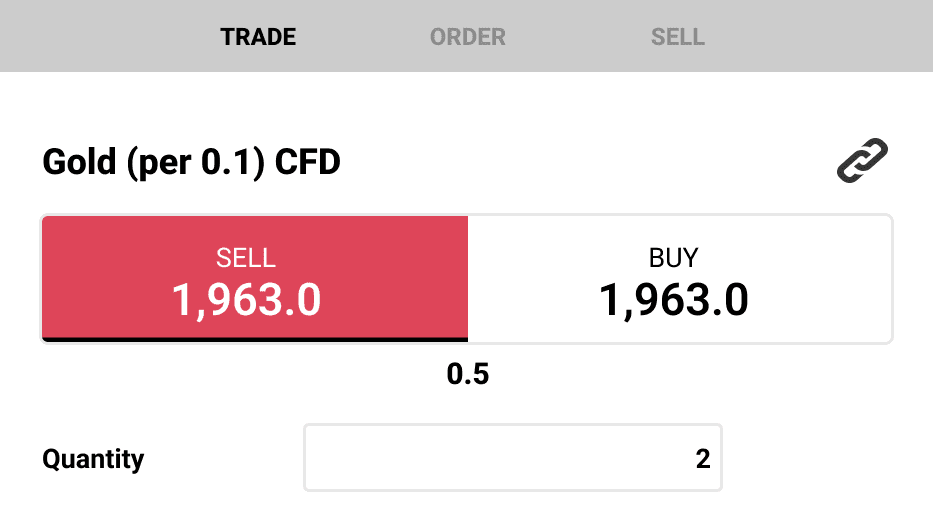

To buy CFDs, all you need to do is go to your market of choice and open up the deal ticket.

Here you’ll see the two prices ‘buy’ and ‘sell’. In this case, you want to go long by selecting the ‘buy’ price.

You’d then fill out the remainder of the deal ticket with your position size and any orders.

Once your position is live, if the market did increase in value, you’d make a profit from this buy position. But if it fell instead, you’d make a loss.

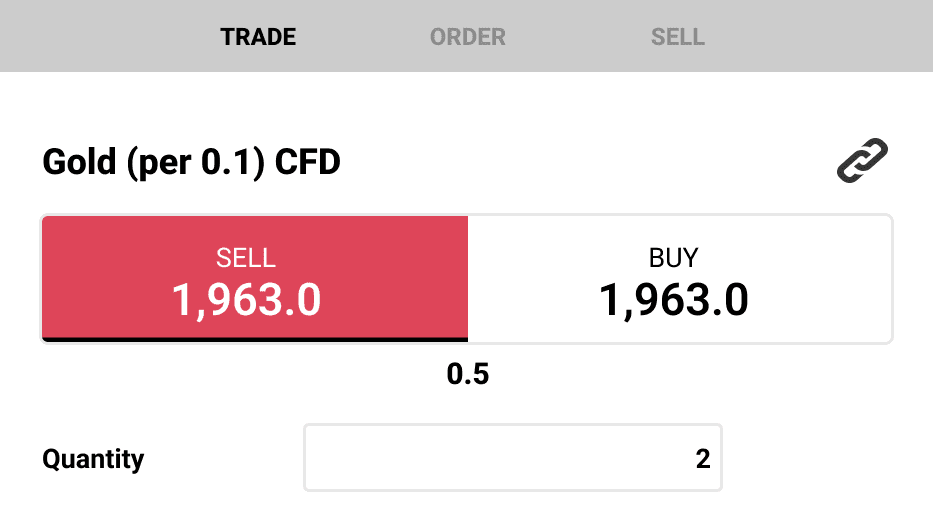

How to sell CFDs

To sell CFDs, or go short, you’d also navigate to your market of choice and open up the deal ticket.

Instead of buying, in this case, you want to select the ‘sell’ price and fill out the remainder of the deal ticket with your position size and any orders.

Once your position is live, if the market fell in value, you’d make a profit from this sell position. But if it increased instead, you’d make a loss.

6. Select how many CFDs to trade

You’ve chosen your market and decided whether to go long or short. But how do you select the size of your position? With CFD trading, you select the number of contracts to buy or sell.

Each contract represents a certain amount of its underlying asset. With stocks, one CFD is equivalent to one share. With FX, you will be trading per pip, therefore if you buy at 1.4305 and sell at 1.4306, you will make one times the pip value of the trade. To see what a contract means for your market, look up the 'tick value' in the instrument's market information sheets.

CFDs are bought and sold in the base currency of the underlying market. So, if you’re buying a US share CFD, then your profit or loss will be calculated in US dollars.

Contracts for difference utilise leverage, which means you only need to have a small percentage of the overall trade value, known as the margin, in your account to open a position. The larger the value of your trade, the more margin is required.

It is important that you have enough funds in your account to cover your margin.

With City Index’s Web Trader platform, you can calculate your margin before placing a trade through the platform’s margin calculator, monitor each position’s margin requirement separately and review your account’s total margin requirement through the “margin level indicator”.

7. Manage your CFD trading risk

Before you place your trade, you’ll want to consider your risk-management strategy.

A key risk-management technique is to place an order, such as a stop loss, that will automatically close the trade if the market reaches a certain level.

A stop-loss order is an instruction that tells your provider to close your position once it reaches a specific level set by you. This will, as the name suggests, be at a worse price than the current market level and can typically be triggered on losing positions to help minimise losses.

A drawback of basic stop orders is that they can be subject to slippage – this is what happens when a market is moving too quickly, and your order can’t be executed at the exact price you’ve asked for. Instead, it will be filled at the first available price, which can be worse than the one you requested.

This is why traders might use a guaranteed stop-loss order or GSLO instead, which will always execute at your chosen price, regardless of market conditions.

They’re free to attach but you’ll incur a charge if triggered.

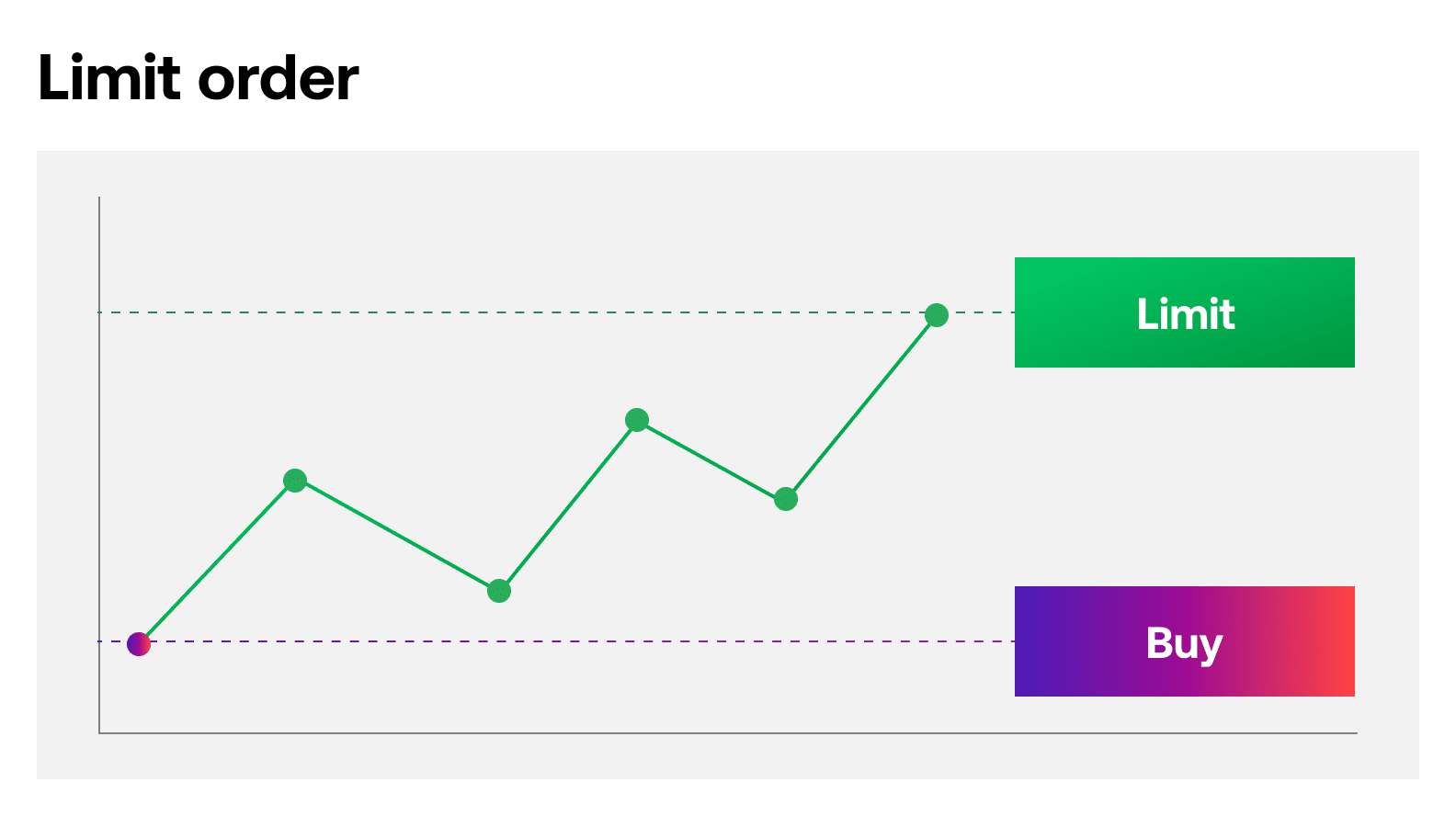

A limit order, meanwhile, is an instruction to close out a trade at a price that is better than the current market level and is typically used to help lock in profits.

Standard stop losses and limit orders are free to use and can be placed in the dealing ticket when you first place your trade, or once it is open.

Once you’ve set up your risk management, you can execute by hitting ‘Place Trade’.

8. Open, monitor and close your CFD trade

Now your position is live, your profit and loss will move as the underlying market goes up and down.

You can track market prices; see your profit/loss update in real time and edit, add to or exit your position from your computer, or by using our mobile trading app.

If you didn’t select a stop or limit before opening the position, then it isn’t too late – you can add them now. If you already have exit orders in place, meanwhile, you can move them to reflect changing conditions.

With a stop loss attached, your trade will automatically close. But otherwise, the position will remain active until you decide to exit the market unless you run out of margin in your account – then your positions may be automatically closed if you don’t top up your funds.

To close a CFD, you can just select the 'close position' option within the positions window.

Alternatively, if you wanted to close a trade manually, you would trade in the opposite direction from where you opened it.

If you bought 500 CFDs at the outset, then you can sell 500 CFDs now to close. If you sold 500 CFDs to open, you buy 500 CFDs to close. But you’ll need to make sure the ‘hedging’ function of the platform is switched off in settings to do this manually, otherwise, you’ll end up with two positions netting each other off.

Your net open profit and loss will now be realised and immediately reflected in your account cash balance. Your P&L will also automatically be converted to your account’s chosen base currency.

To calculate your profit or loss manually, just subtract the opening price from the closing price (or the opposite for short positions), then multiply that figure by the size of your position. Just remember to take any costs into account.

What’s the best CFD platform in Singapore?

Every trader has their own opinion on which platform is best – it all depends on what your specific requirements are. It’s often a good idea to try out a few different options to see what works for you.

City Index Singapore’s trading platform has won multiple awards, including Best Trading Platform* and Best App*. Our CFD platform comes with advanced charting, seamless execution and SMART Signals. You can try out our platform for free by opening a risk-free demo trading account.

TradingView charts

Access the industry-leading TradingView charting package, complete with 80+ custom indicators, drawing tools and trading through charts.

Multi-device trading

Manage your trading account across desktop, mobile and tablet without interruption.

Discover our mobile trading apps

CFD trading signals

Get trade ideas driven by AI and statistics with our SMART Signals, which analyse major global markets based on historical market data.